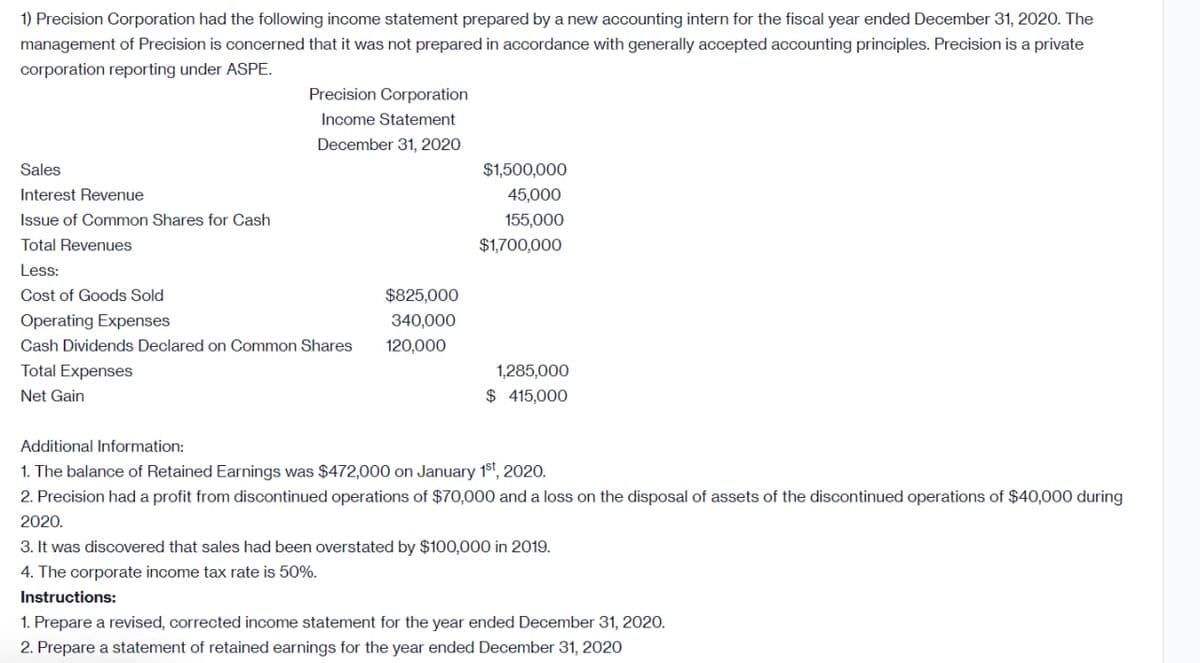

1) Precision Corporation had the following income statement prepared by a new accounting intern for the fiscal year ended December 31, 2020. The management of Precision is concerned that it was not prepared in accordance with generally accepted accounting principles. Precision is a private corporation reporting under ASPE. Precision Corporation Income Statement December 31, 2020 Sales $1,500,000 Interest Revenue 45,000 Issue of Common Shares for Cash 155,000 Total Revenues $1,700,000 Less: Cost of Goods Sold $825,000 Operating Expenses 340,000 Cash Dividends Declared on Common Shares 120,000 Total Expenses 1,285,000 Net Gain $ 415,000 Additional Information: 1. The balance of Retained Earnings was $472,000 on January 1st, 2020. 2. Precision had a profit from discontinued operations of $70,000 and a loss on the disposal of assets of the discontinued operations of $40,000 during 2020. 3. It was discovered that sales had been overstated by $100,000 in 2019. 4. The corporate income tax rate is 50%. Instructions: 1. Prepare a revised, corrected income statement for the year ended December 31, 2020. 2. Prepare a statement of retained earnings for the year ended December 31, 2020

1) Precision Corporation had the following income statement prepared by a new accounting intern for the fiscal year ended December 31, 2020. The management of Precision is concerned that it was not prepared in accordance with generally accepted accounting principles. Precision is a private corporation reporting under ASPE. Precision Corporation Income Statement December 31, 2020 Sales $1,500,000 Interest Revenue 45,000 Issue of Common Shares for Cash 155,000 Total Revenues $1,700,000 Less: Cost of Goods Sold $825,000 Operating Expenses 340,000 Cash Dividends Declared on Common Shares 120,000 Total Expenses 1,285,000 Net Gain $ 415,000 Additional Information: 1. The balance of Retained Earnings was $472,000 on January 1st, 2020. 2. Precision had a profit from discontinued operations of $70,000 and a loss on the disposal of assets of the discontinued operations of $40,000 during 2020. 3. It was discovered that sales had been overstated by $100,000 in 2019. 4. The corporate income tax rate is 50%. Instructions: 1. Prepare a revised, corrected income statement for the year ended December 31, 2020. 2. Prepare a statement of retained earnings for the year ended December 31, 2020

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 5P: Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of...

Related questions

Topic Video

Question

Transcribed Image Text:1) Precision Corporation had the following income statement prepared by a new accounting intern for the fiscal year ended December 31, 2020. The

management of Precision is concerned that it was not prepared in accordance with generally accepted accounting principles. Precision is a private

corporation reporting under ASPE.

Precision Corporation

Income Statement

December 31, 2020

Sales

$1,500,000

Interest Revenue

45,000

Issue of Common Shares for Cash

155,000

Total Revenues

$1,700,000

Less:

Cost of Goods Sold

$825,000

Operating Expenses

340,000

Cash Dividends Declared on Common Shares

120,000

Total Expenses

1,285,000

Net Gain

$ 415,000

Additional Information:

1. The balance of Retained Earnings was $472,000 on January 1st, 2020.

2. Precision had a profit from discontinued operations of $70,000 and a loss on the disposal of assets of the discontinued operations of $40,000 during

2020.

3. It was discovered that sales had been overstated by $100,000 in 2019.

4. The corporate income tax rate is 50%.

Instructions:

1. Prepare a revised, corrected income statement for the year ended December 31, 2020.

2. Prepare a statement of retained earnings for the year ended December 31, 2020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning