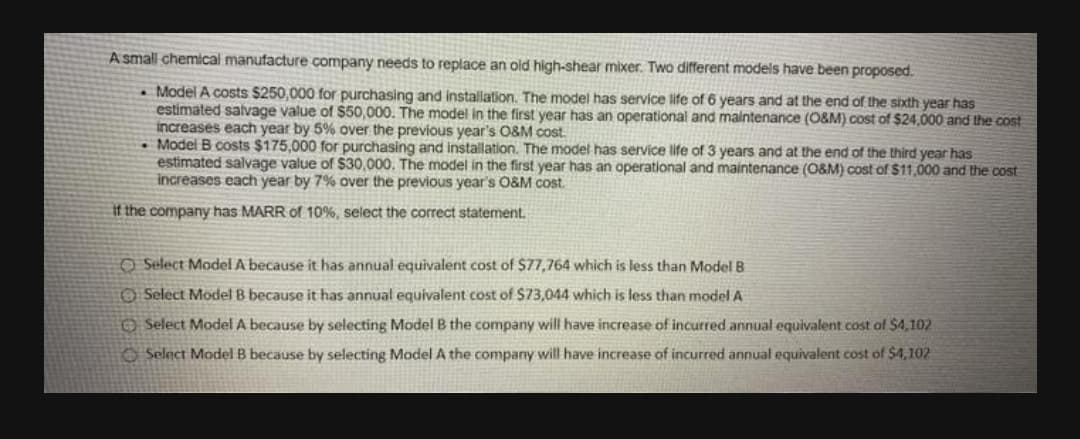

A small chemical manufacture company needs to replace an old high-shear mixer. Two different models have been proposed. . Model A costs $250,000 for purchasing and installation. The model has service life of 6 years and at the end of the sixth year has estimated salvage value of $50,000. The model in the first year has an operational and maintenance (O&M) cost of $24,000 and the cost increases each year by 5 % over the previous year's O&M cost. • Model B costs $175,000 for purchasing and installation. The model has service life of 3 years and at the end of the third year has estimated salvage value of $30,000. The model in the first year has an operational and maintenance (O&M) cost of $11,000 and the cost increases each year by 7% over the previous year's O&M cost. It the company has MARR of 10%, select the correct statement.

A small chemical manufacture company needs to replace an old high-shear mixer. Two different models have been proposed. . Model A costs $250,000 for purchasing and installation. The model has service life of 6 years and at the end of the sixth year has estimated salvage value of $50,000. The model in the first year has an operational and maintenance (O&M) cost of $24,000 and the cost increases each year by 5 % over the previous year's O&M cost. • Model B costs $175,000 for purchasing and installation. The model has service life of 3 years and at the end of the third year has estimated salvage value of $30,000. The model in the first year has an operational and maintenance (O&M) cost of $11,000 and the cost increases each year by 7% over the previous year's O&M cost. It the company has MARR of 10%, select the correct statement.

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 14P

Related questions

Question

Transcribed Image Text:A small chemical manufacture company needs to replace an old high-shear mixer. Two different models have been proposed.

. Model A costs $250,000 for purchasing and installation. The model has service life of 6 years and at the end of the sixth year has

estimated salvage value of $50,000. The model in the first year has an operational and maintenance (O&M) cost of $24,000 and the cost

increases each year by 5% over the previous year's O&M cost.

• Model B costs $175,000 for purchasing and installation. The model has service life of 3 years and at the end of the third year has

estimated salvage value of $30,000. The model in the first year has an operational and maintenance (O&M) cost of $11,000 and the cost

increases each year by 7% over the previouS year's O&M cost.

It the company has MARR of 10%, select the correct statement.

O Select Model A because it has annual equivalent cost of $77,764 which is less than Model B

O Select Model B because it has annual equivalent cost of $73,044 which is less than model A

O Select Model A because by selecting Model B the company will have increase of incurred annual equivalent cost of $4,102

O Select Model B because by selecting Model A the company will have increase of incurred annual equivalent cost of S4,102

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning