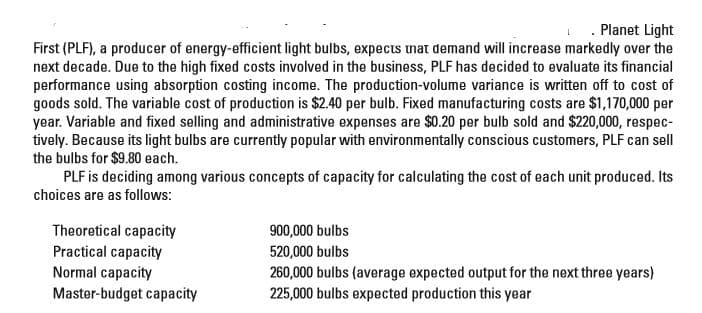

. Planet Light First (PLF), a producer of energy-efficient light bulbs, expects unat demand will increase markedly over the next decade. Due to the high fixed costs involved in the business, PLF has decided to evaluate its financial performance using absorption costing income. The production-volume variance is written off to cost of goods sold. The variable cost of production is $2.40 per bulb. Fixed manufacturing costs are $1,170,000 per year. Variable and fixed selling and administrative expenses are $0.20 per bulb sold and $220,000, respec- tively. Because its light bulbs are currently popular with environmentally conscious customers, PLF can sell the bulbs for $9.80 each. PLF is deciding among various concepts of capacity for calculating the cost of each unit produced. Its choices are as follows: Theoretical capacity Practical capacity Normal capacity Master-budget capacity 900,000 bulbs 520,000 bulbs 260,000 bulbs (average expected output for the next three years) 225,000 bulbs expected production this year

. Planet Light First (PLF), a producer of energy-efficient light bulbs, expects unat demand will increase markedly over the next decade. Due to the high fixed costs involved in the business, PLF has decided to evaluate its financial performance using absorption costing income. The production-volume variance is written off to cost of goods sold. The variable cost of production is $2.40 per bulb. Fixed manufacturing costs are $1,170,000 per year. Variable and fixed selling and administrative expenses are $0.20 per bulb sold and $220,000, respec- tively. Because its light bulbs are currently popular with environmentally conscious customers, PLF can sell the bulbs for $9.80 each. PLF is deciding among various concepts of capacity for calculating the cost of each unit produced. Its choices are as follows: Theoretical capacity Practical capacity Normal capacity Master-budget capacity 900,000 bulbs 520,000 bulbs 260,000 bulbs (average expected output for the next three years) 225,000 bulbs expected production this year

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter7: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 62P

Related questions

Question

Calculate the inventoriable cost per unit using each level of capacity to compute fixed

Transcribed Image Text:. Planet Light

First (PLF), a producer of energy-efficient light bulbs, expects unat demand will increase markedly over the

next decade. Due to the high fixed costs involved in the business, PLF has decided to evaluate its financial

performance using absorption costing income. The production-volume variance is written off to cost of

goods sold. The variable cost of production is $2.40 per bulb. Fixed manufacturing costs are $1,170,000 per

year. Variable and fixed selling and administrative expenses are $0.20 per bulb sold and $220,000, respec-

tively. Because its light bulbs are currently popular with environmentally conscious customers, PLF can sell

the bulbs for $9.80 each.

PLF is deciding among various concepts of capacity for calculating the cost of each unit produced. Its

choices are as follows:

Theoretical capacity

Practical capacity

Normal capacity

Master-budget capacity

900,000 bulbs

520,000 bulbs

260,000 bulbs (average expected output for the next three years)

225,000 bulbs expected production this year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub