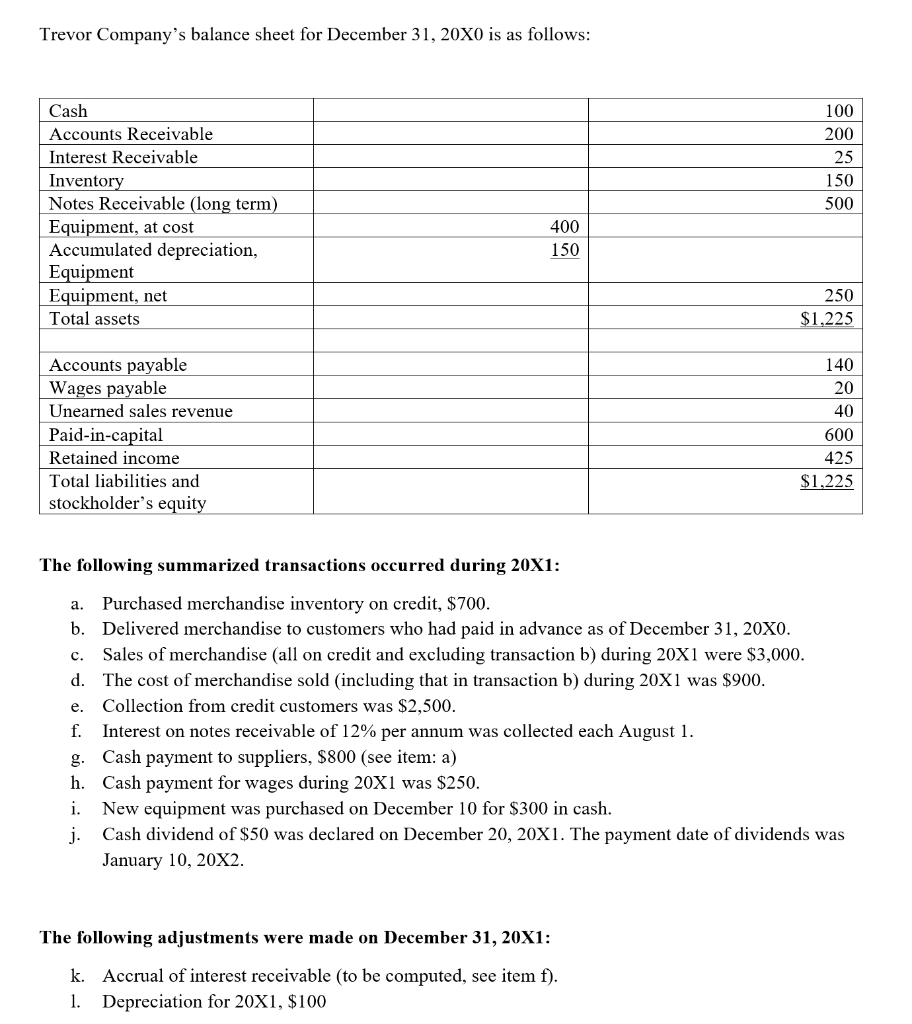

Trevor Company's balance sheet for December 31, 20XO is as follows: Cash 100 Accounts Receivable 200 Interest Receivable 25 Inventory Notes Receivable (long term) Equipment, at cost Accumulated depreciation, Equipment Equipment, net Total assets 150 500 400 150 250 $1,225 Accounts payable Wages payable 140 20 Unearned sales revenue 40 Paid-in-capital Retained income 600 425 Total liabilities and $1,225 stockholder's equity The following summarized transactions occurred during 20X1: a. Purchased merchandise inventory on credit, $700. b. Delivered merchandise to customers who had paid in advance as of December 31, 20X0. c. Sales of merchandise (all on credit and excluding transaction b) during 20X1 were $3,000. d. The cost of merchandise sold (including that in transaction b) during 20X1 was $900. с. e. Collection from credit customers was $2,500. f. Interest on notes receivable of 12% per annum was collected each August 1. g. Cash payment to suppliers, $800 (see item: a) h. Cash payment for wages during 20X1 was $250. i. New equipment was purchased on December 10 for $300 in cash. Cash dividend of $50 was declared on December 20, 20X1. The payment date of dividends was January 10, 20X2. j.

Trevor Company's balance sheet for December 31, 20XO is as follows: Cash 100 Accounts Receivable 200 Interest Receivable 25 Inventory Notes Receivable (long term) Equipment, at cost Accumulated depreciation, Equipment Equipment, net Total assets 150 500 400 150 250 $1,225 Accounts payable Wages payable 140 20 Unearned sales revenue 40 Paid-in-capital Retained income 600 425 Total liabilities and $1,225 stockholder's equity The following summarized transactions occurred during 20X1: a. Purchased merchandise inventory on credit, $700. b. Delivered merchandise to customers who had paid in advance as of December 31, 20X0. c. Sales of merchandise (all on credit and excluding transaction b) during 20X1 were $3,000. d. The cost of merchandise sold (including that in transaction b) during 20X1 was $900. с. e. Collection from credit customers was $2,500. f. Interest on notes receivable of 12% per annum was collected each August 1. g. Cash payment to suppliers, $800 (see item: a) h. Cash payment for wages during 20X1 was $250. i. New equipment was purchased on December 10 for $300 in cash. Cash dividend of $50 was declared on December 20, 20X1. The payment date of dividends was January 10, 20X2. j.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter14: Statement Of Cash Flows

Section: Chapter Questions

Problem 50P: The following balance sheets and income statement were taken from the records of Rosie-Lee Company:...

Related questions

Question

Please help me

Transcribed Image Text:Trevor Company's balance sheet for December 31, 20XO is as follows:

Cash

100

Accounts Receivable

200

Interest Receivable

25

Inventory

Notes Receivable (long term)

Equipment, at cost

Accumulated depreciation,

Equipment

Equipment, net

Total assets

150

500

400

150

250

$1,225

Accounts payable

Wages payable

140

20

Unearned sales revenue

40

Paid-in-capital

600

Retained income

425

Total liabilities and

$1,225

stockholder's equity

The following summarized transactions occurred during 20X1:

Purchased merchandise inventory on credit, $700.

b. Delivered merchandise to customers who had paid in advance as of December 31, 20X0.

а.

с.

Sales of merchandise (all on credit and excluding transaction b) during 20X1 were $3,000.

d. The cost of merchandise sold (including that in transaction b) during 20X1 was $900.

е.

Collection from credit customers was $2,500.

f.

Interest on notes receivable of 12% per annum was collected each August 1.

g. Cash payment to suppliers, $800 (see item: a)

h. Cash payment for wages during 20X1 was $250.

New equipment was purchased on December 10 for $300 in cash.

i.

j.

Cash dividend of $50 was declared on December 20, 20X1. The payment date of dividends was

January 10, 20X2.

The following adjustments were made on December 31, 20X1:

k. Accrual of interest receivable (to be computed, see item f).

1. Depreciation for 20X1, $100

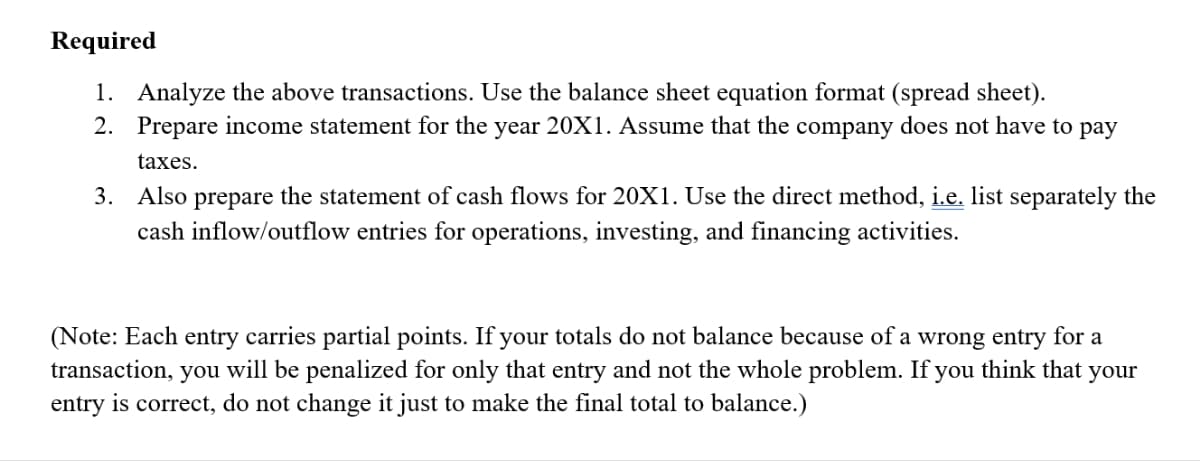

Transcribed Image Text:Required

1. Analyze the above transactions. Use the balance sheet equation format (spread sheet).

2. Prepare income statement for the year 20X1. Assume that the company does not have to pay

taxes.

3. Also prepare the statement of cash flows for 20X1. Use the direct method, i.e. list separately the

cash inflow/outflow entries for operations, investing, and financing activities.

(Note: Each entry carries partial points. If your totals do not balance because of a wrong entry for a

transaction, you will be penalized for only that entry and not the whole problem. If you think that

entry is correct, do not change it just to make the final total to balance.)

your

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning