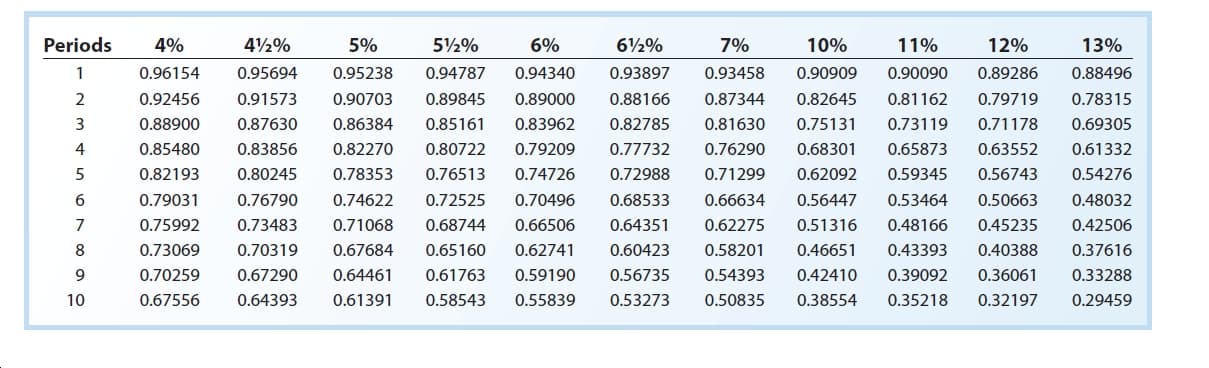

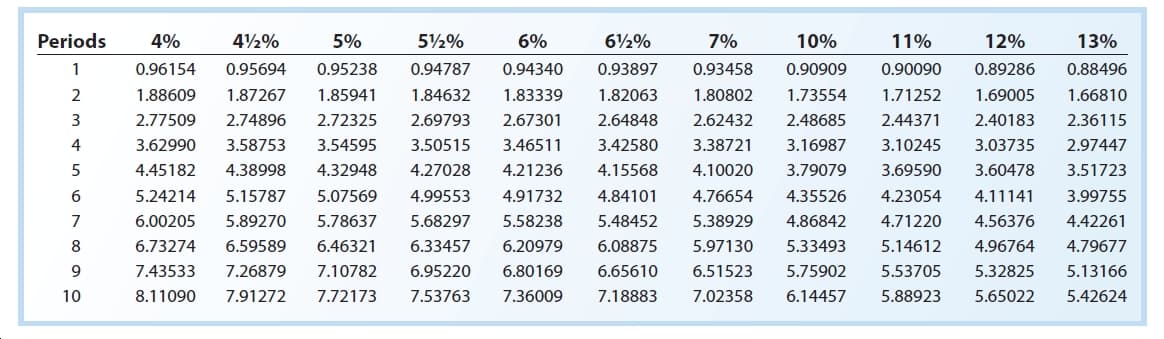

Periods 52% 4% 42% 5% 6% 7% 10% 11% 12% 13% 0.96154 0.95694 0.94787 0.94340 0.93897 0.93458 0.90909 0.89286 0.95238 0.90090 0.88496 0.91573 0.90703 0.89000 0.88166 0.92456 0.89845 0.87344 0.82645 0.81162 0.79719 0.78315 3 0.88900 0.87630 0.86384 0.85161 0.83962 0.82785 0.81630 0.75131 0.73119 0.71178 0.69305 0.80722 0.68301 0.85480 0.83856 0.82270 0.79209 0.77732 0.76290 0.65873 0.63552 0.61332 0.78353 0.76513 0.71299 0.54276 0.82193 0.80245 0.74726 0.72988 0.62092 0.59345 0.56743 0.79031 0.74622 0.72525 0.68533 0.66634 0.50663 0.76790 0.70496 0.56447 0.53464 0.48032 0.75992 0.73483 0.71068 0.68744 0.66506 0.64351 0.62275 0.51316 0.48166 0.45235 0.42506 0.65160 0.60423 0.58201 0.40388 8 0.73069 0.70319 0.67684 0.62741 0.46651 0.43393 0.37616 0.36061 0.70259 0.64461 0.59190 0.54393 0.67290 0.61763 0.56735 0.42410 0.39092 0.33288 0.64393 10 0.67556 0.61391 0.58543 0.55839 0.53273 0.50835 0.38554 0.35218 0.32197 0.29459 Periods 4% 42% 5½% 6% 7% 10% 11% 12% 13% 0.94340 0.96154 0.95694 0.95238 0.94787 0.93897 0.93458 0.90909 0.90090 0.89286 0.88496 1.82063 1.73554 1.69005 1.88609 1.87267 1.85941 1.84632 1.83339 1.80802 1.71252 1.66810 2.72325 3 2.77509 2.74896 2.69793 2.67301 2.64848 2.62432 2.48685 2.44371 2.40183 2.36115 3.62990 3.50515 2.97447 4 3.58753 3.54595 3.46511 3.42580 3.38721 3.16987 3.10245 3.03735 4.38998 4.45182 4.32948 4.27028 4.21236 4.15568 4.10020 3.79079 3.69590 3.60478 3.51723 5.15787 5.07569 5.24214 4.99553 4.91732 4.84101 4.76654 4.35526 4.23054 4.11141 3.99755 6.00205 5.89270 5.78637 5.68297 5.58238 5.48452 5.38929 4.86842 4.71220 4.56376 4.42261 6.73274 6.59589 6.46321 6.33457 6.20979 6.08875 5.97130 5.33493 5.14612 4.96764 4.79677 6.51523 9. 7.43533 7.26879 7.10782 6.95220 6.80169 6.65610 5.75902 5.53705 5.32825 5.13166 7.91272 7.53763 7.18883 7.02358 10 8.11090 7.72173 7.36009 6.14457 5.88923 5.65022 5.42624

Boyd Co. produces and sells aviation equipment. On the first day of its fiscal year, Boyd Co. issued $80,000,000 of five-year, 9% bonds at a market (effective) interest rate of 12%,with interest payable semiannually. Compute the following, presenting figures used in your computations:

a. The amount of cash proceeds from the sale of the bonds. Use the tables of present values in Exhibits 8 and 10. Round to the nearest dollar.

b. The amount of discount to be amortized for the first semiannual interest payment period, using the interest method. Round to the nearest dollar.

c. The amount of discount to be amortized for the second semiannual interest payment period, using the interest method. Round to the nearest dollar.

d. The amount of the bond interest expense for the first year.

Exhibits 8 and 10 attached

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 6 images