Sweet Sugar Company manufactures three products (white sugar, brown sugar, and powdered sugar) in a continuous production process. Senior management has asked the controller to conduct an activity-based costing study. The controller identified the amount of factory overhead required by the critical activities of the organization as follows: Activity. Budgeted activity cost Production. $489,900 Setup. 117,600 Inspection. 105,600 Shipping. 144,300 Customer service. 65,500 Total. $ 922,900 The activity bases identified for each activity are as follows: Activity. Activity base. Production. Machine hours Setup. Number of set ups Inspection. Number of Inspections Shipping. Number of customer orders. Customer service. Number of customer service requests. The activity bases usage Quantities and units produced for the three products were determined from corporate records and are as follows: (Image 1) Step 2 in (image 2)

Sweet Sugar Company manufactures three products (white sugar, brown sugar, and powdered sugar) in a continuous production process. Senior management has asked the controller to conduct an activity-based costing study. The controller identified the amount of factory

Activity. Budgeted activity cost

Production. $489,900

Setup. 117,600

Inspection. 105,600

Shipping. 144,300

Customer service. 65,500

Total. $ 922,900

The activity bases identified for each activity are as follows:

Activity. Activity base.

Production. Machine hours

Setup. Number of set ups

Inspection. Number of Inspections

Shipping. Number of customer orders.

Customer service. Number of customer service requests.

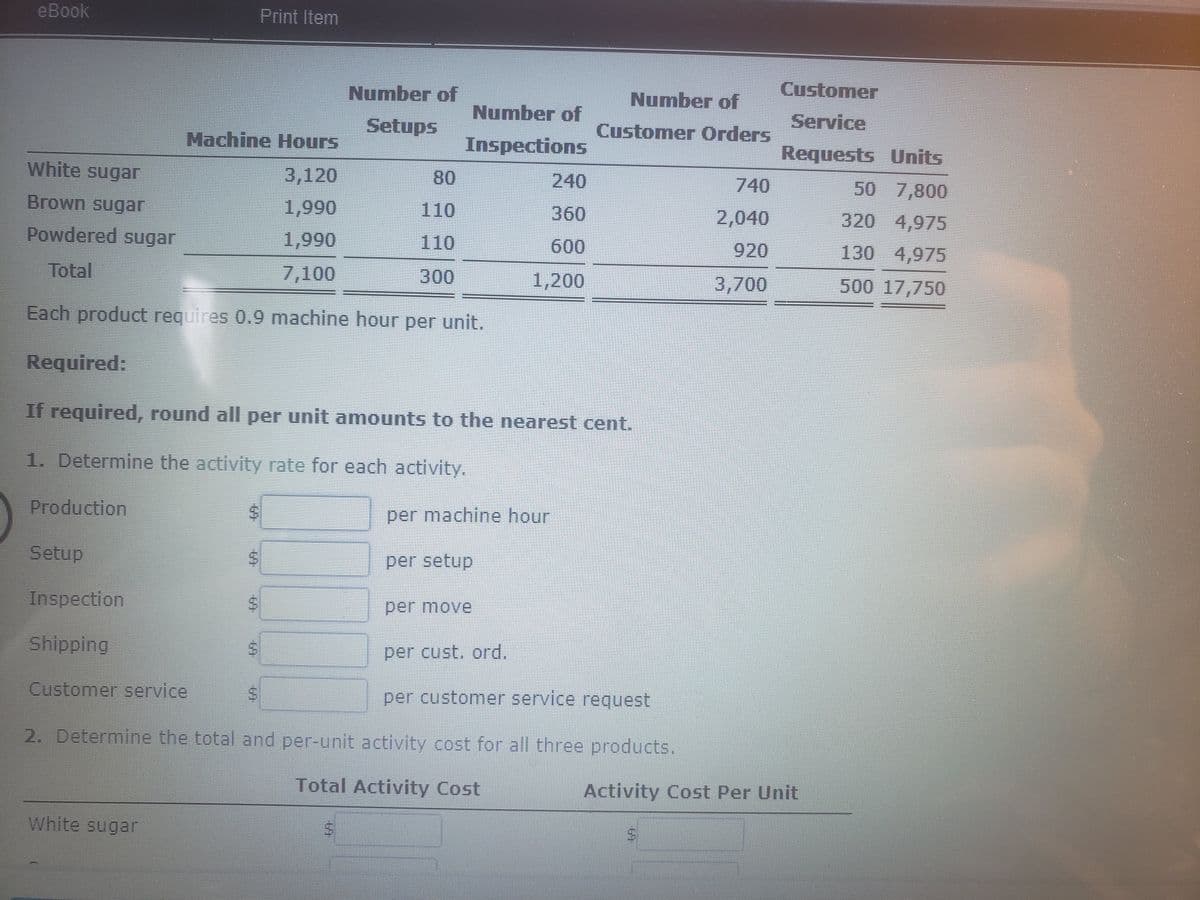

The activity bases usage Quantities and units produced for the three products were determined from corporate records and are as follows:

(Image 1)

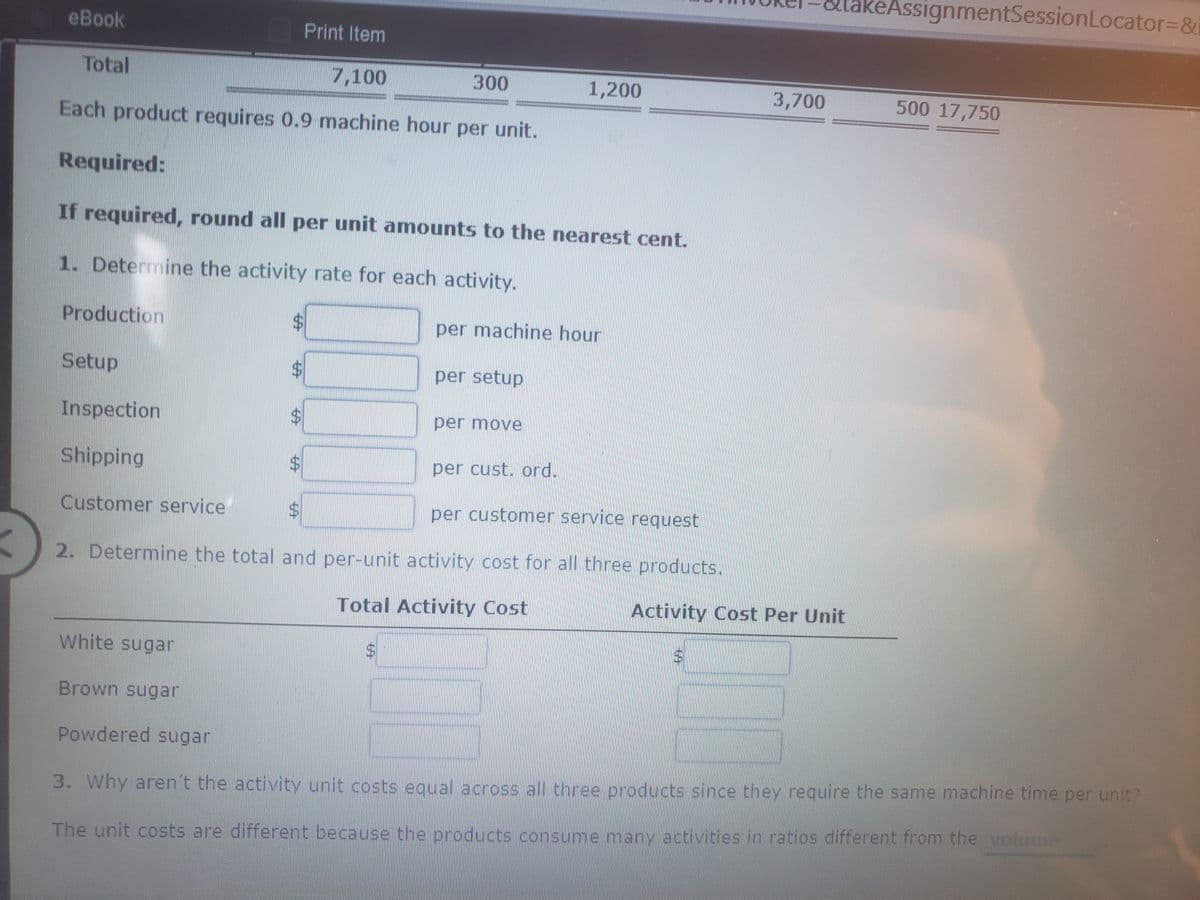

Step 2 in (image 2)

Answer:

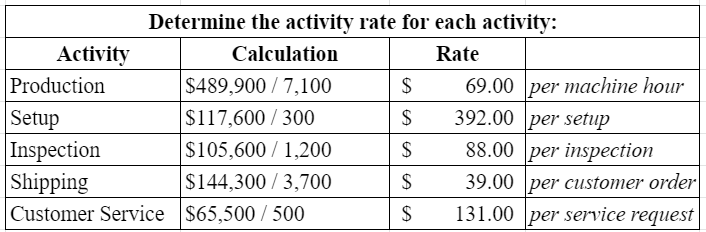

Part 1:

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images