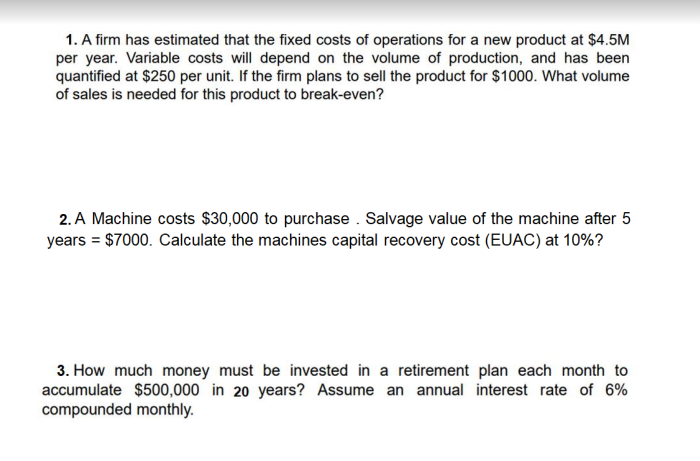

1. A firm has estimated that the fixed costs of operations for a new product at $4.5M per year. Variable costs will depend on the volume of production, and has been quantified at $250 per unit. If the firm plans to sell the product for $1000. What volume of sales is needed for this product to break-even? 2. A Machine costs $30,000 to purchase . Salvage value of the machine after 5 years = $7000. Calculate the machines capital recovery cost (EUAC) at 10%? 3. How much money must be invested in a retirement plan each month to accumulate $500,000 in 20 years? Assume an annual interest rate of 6% compounded monthly.

1. A firm has estimated that the fixed costs of operations for a new product at $4.5M per year. Variable costs will depend on the volume of production, and has been quantified at $250 per unit. If the firm plans to sell the product for $1000. What volume of sales is needed for this product to break-even? 2. A Machine costs $30,000 to purchase . Salvage value of the machine after 5 years = $7000. Calculate the machines capital recovery cost (EUAC) at 10%? 3. How much money must be invested in a retirement plan each month to accumulate $500,000 in 20 years? Assume an annual interest rate of 6% compounded monthly.

Chapter17: Capital And Time

Section: Chapter Questions

Problem 17.5P

Related questions

Question

please answer question 3 with details on how to do it. Thank you.

Transcribed Image Text:1. A firm has estimated that the fixed costs of operations for a new product at $4.5M

per year. Variable costs will depend on the volume of production, and has been

quantified at $250 per unit. If the firm plans to sell the product for $1000. What volume

of sales is needed for this product to break-even?

2. A Machine costs $30,000 to purchase . Salvage value of the machine after 5

years = $7000. Calculate the machines capital recovery cost (EUAC) at 10%?

3. How much money must be invested in a retirement plan each month to

accumulate $500,000 in 20 years? Assume an annual interest rate of 6%

compounded monthly.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning