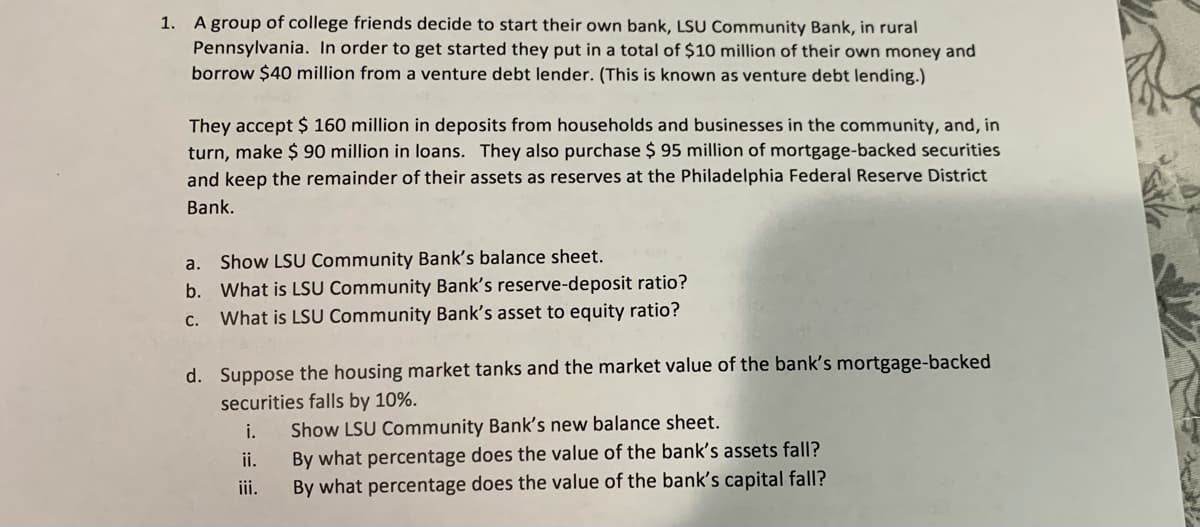

1. A group of college friends decide to start their own bank, LSU Community Bank, in rural Pennsylvania. In order to get started they put in a total of $10 million of their own money and borrow $40 million from a venture debt lender. (This is known as venture debt lending.) They accept $ 160 million in deposits from households and businesses in the community, and, in turn, make $ 90 million in loans. They also purchase $ 95 million of mortgage-backed securities and keep the remainder of their assets as reserves at the Philadelphia Federal Reserve District Bank. a. Show LSU Community Bank's balance sheet. b. What is LSU Community Bank's reserve-deposit ratio? What is LSU Community Bank's asset to equity ratio? C.

1. A group of college friends decide to start their own bank, LSU Community Bank, in rural Pennsylvania. In order to get started they put in a total of $10 million of their own money and borrow $40 million from a venture debt lender. (This is known as venture debt lending.) They accept $ 160 million in deposits from households and businesses in the community, and, in turn, make $ 90 million in loans. They also purchase $ 95 million of mortgage-backed securities and keep the remainder of their assets as reserves at the Philadelphia Federal Reserve District Bank. a. Show LSU Community Bank's balance sheet. b. What is LSU Community Bank's reserve-deposit ratio? What is LSU Community Bank's asset to equity ratio? C.

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter8: Savings,investment And The Financial System

Section: Chapter Questions

Problem 8PA

Related questions

Question

Please answer part d and balance the balance sheet

Transcribed Image Text:1. A group of college friends decide to start their own bank, LSU Community Bank, in rural

Pennsylvania. In order to get started they put in a total of $10 million of their own money and

borrow $40 million from a venture debt lender. (This is known as venture debt lending.)

They accept $ 160 million in deposits from households and businesses in the community, and, in

turn, make $ 90 million in loans. They also purchase $ 95 million of mortgage-backed securities

and keep the remainder of their assets as reserves at the Philadelphia Federal Reserve District

Bank.

a. Show LSU Community Bank's balance sheet.

b. What is LSU Community Bank's reserve-deposit ratio?

C.

What is LSU Community Bank's asset to equity ratio?

d. Suppose the housing market tanks and the market value of the bank's mortgage-backed

securities falls by 10%.

i.

Show LSU Community Bank's new balance sheet.

ii.

By what percentage does the value of the bank's assets fall?

iii.

By what percentage does the value of the bank's capital fall?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning