Current Year Previous Year Current assets: $ 320,000 $ 414,000 Cash Marketable securities 496,800 336,000 Accounts and notes receivable (net) 619,200 464,000 272,000 Inventories 351,900 Prepaid expenses 188,100 208,000 Total current assets $2,070,000 $1,600,000 Current liabilities: $ 675,000 $ 600,000 Accounts and notes payable (short-term) Accrued liabilities 225,000 200,000 $ 800,000 $ 900,000 Total current liabilities

Current Year Previous Year Current assets: $ 320,000 $ 414,000 Cash Marketable securities 496,800 336,000 Accounts and notes receivable (net) 619,200 464,000 272,000 Inventories 351,900 Prepaid expenses 188,100 208,000 Total current assets $2,070,000 $1,600,000 Current liabilities: $ 675,000 $ 600,000 Accounts and notes payable (short-term) Accrued liabilities 225,000 200,000 $ 800,000 $ 900,000 Total current liabilities

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.10P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

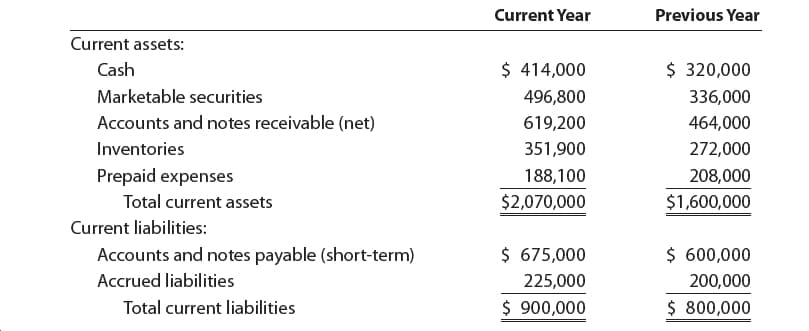

The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years:

Please see the attachment for details:

a. Determine for each year (1) the

b. What conclusions can be drawn from these data as to the company’s ability

to meet its currently maturing debts?

Transcribed Image Text:Current Year

Previous Year

Current assets:

$ 320,000

$ 414,000

Cash

Marketable securities

496,800

336,000

Accounts and notes receivable (net)

619,200

464,000

272,000

Inventories

351,900

Prepaid expenses

188,100

208,000

Total current assets

$2,070,000

$1,600,000

Current liabilities:

$ 675,000

$ 600,000

Accounts and notes payable (short-term)

Accrued liabilities

225,000

200,000

$ 800,000

$ 900,000

Total current liabilities

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning