Your company has just signed a three-year nonrenewable contract with the city of New Orleans for earthmoving work. You are investigating the purchase of heavy construction equipment for this job. The equipment costs $209,000 and qualifies for five-year MACRS depreciation. At the end of the three-year contract, you expect to be able to sell the equipment for $74,000. If the projected operating expense for b equipment is $64,000 per year, what is the after-tax equivalent uniform annual cost (EUAC) of owning and operating this equipment? The effective income tax rate is 25%, and the after-tax MARR is 11% per y Click the icon to view the GDS Recovery Rates (r) for the 5-year property class. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 11% per year.

Your company has just signed a three-year nonrenewable contract with the city of New Orleans for earthmoving work. You are investigating the purchase of heavy construction equipment for this job. The equipment costs $209,000 and qualifies for five-year MACRS depreciation. At the end of the three-year contract, you expect to be able to sell the equipment for $74,000. If the projected operating expense for b equipment is $64,000 per year, what is the after-tax equivalent uniform annual cost (EUAC) of owning and operating this equipment? The effective income tax rate is 25%, and the after-tax MARR is 11% per y Click the icon to view the GDS Recovery Rates (r) for the 5-year property class. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 11% per year.

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 2E

Related questions

Question

Use tables to answer question

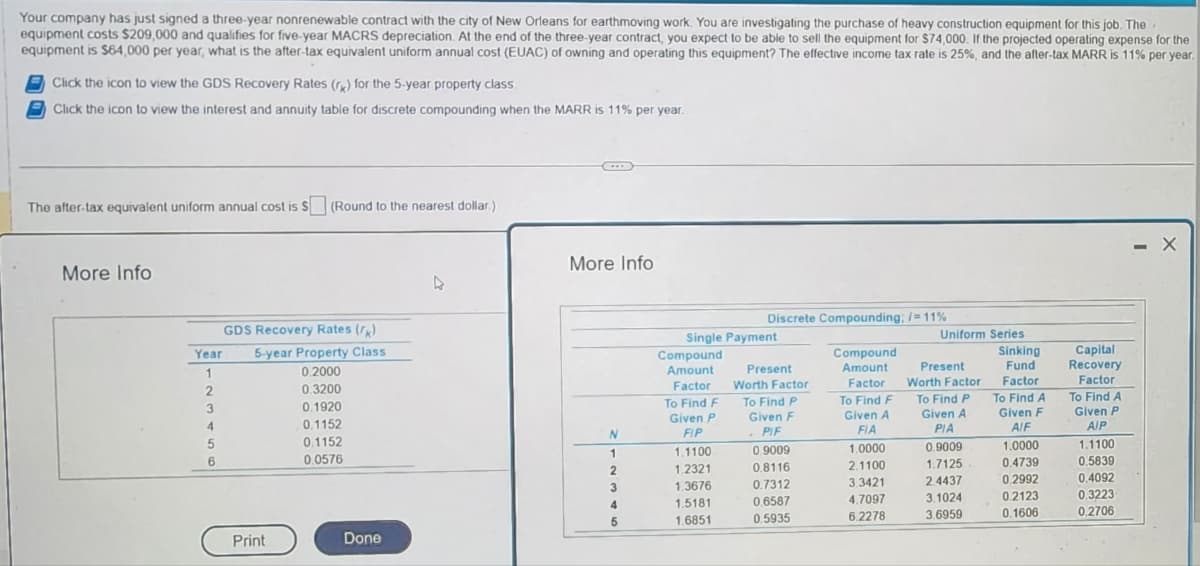

Transcribed Image Text:Your company has just signed a three-year nonrenewable contract with the city of New Orleans for earthmoving work. You are investigating the purchase of heavy construction equipment for this job. The

equipment costs $209,000 and qualifies for five-year MACRS depreciation. At the end of the three-year contract, you expect to be able to sell the equipment for $74,000. If the projected operating expense for the

equipment is $64,000 per year, what is the after-tax equivalent uniform annual cost (EUAC) of owning and operating this equipment? The effective income tax rate is 25%, and the after-tax MARR is 11% per year.

Click the icon to view the GDS Recovery Rates (r) for the 5-year property class.

Click the icon to view the interest and annuity table for discrete compounding when the MARR is 11% per year.

The after-tax equivalent uniform annual cost is $ (Round to the nearest dollar.)

More Info

GDS Recovery Rates (k)

5-year Property Class

0.2000

0.3200

0.1920

0.1152

0.1152

0.0576

Year

1

2

3

4

5

6

Print

Done

4

C

More Info

N

1

2

3

4

5

Discrete Compounding; /= 11%

Single Payment

Compound

Amount

Factor

To Find F

Given P

FIP

1.1100

P

1.2321

1.3676

1.5181

1.6851

Present

Worth Factor

To Find P

Given F

. PIF

0.9009

0.8116

0.7312

0.6587

0.5935

Compound

Amount

Factor

To Find F

Given A

FIA

1.0000

2.1100

3.3421

4.7097

6.2278

Uniform Series

Present

Worth Factor

To Find P

Given A

PIA

0.9009

1.7125

2.4437

3.1024

3.6959

Sinking

Fund

Factor

To Find A

Given F

A/F

1.0000

0.4739

0.2992

0.2123

0.1606

Capital

Recovery

Factor

To Find A

Given P

A/P

1.1100

0.5839

0.4092

0.3223

0.2706

#

- X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning