. The company's business conditions are improving. One possible result is a sales volume of 18,000 units. The company president is onfident that this volume is within the relevant range of existing capacity. How much would operating income increase over the udgeted amount of $159,000 if this level is reached without increasing capacity?

. The company's business conditions are improving. One possible result is a sales volume of 18,000 units. The company president is onfident that this volume is within the relevant range of existing capacity. How much would operating income increase over the udgeted amount of $159,000 if this level is reached without increasing capacity?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter8: Budgeting

Section: Chapter Questions

Problem 6PA: Budgeted income statement and balance sheet As a preliminary to requesting budget estimates of...

Related questions

Question

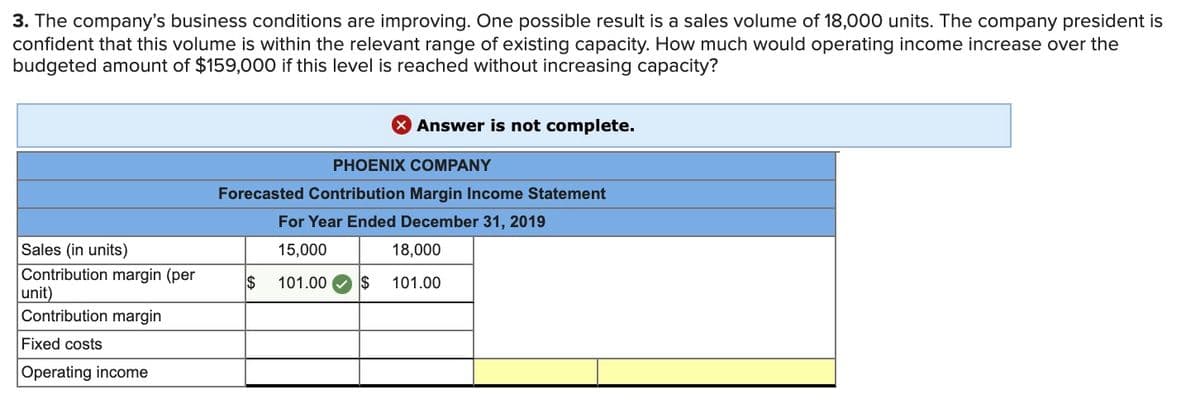

Transcribed Image Text:3. The company's business conditions are improving. One possible result is a sales volume of 18,000 units. The company president is

confident that this volume is within the relevant range of existing capacity. How much would operating income increase over the

budgeted amount of $159,000 if this level is reached without increasing capacity?

X Answer is not complete.

PHOENIX COMPANY

Forecasted Contribution Margin Income Statement

For Year Ended December 31, 2019

Sales (in units)

Contribution margin (per

unit)

Contribution margin

15,000

18,000

$

101.00

$

101.00

Fixed costs

Operating income

![!

Required information

[The following information applies to the questions displayed below.]

Phoenix Company's 2019 master budget included the following fixed budget report. It is based on an expected production

and sales volume of 15,000 units.

PHOENIX COMPANY

Fixed Budget Report

For Year Ended December 31, 2019

Sales

$3,000,000

Cost of goods sold

Direct materials

$975,000

225,000

60,000

300,000

195,000

200,000

Direct labor

Machinery repairs (variable cost)

Depreciation-Plant equipment (straight-line)

Utilities ($45,000 is variable)

Plant management salaries

Gross profit

Selling expenses

Packaging

Shipping

Sales salary (fixed annual amount)

General and administrative expenses

Advertising expense

Salaries

Entertainment expense

1,955,000

1,045,000

75,000

105,000

250,000

430,000

125,000

241,000

90,000

456,000

159,000

Income from operations

$

3. The company's business conditions are improving. One possible result is a sales volume of 18,000 units. The company president is

confident that this volume is within the relevant range of existing capacity. How much would operating income increase over the

budgeted amount of $159,000 if this level is reached without increasing capacity?](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F4a0cdaf2-3070-4739-98e3-9e022e7682dd%2F9040cfdb-5d83-41b1-8268-55e4bb822fd0%2Fgiye75c_processed.jpeg&w=3840&q=75)

Transcribed Image Text:!

Required information

[The following information applies to the questions displayed below.]

Phoenix Company's 2019 master budget included the following fixed budget report. It is based on an expected production

and sales volume of 15,000 units.

PHOENIX COMPANY

Fixed Budget Report

For Year Ended December 31, 2019

Sales

$3,000,000

Cost of goods sold

Direct materials

$975,000

225,000

60,000

300,000

195,000

200,000

Direct labor

Machinery repairs (variable cost)

Depreciation-Plant equipment (straight-line)

Utilities ($45,000 is variable)

Plant management salaries

Gross profit

Selling expenses

Packaging

Shipping

Sales salary (fixed annual amount)

General and administrative expenses

Advertising expense

Salaries

Entertainment expense

1,955,000

1,045,000

75,000

105,000

250,000

430,000

125,000

241,000

90,000

456,000

159,000

Income from operations

$

3. The company's business conditions are improving. One possible result is a sales volume of 18,000 units. The company president is

confident that this volume is within the relevant range of existing capacity. How much would operating income increase over the

budgeted amount of $159,000 if this level is reached without increasing capacity?

Expert Solution

Step 1 Flexible Budget for 2019

| Phoenix Company | ||||

| Flexible Budget for 2019 | ||||

| Flexible Budget | ||||

| Flexible Budget For | ||||

| Particulars | Variable amount per unit | Total Fixed Cost | Volume - 14000 units | Volume - 16000 units |

| Sales | $200.00 | $2,800,000.00 | $3,200,000.00 | |

| Variable costs: | ||||

| Direct materials | $65.00 | $910,000.00 | $1,040,000.00 | |

| Direct labor | $15.00 | $210,000.00 | $240,000.00 | |

| Machinery repairs | $4.00 | $56,000.00 | $64,000.00 | |

| Utilities | $3.00 | $42,000 | $48,000.00 | |

| Packaging | $5.00 | $70,000.00 | $80,000.00 | |

| Shipping | $7.00 | $98,000.00 | $112,000.00 | |

| Total Variable costs | $99.00 | $1,386,000 | $1,584,000.00 | |

| Contribution margin | $101.00 | $1,414,000.00 | 1,616,000.00 | |

| Fixed Costs: | ||||

| Depreciation—Plant equipment | $300,000.00 | $300,000.00 | $300,000.00 | |

| Utilities | $150,000.00 | $150,000.00 | $150,000.00 | |

| Plant management salaries | $200,000.00 | $200,000.00 | $200,000.00 | |

| Sales Salaries | $250,000.00 | $250,000.00 | $250,000.00 | |

| Advertising expense | $125,000.00 | $125,000.00 | $125,000.00 | |

| Salaries | $241,000.00 | $241,000.00 | $241,000.00 | |

| Entertainment expense | $90,000.00 | $90,000.00 | $90,000.00 | |

| Total Fixed Costs | $1,356,000.00 | $1,356,000.00 | $1,356,000.00 | |

| Net Operating Income | $58,000.00 | $260,000.00 | ||

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning