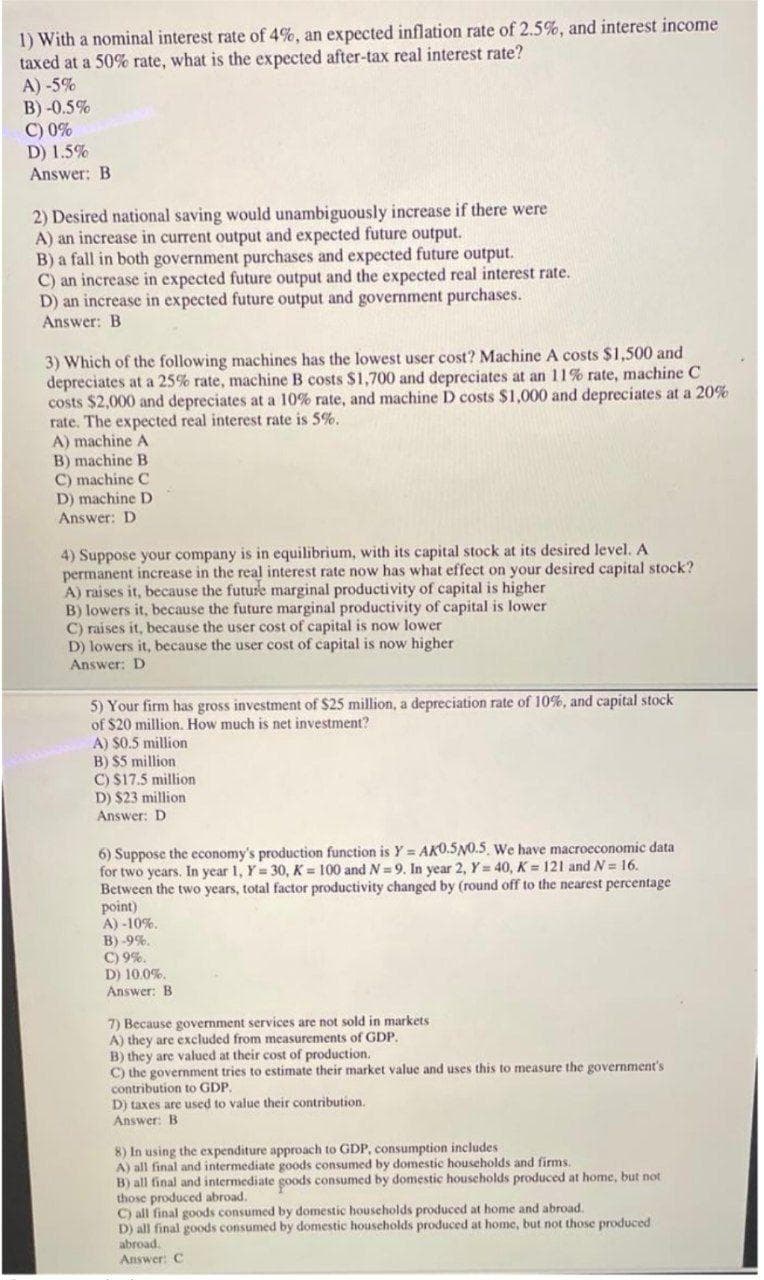

1) With a nominal interest rate of 4%, an expected inflation rate of 2.5%, and interest income taxed at a 50% rate, what is the expected after-tax real interest rate? A) -5% B) -0.5% C) 0% D) 1.5% Answer: B 2) Desired national saving would unambiguously increase if there were A) an increase in current output and expected future output. B) a fall in both government purchases and expected future output. C) an increase in expected future output and the expected real interest rate. D) an increase in expected future output and government purchases. Answer: B 3) Which of the following machines has the lowest user cost? Machine A costs $1,500 and depreciates at a 25% rate, machine B costs $1,700 and depreciates at an 11% rate, machine C costs $2,000 and depreciates at a 10% rate, and machine D costs $1,000 and depreciates at a 20% rate. The expected real interest rate is 5%. A) machine A B) machine B C) machine C D) machine D Answer: D 4) Suppose your company is in equilibrium, with its capital stock at its desired level. A permanent increase in the real interest rate now has what effect on your desired capital stock? A) raises it, because the future marginal productivity of capital is higher B) lowers it, because the future marginal productivity of capital is lower C) raises it, because the user cost of capital is now lower D) lowers it, because the user cost of capital is now higher Answer: D 5) Your firm has gross investment of $25 million, a depreciation rate of 10%, and capital stock of $20 million. How much is net investment? A) $0.5 million B) $5 million C) $17.5 million D) $23 million Answer: D 6) Suppose the economy's production function is Y= AKO.5N0.5, We have macroeconomic data for two years. In year 1, Y= 30, K = 100 and N=9. In year 2, Y= 40, K= 121 and N= 16. Between the two years, total factor productivity changed by (round off to the nearest percentage point) A) -10%. B) -9%. C) 9%. D) 10.0%. Answer: B 7) Because government services are not sold in markets A) they are excluded from mcasurements of GDP. B) they are valued at their cost of production. C) the government tries to estimate their market value and uses this to measure the government's contribution to GDP. D) taxes are used to value their contribution. Answer: B 8) In using the expenditure approach to GDP, consumption includes A) all final and intermediate goods consumed by domestic households and firms. B) all final and intermediate goods consumed by domestic houscholds produced at home, but not those produced abroad. C) all final goods consumed by domestic households produced at home and abroad. D) all final goods consumed by domestic households produced at home, but not those produced abroad. Answer: C

1) With a nominal interest rate of 4%, an expected inflation rate of 2.5%, and interest income taxed at a 50% rate, what is the expected after-tax real interest rate? A) -5% B) -0.5% C) 0% D) 1.5% Answer: B 2) Desired national saving would unambiguously increase if there were A) an increase in current output and expected future output. B) a fall in both government purchases and expected future output. C) an increase in expected future output and the expected real interest rate. D) an increase in expected future output and government purchases. Answer: B 3) Which of the following machines has the lowest user cost? Machine A costs $1,500 and depreciates at a 25% rate, machine B costs $1,700 and depreciates at an 11% rate, machine C costs $2,000 and depreciates at a 10% rate, and machine D costs $1,000 and depreciates at a 20% rate. The expected real interest rate is 5%. A) machine A B) machine B C) machine C D) machine D Answer: D 4) Suppose your company is in equilibrium, with its capital stock at its desired level. A permanent increase in the real interest rate now has what effect on your desired capital stock? A) raises it, because the future marginal productivity of capital is higher B) lowers it, because the future marginal productivity of capital is lower C) raises it, because the user cost of capital is now lower D) lowers it, because the user cost of capital is now higher Answer: D 5) Your firm has gross investment of $25 million, a depreciation rate of 10%, and capital stock of $20 million. How much is net investment? A) $0.5 million B) $5 million C) $17.5 million D) $23 million Answer: D 6) Suppose the economy's production function is Y= AKO.5N0.5, We have macroeconomic data for two years. In year 1, Y= 30, K = 100 and N=9. In year 2, Y= 40, K= 121 and N= 16. Between the two years, total factor productivity changed by (round off to the nearest percentage point) A) -10%. B) -9%. C) 9%. D) 10.0%. Answer: B 7) Because government services are not sold in markets A) they are excluded from mcasurements of GDP. B) they are valued at their cost of production. C) the government tries to estimate their market value and uses this to measure the government's contribution to GDP. D) taxes are used to value their contribution. Answer: B 8) In using the expenditure approach to GDP, consumption includes A) all final and intermediate goods consumed by domestic households and firms. B) all final and intermediate goods consumed by domestic houscholds produced at home, but not those produced abroad. C) all final goods consumed by domestic households produced at home and abroad. D) all final goods consumed by domestic households produced at home, but not those produced abroad. Answer: C

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

Answers are already given please explain.

Transcribed Image Text:1) With a nominal interest rate of 4%, an expected inflation rate of 2.5%, and interest income

taxed at a 50% rate, what is the expected after-tax real interest rate?

A) -5%

B) -0.5%

C) 0%

D) 1.5%

Answer: B

2) Desired national saving would unambiguously increase if there were

A) an increase in current output and expected future output.

B) a fall in both government purchases and expected future output.

C) an increase in expected future output and the expected real interest rate.

D) an increase in expected future output and government purchases.

Answer: B

3) Which of the following machines has the lowest user cost? Machine A costs $1,500 and

depreciates at a 25% rate, machine B costs $1,700 and depreciates at an 11% rate, machine C

costs $2,000 and depreciates at a 10% rate, and machine D costs $1,000 and depreciates at a 20%

rate. The expected real interest rate is 5%.

A) machine A

B) machine B

C) machine C

D) machine D

Answer: D

4) Suppose your company is in equilibrium, with its capital stock at its desired level. A

permanent increase in the real interest rate now has what effect on your desired capital stock?

A) raises it, because the future marginal productivity of capital is higher

B) lowers it, because the future marginal productivity of capital is lower

C) raises it, because the user cost of capital is now lower

D) lowers it, because the user cost of capital is now higher

Answer: D

5) Your firm has gross investment of $25 million, a depreciation rate of 10%, and capital stock

of $20 million. How much is net investment?

A) $0.5 million

B) $5 million

C) $17.5 million

D) $23 million

Answer: D

6) Suppose the economy's production function is Y = AKO.5N0.5, We have macroeconomic data

for two years. In year 1, Y= 30, K = 100 and N=9. In year 2, Y= 40, K = 121 and N= 16.

Between the two years, total factor productivity changed by (round off to the nearest percentage

point)

A) -10%.

B) -9%.

C) 9%.

D) 10.0%.

Answer: B

7) Because government services are not sold in markets

A) they are excluded from measurements of GDP,

B) they are valued at their cost of production.

C) the government tries to estimate their market value and uses this to measure the government's

contribution to GDP.

D) taxes are used to value their contribution.

Answer: B

8) In using the expenditure approach to GDP, consumption includes

A) all final and intermediate goods consumed by domestic households and firms.

B) all final and intermediate goods consumed by domestic houscholds produced at home, but not

those produced abroad.

C) all final goods consumed by domestic houscholds produced at home and abroad.

D) all final goods consumed by domestic households produced at home, but not those produced

abroad.

Answer: C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education