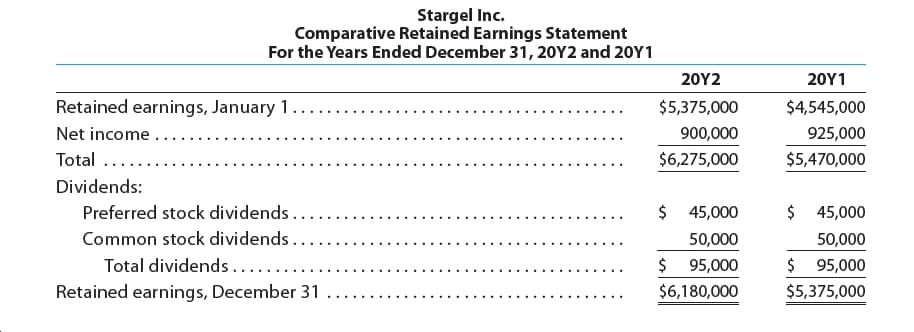

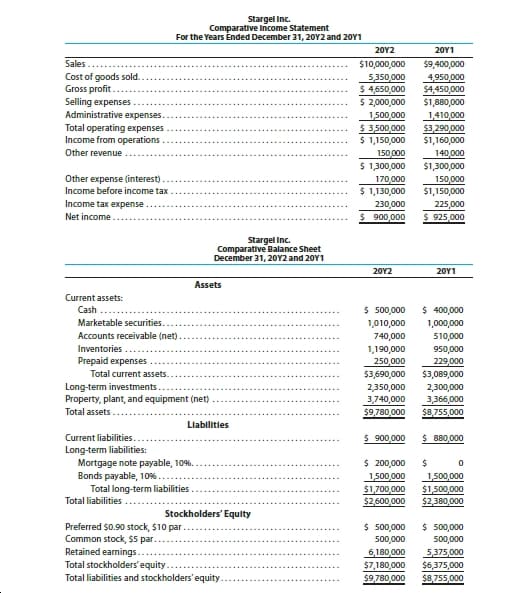

Stargel Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y 1 20Υ2 20Υ1 Retained earnings, January 1 $5,375,000 $4,545,000 Net income . 900,000 925,000 Total .... $6,275,000 $5,470,000 Dividends: Preferred stock dividends... Common stock dividends.. Total dividends ..... $ 45,000 $ 45,000 50,000 50,000 $ 95,000 $ 95,000 Retained earnings, December 31 $6,180,000 $5,375,000 Stargel Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Υ2 20Υ1 Sales $10,000,000 $9,400,000 Cost of goods sold. Gross profit Selling expenses. Administrative expenses. Total operating expenses Income from operations 5,350,000 $ 4,650,000 $ 2,000,000 4,950,000 $4,450,000 $1,880,000 1,410,000 $3,290,000 $1,160,000 1,500,000 $ 3,500,000 $ 1,150,000 Other revenue 150,000 140,000 $ 1300,000 $1,300,000 Other expense (interest) 170,000 $ 1,130,000 150,000 $1,150,000 Income before income tax Income tax expense. 230,000 225,000 Net income $ 900,000 $ 925,000 Stargel Inc. Comparative Balance Sheet December 31, 20Y2 and 20Y1 20Y2 20Υ1 Assets Current assets: $ 500,000 1,010,000 740,000 $ 400,000 Cash Marketable securities. 1,000,000 Accounts receivable (net) 510,000 Inventories. 1,190,000 250,000 $3,690,000 950,000 229,000 $3,089,000 2,300,000 Prepaid expenses Total current assets. Long-term investments Property, plant, and equipment (net) 2350,000 3,740,000 3,366,000 Total assets. $9,780,000 $8,755,000 Llabilities $ 900,000 $ 880,000 Current liabilities Long-term liabilities: Mortgage note payable, 10%. Bonds payable, 10%.. Total long-term liabilities $ 200,000 1500,000 $1,700,000 $2,600,000 1,500,000 $1,500,000 $2,380,000 Total liabilities Stockholders' Equity Preferred $0.90 stock, $10 par Common stock, $5 par. Retained earnings. Total stockholders' equity Total liabilities and stockholders'equity. $ 500,000 500,000 6,180,000 $7,180,000 $ 500,000 500,000 5,375,000 $6,375,000 $9,780,000 $8,755,000

The comparative financial statements of Stargel Inc. are as follows. The market price of Stargel common stock was $119.70 on December 31, 20Y2.

Please see the attachment for details:

Instructions

Determine the following measures for 20Y2, rounding to one decimal place including percentages, except for per-share amounts:

1. Working capital

2. Current ratio

3. Quick ratio

4. Accounts receivable turnover

5. Number of days’ sales in receivables

6. Inventory turnover

7. Number of days’ sales in inventory

8. Ratio of fixed assets to long-term liabilities

9. Ratio of liabilities to stockholders’ equity

10. Times interest earned

11. Asset turnover

12. Return on total assets

13. Return on stockholders’ equity

14. Return on common stockholders’ equity

15. Earnings per share on common stock

16. Price-earnings ratio

17. Dividends per share of common stock

18. Dividend yield

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images