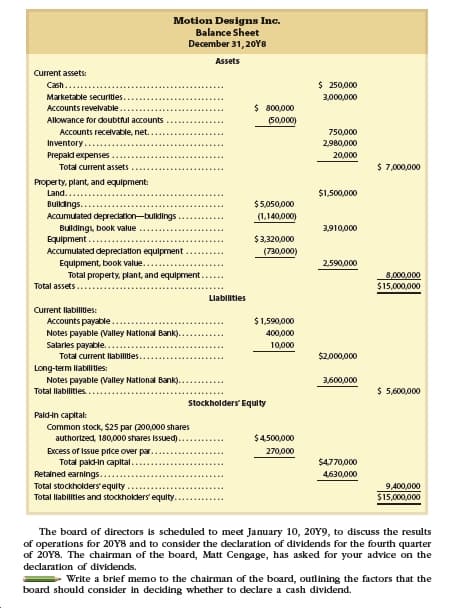

Motion Designs Inc. Balance Sheet December 31, 20Y8 Assets Current assets: $ 250,000 Cash. Marketable securities. 3,000.000 $ 800,000 Accounts rewelvable Allowance for doubttul accounts (50,000) Accounts recelvable, net. 750,000 2,980.000 20,000 Inventory. Prepaid expenses Total current assets $ 7,000,000 Property, plant, and equipment: Land.. Buldings... Acaumulated depreciation-bulkdings Buldings, book value Equipment Accumulated depreciation equipment. Equipment, book value.. Total property, plant, and equipment.... $1,500,000 $5,050,000 (1,140,000) 3,910,000 $3,320,000 (730,000) 2,590.000 8,000.000 $15,000,000 Total assets. Llabilitles Current llabilities: $1,590,000 400,000 Accounts payable. Notes payable (Valley National Bank).. Salarles payable.. 10,000 $2,000,000 Total current Ilabilities.. Long-term llabilitles: Notes payable (Valley National Bank).. 3,600,000 $ 5,600,000 Total llabilitles. Stockholders Equity Paid-in capital: Common stock, $25 par (200,000 shares $4.500,000 authorized, 180,000 shares Issued). Excess of Issue price over par Total pald-in capital. Retained earnings. Total stockholders'equity 270,000 $4,770,000 4630.000 9,400,000 $15,000,000 Total llabilities and stockholders equity. .. The board of directors is scheduled to meet January 10, 20Y9, to discuss the results of operations for 20Y8 and to consider the declaration of dividends for the fourth quarter of 20Y8. The chairman of the board, Matt Cengage, has asked for your advice on the dedaration of dividends. Write a brief memo to the chairman of the board, outlining the factors that the board should consider in deciding whether to declare a cash dividend.

Dividend Valuation

Dividend refers to a reward or cash that a company gives to its shareholders out of the profits. Dividends can be issued in various forms such as cash payment, stocks, or in any other form as per the company norms. It is usually a part of the profit that the company shares with its shareholders.

Dividend Discount Model

Dividend payments are generally paid to investors or shareholders of a company when the company earns profit for the year, thus representing growth. The dividend discount model is an important method used to forecast the price of a company’s stock. It is based on the computation methodology that the present value of all its future dividends is equivalent to the value of the company.

Capital Gains Yield

It may be referred to as the earnings generated on an investment over a particular period of time. It is generally expressed as a percentage and includes some dividends or interest earned by holding a particular security. Cases, where it is higher normally, indicate the higher income and lower risk. It is mostly computed on an annual basis and is different from the total return on investment. In case it becomes too high, indicates that either the stock prices are going down or the company is paying higher dividends.

Stock Valuation

In simple words, stock valuation is a tool to calculate the current price, or value, of a company. It is used to not only calculate the value of the company but help an investor decide if they want to buy, sell or hold a company's stocks.

Motion Designs Inc. has paid quarterly cash dividends since 20Y7. These dividends have steadily increased from $0.05 per share to the latest dividend declaration of $0.50 per share. The board of directors would like to continue this trend and is hesitant to suspend or decrease the amount of quarterly dividends. Unfortunately, sales dropped sharply in the fourth quarter of 20Y8 due to worsening economic conditions and increased competition. As a result, the board is uncertain as to whether it should declare a dividend for the last quarter of 20Y8.

On October 1, 20Y8, Motion Designs Inc. borrowed $4,000,000 from Valley National Bank to use in modernizing its retail stores and to expand its product line in response to changes in its industry. The terms of the 10-year, 6% loan require Motion Designs to do the following:

• Pay monthly interest on the last day of the month

• Pay $400,000 of the principal each October 1, beginning in 20Y9

• Maintain a

• Maintain a minimum balance (a compensating balance) of $100,000 in its Valley National Bank account

On December 31, 20Y8, $1,000,000 of the $4,000,000 loan had been disbursed in modernization of the retail stores and in expansion of the product line. Motion Designs Inc.’s balance sheet as of December 31, 20Y8, follows:

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images