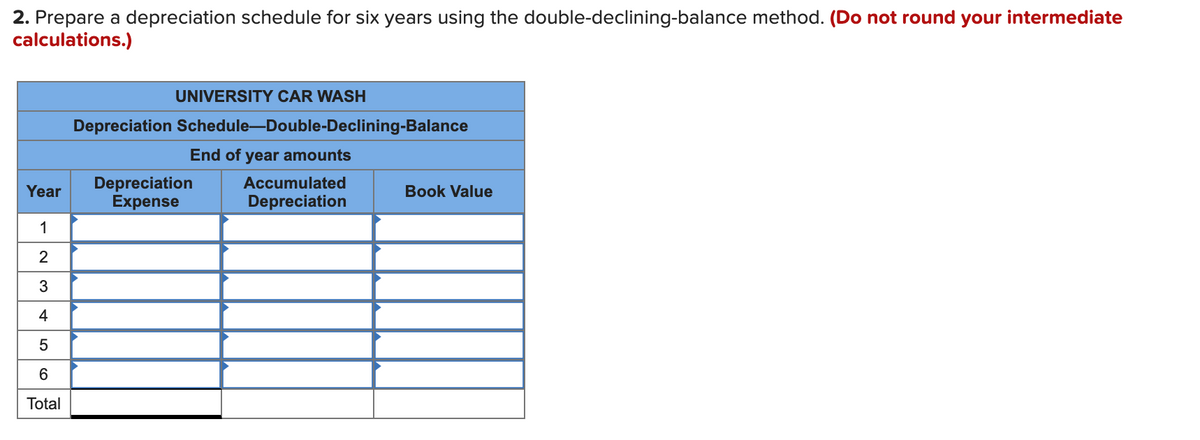

1) University Car Wash built a deluxe car wash across the street from campus. The new machines cost $240,000 including installation. The company estimates that the equipment will have a residual value of $30,000. University Car Wash also estimates it will use the machine for six years or about 12,000 total hours. Actual use per year was as follows: Year Hours Used 1 2,600 2 2,100 3 2,200 4 1,800 5 1,600 6 1,700 Picture 1) Prepare a depreciation schedule for six years using the double-declining-balance method. (Do not round your intermediate calculations.) 2)University Car Wash built a deluxe car wash across the street from campus. The new machines cost $240,000 including installation. The company estimates that the equipment will have a residual value of $30,000. University Car Wash also estimates it will use the machine for six years or about 12,000 total hours. Actual use per year was as follows: Year Hours Used 1 2,600 2 2,100 3 2,200 4 1,800 5 1,600 6 1,700 Picture 2) Prepare a depreciation schedule for six years using the activity-based method.

1) University Car Wash built a deluxe car wash across the street from campus. The new machines cost $240,000 including installation. The company estimates that the equipment will have a residual value of $30,000. University Car Wash also estimates it will use the machine for six years or about 12,000 total hours. Actual use per year was as follows:

| Year | Hours Used |

| 1 | 2,600 |

| 2 | 2,100 |

| 3 | 2,200 |

| 4 | 1,800 |

| 5 | 1,600 |

| 6 | 1,700 |

Picture 1) Prepare a

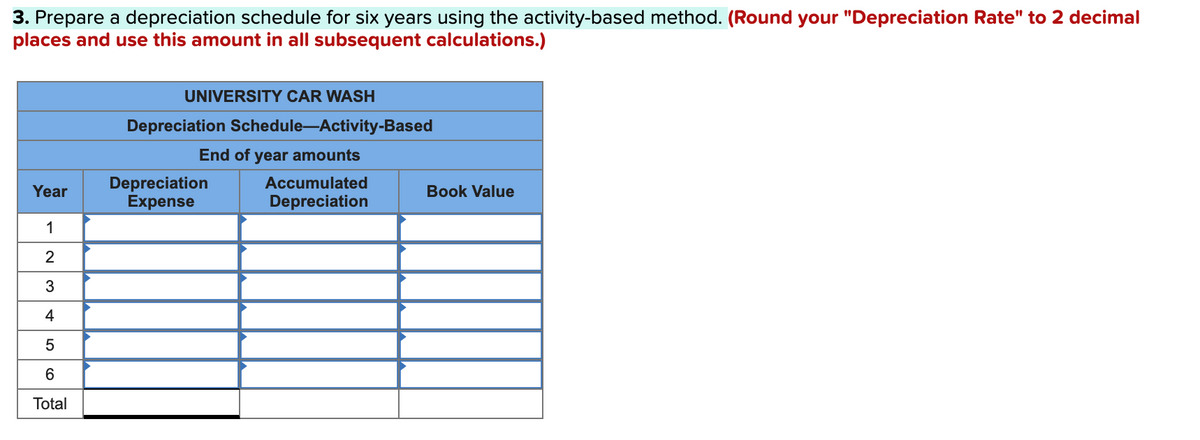

2)University Car Wash built a deluxe car wash across the street from campus. The new machines cost $240,000 including installation. The company estimates that the equipment will have a residual value of $30,000. University Car Wash also estimates it will use the machine for six years or about 12,000 total hours. Actual use per year was as follows:

| Year | Hours Used |

| 1 | 2,600 |

| 2 | 2,100 |

| 3 | 2,200 |

| 4 | 1,800 |

| 5 | 1,600 |

| 6 | 1,700 |

Picture 2) Prepare a depreciation schedule for six years using the activity-based method.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images