Zeus Industries manufactures two types of electrical power units, custom and standard, which involve four factory overhead activities-production setup, procurement, quality control, and materials management. An activity analysis of the overhead revealed the following estimated activity costs and activity bases for these activities: Activity Activity Cost Activity Base Production setup $ 75,000 Number of setups Procurement 120,750 Number of purchase orders (PO) Quality control 136,500 Number of inspections Materials management 129,500 Number of components Total $461,750 The activity-base usage quantities for each product are as follows: 三 Purchase Setups Inspections Components Unit Volume Orders Custom 500 850 1,700 400 1,000 Standard 100 200 400 300 1,000 Total 600 1,050 2,100 700 2,000 a. Determine an activity rate for each activity. Activity Rates Production Setup Procurement Quality Control Materials Management Activity cost + Activity base Activity rate $ /setup /PO $ /inspection /component

Zeus Industries manufactures two types of electrical power units, custom and standard, which involve four factory overhead activities-production setup, procurement, quality control, and materials management. An activity analysis of the overhead revealed the following estimated activity costs and activity bases for these activities: Activity Activity Cost Activity Base Production setup $ 75,000 Number of setups Procurement 120,750 Number of purchase orders (PO) Quality control 136,500 Number of inspections Materials management 129,500 Number of components Total $461,750 The activity-base usage quantities for each product are as follows: 三 Purchase Setups Inspections Components Unit Volume Orders Custom 500 850 1,700 400 1,000 Standard 100 200 400 300 1,000 Total 600 1,050 2,100 700 2,000 a. Determine an activity rate for each activity. Activity Rates Production Setup Procurement Quality Control Materials Management Activity cost + Activity base Activity rate $ /setup /PO $ /inspection /component

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 11E: Lonsdale Inc. manufactures entry and dining room lighting fixtures. Five activities are used in...

Related questions

Question

100%

Thank you for checking.

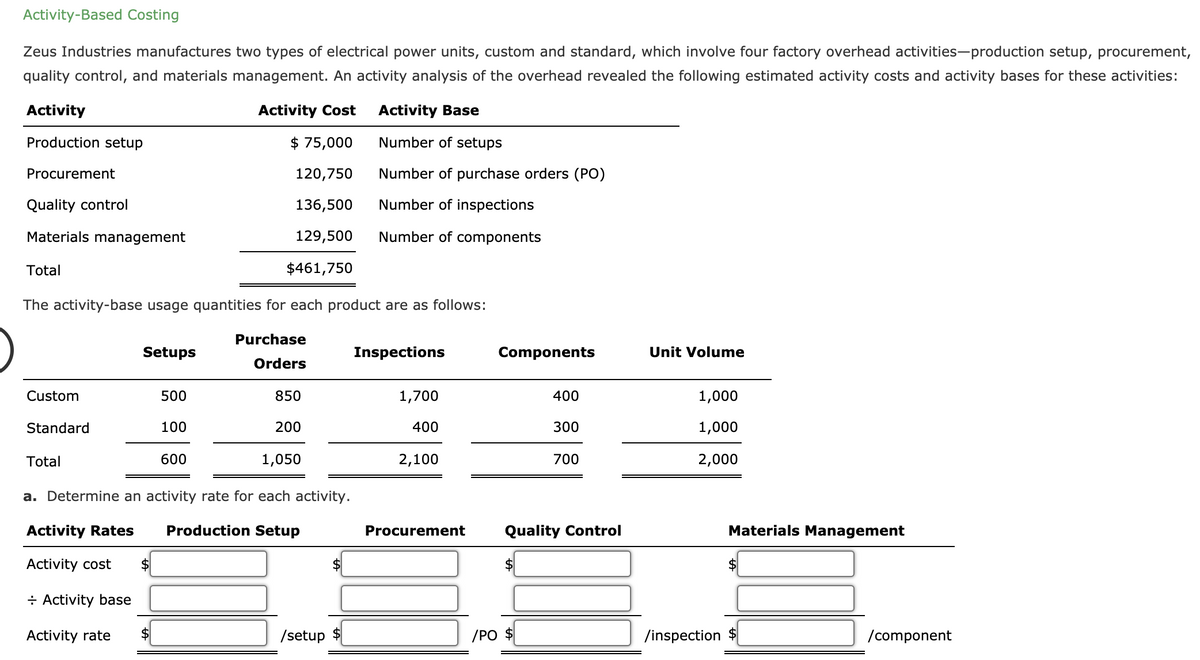

Transcribed Image Text:Activity-Based Costing

Zeus Industries manufactures two types of electrical power units, custom and standard, which involve four factory overhead activities-production setup, procurement,

quality control, and materials management. An activity analysis of the overhead revealed the following estimated activity costs and activity bases for these activities:

Activity

Activity Cost

Activity Base

Production setup

$ 75,000

Number of setups

Procurement

120,750

Number of purchase orders (PO)

Quality control

136,500

Number of inspections

Materials management

129,500

Number of components

Total

$461,750

The activity-base usage quantities for each product are as follows:

Purchase

Setups

Inspections

Components

Unit Volume

Orders

Custom

500

850

1,700

400

1,000

Standard

100

200

400

300

1,000

Total

600

1,050

2,100

700

2,000

a. Determine an activity rate for each activity.

Activity Rates

Production Setup

Procurement

Quality Control

Materials Management

Activity cost

2$

$4

$4

$

÷ Activity base

Activity rate

/setup $

/PO $

/inspection $

/component

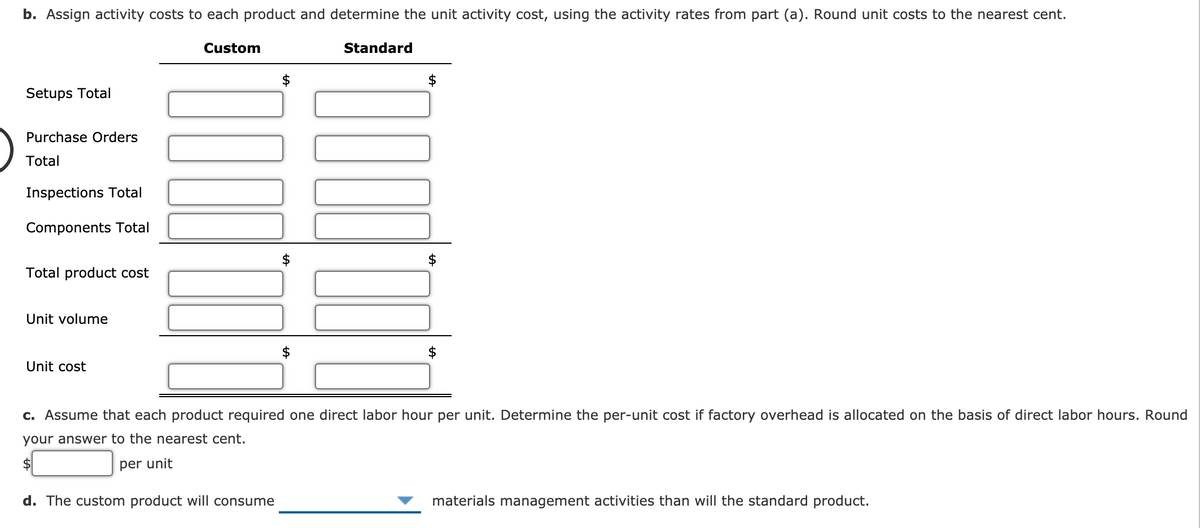

Transcribed Image Text:b. Assign activity costs to each product and determine the unit activity cost, using the activity rates from part (a). Round unit costs to the nearest cent.

Custom

Standard

$

2$

Setups Total

Purchase Orders

Total

Inspections Total

Components Total

Total product cost

Unit volume

$

Unit cost

c. Assume that each product required one direct labor hour per unit. Determine the per-unit cost if factory overhead is allocated on the basis of direct labor hours. Round

your answer to the nearest cent.

per unit

d. The custom product will consume

materials management activities than will the standard product.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning