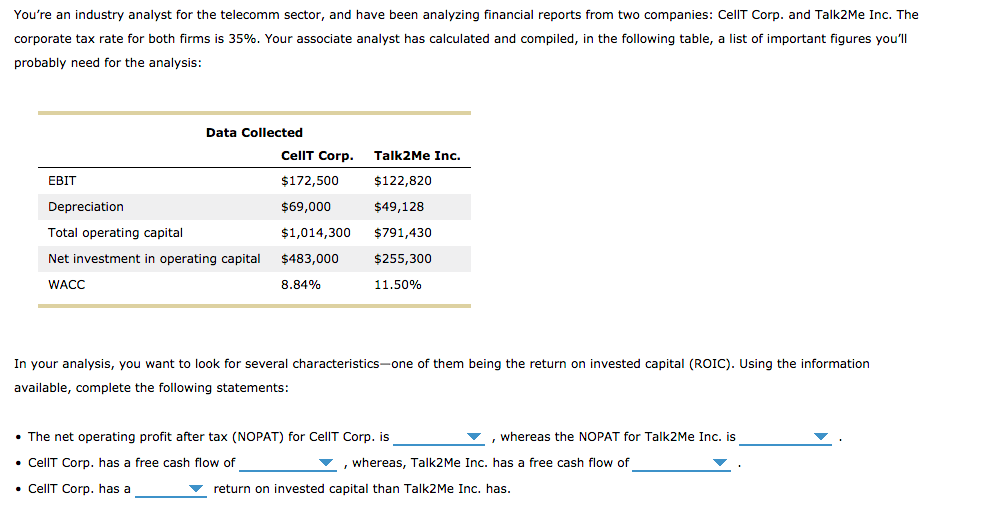

You're an industry analyst for the telecomm sector, and have been analyzing financial reports from two companies: CellT Corp. and Talk2Me Inc. The corporate tax rate for both firms is 35%. Your associate analyst has calculated and compiled, in the following table, a list of important figures you'll probably need for the analysis: Data Collected CellT Corp. Talk2Me Inc. EBIT $172,500 $122,820 Depreciation $69,000 $49,128 Total operating capital $1,014,300 $791,430 Net investment in operating capital $483,000 $255,300 WACC 8.84% 11.50% In your analysis, you want to look for several characteristics-one of them being the return on invested capital (ROIC). Using the information available, complete the following statements: • The net operating profit after tax (NOPAT) for CellT Corp. is , whereas the NOPAT for Talk2Me Inc. is • CellT Corp. has a free cash flow of , whereas, Talk2Me Inc. has cash flow of • CellT Corp. has a return on invested capital than Talk2Me Inc. has. Your inference from the analysis is that both firms are in a high-growth phase, and their growth will be profitable. Considering your analysis, which of the following statements is true? O If a company has positive NOPAT but a negative free cash flow, then the firm could be in a high-growth phase and making investments in operating capital to support growth. O If a company has negative NOPAT but a positive free cash flow, then the firm could be in a high-growth phase and making investments in operating capital to support growth.

You're an industry analyst for the telecomm sector, and have been analyzing financial reports from two companies: CellT Corp. and Talk2Me Inc. The corporate tax rate for both firms is 35%. Your associate analyst has calculated and compiled, in the following table, a list of important figures you'll probably need for the analysis: Data Collected CellT Corp. Talk2Me Inc. EBIT $172,500 $122,820 Depreciation $69,000 $49,128 Total operating capital $1,014,300 $791,430 Net investment in operating capital $483,000 $255,300 WACC 8.84% 11.50% In your analysis, you want to look for several characteristics-one of them being the return on invested capital (ROIC). Using the information available, complete the following statements: • The net operating profit after tax (NOPAT) for CellT Corp. is , whereas the NOPAT for Talk2Me Inc. is • CellT Corp. has a free cash flow of , whereas, Talk2Me Inc. has cash flow of • CellT Corp. has a return on invested capital than Talk2Me Inc. has. Your inference from the analysis is that both firms are in a high-growth phase, and their growth will be profitable. Considering your analysis, which of the following statements is true? O If a company has positive NOPAT but a negative free cash flow, then the firm could be in a high-growth phase and making investments in operating capital to support growth. O If a company has negative NOPAT but a positive free cash flow, then the firm could be in a high-growth phase and making investments in operating capital to support growth.

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 4TP: You are considering two possible companies for investment purposes. The following data is available...

Related questions

Question

Transcribed Image Text:You're an industry analyst for the telecomm sector, and have been analyzing financial reports from two companies: CellT Corp. and Talk2Me Inc. The

corporate tax rate for both firms is 35%. Your associate analyst has calculated and compiled, in the following table, a list of important figures you'll

probably need for the analysis:

Data Collected

CellT Corp.

Talk2Me Inc.

EBIT

$172,500

$122,820

Depreciation

$69,000

$49,128

Total operating capital

$1,014,300

$791,430

Net investment in operating capital

$483,000

$255,300

WACC

8.84%

11.50%

In your analysis, you want to look for several characteristics-one of them being the return on invested capital (ROIC). Using the information

available, complete the following statements:

• The net operating profit after tax (NOPAT) for CellT Corp. is

, whereas the NOPAT for Talk2Me Inc. is

• CellT Corp. has a free cash flow of

, whereas, Talk2Me Inc. has

cash flow of

• CellT Corp. has a

return on invested capital than Talk2Me Inc. has.

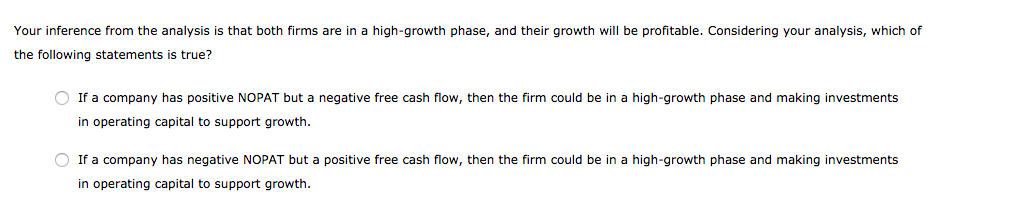

Transcribed Image Text:Your inference from the analysis is that both firms are in a high-growth phase, and their growth will be profitable. Considering your analysis, which of

the following statements is true?

O If a company has positive NOPAT but a negative free cash flow, then the firm could be in a high-growth phase and making investments

in operating capital to support growth.

O If a company has negative NOPAT but a positive free cash flow, then the firm could be in a high-growth phase and making investments

in operating capital to support growth.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College