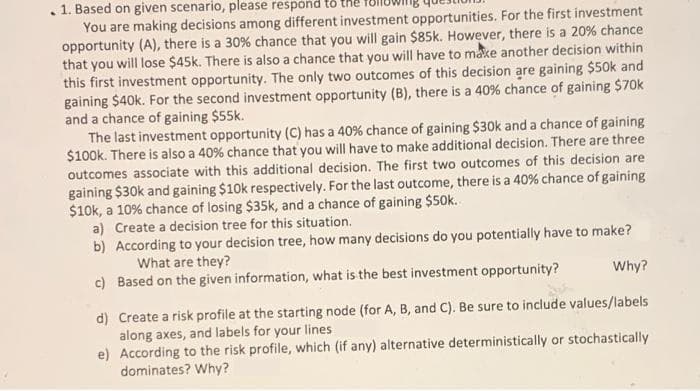

1. Based on given scenario, please resp You are making decisions among different investment opportunities. For the first investment opportunity (A), there is a 30% chance that you will gain $85k. However, there is a 20% chance that you will lose $45k. There is also a chance that you will have to make another decision within this first investment opportunity. The only two outcomes of this decision are gaining $50k and gaining $40k. For the second investment opportunity (B), there is a 40% chance of gaining $70k and a chance of gaining $55k. The last investment opportunity (C) has a 40 % chance of gaining $30k and a chance of gaining $100k. There is also a 40% chance that you will have to make additional decision. There are three outcomes associate with this additional decision. The first two outcomes of this decision are gaining $30k and gaining $10k respectively. For the last outcome, there is a 40% chance of gaining $10k, a 10% chance of losing $35k, and a chance of gaining $50k.. a) Create a decision tree for this situation. b) According to your decision tree, how many decisions do you potentially have to make? What are they? c) Based on the given information, what is the best investment opportunity? Why? d) Create a risk profile at the starting node (for A, B, and C). Be sure to include values/labels along axes, and labels for your lines e) According to the risk profile, which (if any) alternative deterministically or stochastically dominates? Why?

1. Based on given scenario, please resp You are making decisions among different investment opportunities. For the first investment opportunity (A), there is a 30% chance that you will gain $85k. However, there is a 20% chance that you will lose $45k. There is also a chance that you will have to make another decision within this first investment opportunity. The only two outcomes of this decision are gaining $50k and gaining $40k. For the second investment opportunity (B), there is a 40% chance of gaining $70k and a chance of gaining $55k. The last investment opportunity (C) has a 40 % chance of gaining $30k and a chance of gaining $100k. There is also a 40% chance that you will have to make additional decision. There are three outcomes associate with this additional decision. The first two outcomes of this decision are gaining $30k and gaining $10k respectively. For the last outcome, there is a 40% chance of gaining $10k, a 10% chance of losing $35k, and a chance of gaining $50k.. a) Create a decision tree for this situation. b) According to your decision tree, how many decisions do you potentially have to make? What are they? c) Based on the given information, what is the best investment opportunity? Why? d) Create a risk profile at the starting node (for A, B, and C). Be sure to include values/labels along axes, and labels for your lines e) According to the risk profile, which (if any) alternative deterministically or stochastically dominates? Why?

Operations Research : Applications and Algorithms

4th Edition

ISBN:9780534380588

Author:Wayne L. Winston

Publisher:Wayne L. Winston

Chapter17: Markov Chains

Section: Chapter Questions

Problem 11RP

Related questions

Question

Need answer for a,d,e

Transcribed Image Text:1. Based on given scenario, please respond

You are making decisions among different investment opportunities. For the first investment

opportunity (A), there is a 30% chance that you will gain $85k. However, there is a 20% chance

that you will lose $45k. There is also a chance that you will have to make another decision within

this first investment opportunity. The only two outcomes of this decision are gaining $50k and

gaining $40k. For the second investment opportunity (B), there is a 40% chance of gaining $70k

and a chance of gaining $55k.

The last investment opportunity (C) has a 40% chance of gaining $30k and a chance of gaining

$100k. There is also a 40% chance that you will have to make additional decision. There are three

outcomes associate with this additional decision. The first two outcomes of this decision are

gaining $30k and gaining $10k respectively. For the last outcome, there is a 40% chance of gaining

$10k, a 10% chance of losing $35k, and a chance of gaining $50k.

a) Create a decision tree for this situation.

b) According to your decision tree, how many decisions do you potentially have to make?

What are they?

c) Based on the given information, what is the best investment opportunity?

Why?

d) Create a risk profile at the starting node (for A, B, and C). Be sure to include values/labels

along axes, and labels for your lines

e) According to the risk profile, which (if any) alternative deterministically or stochastically

dominates? Why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, computer-science and related others by exploring similar questions and additional content below.Recommended textbooks for you

Operations Research : Applications and Algorithms

Computer Science

ISBN:

9780534380588

Author:

Wayne L. Winston

Publisher:

Brooks Cole

Operations Research : Applications and Algorithms

Computer Science

ISBN:

9780534380588

Author:

Wayne L. Winston

Publisher:

Brooks Cole