Raleigh Company produces and sells a single product. The company would like to budget its net operating income (NOI) for the coming year assuming an increase in unit sales but with price, variable cost per unit, and total fixed cost remaining the same. For the past year, the company reported the following results: Sales 24 548,000 Margin of safety Fixed cost 24 228,000 24 204,800 18 If the company expects a 25% increase in unit sales, its NOI for the coming period would be closest to: $ 137,000 $ 410,498 $ 233,600 $ 438,400 E. None of the above A. В. С. D.

Raleigh Company produces and sells a single product. The company would like to budget its net operating income (NOI) for the coming year assuming an increase in unit sales but with price, variable cost per unit, and total fixed cost remaining the same. For the past year, the company reported the following results: Sales 24 548,000 Margin of safety Fixed cost 24 228,000 24 204,800 18 If the company expects a 25% increase in unit sales, its NOI for the coming period would be closest to: $ 137,000 $ 410,498 $ 233,600 $ 438,400 E. None of the above A. В. С. D.

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter4: Accounting For Factory Overhead

Section: Chapter Questions

Problem 15P: The following information, taken from the books of Herman Brothers Manufacturing represents the...

Related questions

Question

Please I want to learn how to make these problems with a good explanation. One of those there is the possible answer.

I NEED ONLY QUESTION 18

Thank you

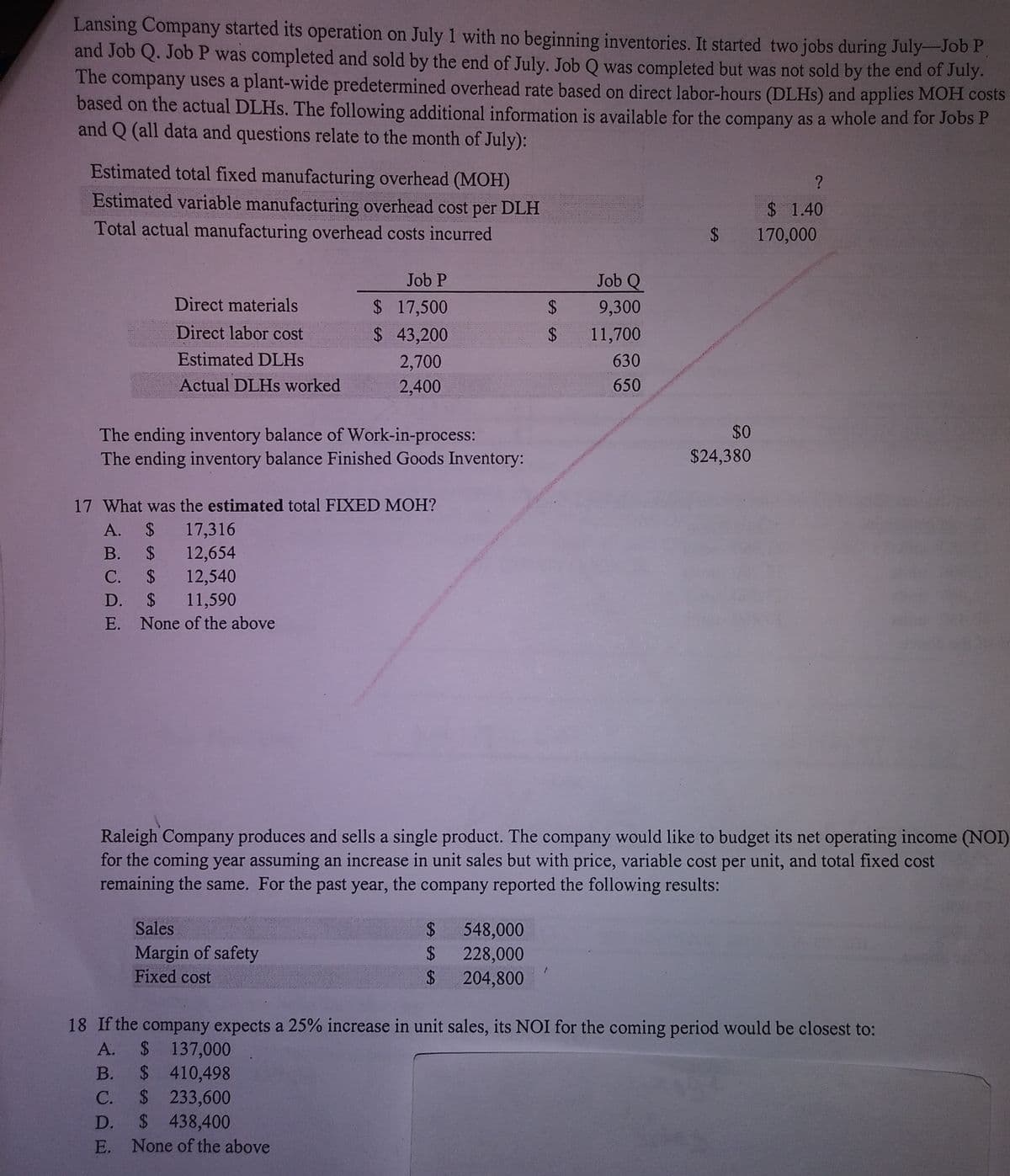

Transcribed Image Text:Lansing Company started its operation on July 1 with no beginning inventories. It started two jobs during July-Job P

and Job Q. Job P was completed and sold by the end of July. Job Q was completed but was not sold by the end of July.

The company uses a plant-wide predetermined overhead rate based on direct labor-hours (DLHS) and applies MOH costs

based on the actual DLHs. The following additional information is available for the company as a whole and for Jobs P

and Q (all data and questions relate to the month of July):

Estimated total fixed manufacturing overhead (MOH)

Estimated variable manufacturing overhead cost per DLH

$ 1.40

Total actual manufacturing overhead costs incurred

$ 170,000

Job P

Job Q

Direct materials

$ 17,500

$ 43,200

24

9,300

Direct labor cost

2$

11,700

Estimated DLHS

2,700

630

Actual DLHS worked

2,400

650

$0

The ending inventory balance of Work-in-process:

The ending inventory balance Finished Goods Inventory:

$24,380

17 What was the estimated total FIXED MOH?

$ 17,316

B. $ 12,654

А.

$ 12,540

$ 11,590

С.

D.

E. None of the above

Raleigh Company produces and sells a single product. The company would like to budget its net operating income (NOI)

for the coming year assuming an increase in unit sales but with price, variable cost per unit, and total fixed cost

remaining the same. For the past year, the company reported the following results:

Sales

Margin of safety

Fixed cost

$ 548,000

228,000

%24

24

204,800

18 If the company expects a 25% increase in unit sales, its NOI for the coming period would be closest to:

$ 137,000

$ 410,498

$ 233,600

$ 438,400

A.

В.

C.

D.

E. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning