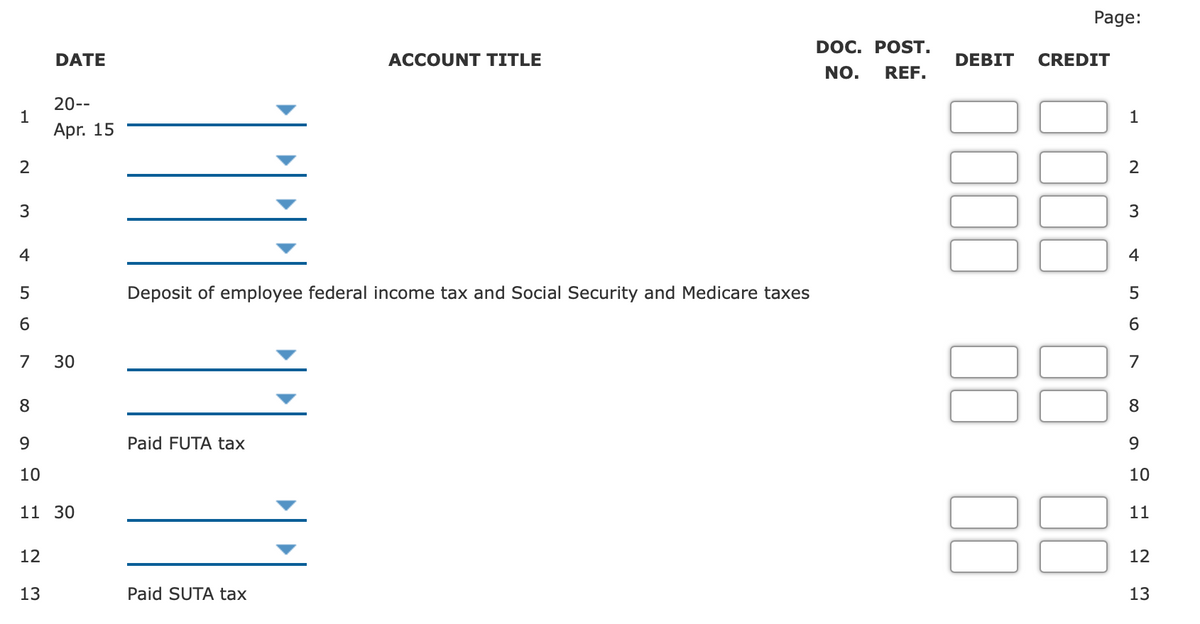

Journal Entries for Payment of Employer Payroll Taxes Angel Ruiz owns a business called Ruiz Construction Co. He does his banking at Citizens National Bank in Portland, Oregon. The amounts in his general ledger for payroll taxes and the employees' withholding of Social Security, Medicare, and federal income tax payable as of April 15 of the current year are as follows: Social Security tax payable (includes both employer and employee) $11,250 Medicare tax payable (includes both employer and employee) 2,625 FUTA tax payable 700 SUTA tax payable 3,990 Employee income tax payable 5,860 Journalize the quarterly payment of the employee federal income taxes and Social Security and Medicare taxes on April 15, 20--, and the payments of the FUTA and SUTA taxes on April 30, 20--.

Journal Entries for Payment of Employer Payroll Taxes Angel Ruiz owns a business called Ruiz Construction Co. He does his banking at Citizens National Bank in Portland, Oregon. The amounts in his general ledger for payroll taxes and the employees' withholding of Social Security, Medicare, and federal income tax payable as of April 15 of the current year are as follows: Social Security tax payable (includes both employer and employee) $11,250 Medicare tax payable (includes both employer and employee) 2,625 FUTA tax payable 700 SUTA tax payable 3,990 Employee income tax payable 5,860 Journalize the quarterly payment of the employee federal income taxes and Social Security and Medicare taxes on April 15, 20--, and the payments of the FUTA and SUTA taxes on April 30, 20--.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 2RE: Refer to RE18-1. Assume that Parkers taxable income for Year 1 is 150,000. Prepare the journal entry...

Related questions

Question

Angel Ruiz owns a business called Ruiz Construction Co. He does his banking at Citizens National Bank in Portland, Oregon. The amounts in his general ledger for payroll taxes and the employees' withholding of Social Security, Medicare, and federal income tax payable as of April 15 of the current year are as follows:

| Social Security tax payable (includes both employer and employee) | $11,250 |

| Medicare tax payable (includes both employer and employee) | 2,625 |

| FUTA tax payable | 700 |

| SUTA tax payable | 3,990 |

| Employee income tax payable | 5,860 |

Journalize the quarterly payment of the employee federal income taxes and Social Security and Medicare taxes on April 15, 20--, and the payments of the FUTA and SUTA taxes on April 30, 20--.

Transcribed Image Text:Page:

DOC. POST.

DATE

ACCOUNT TITLE

DEBIT

CREDIT

NO.

REF.

20--

1

Apr. 15

2

3

3

4

4

Deposit of employee federal income tax and Social Security and Medicare taxes

7

30

7

8.

9.

Paid FUTA tax

10

10

11 30

11

12

12

13

Paid SUTA tax

13

000

LO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning