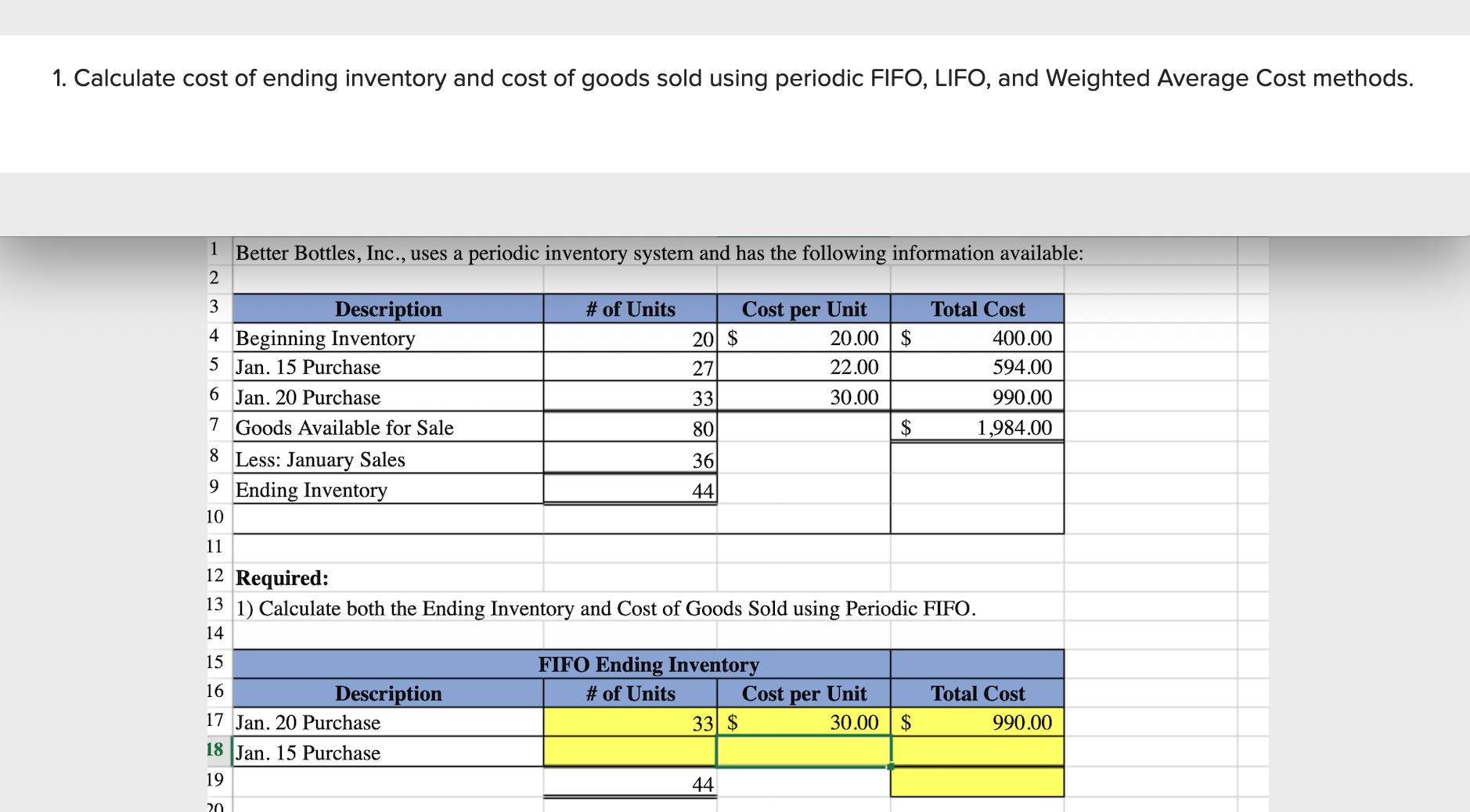

1. Calculate cost of ending inventory and cost of goods sold using periodic FIIFO, LIFO, and Weighted Average Cost methods. 1 Better Bottles, Inc., uses a periodic inventory system and has the following information available: # of Units Description Beginning Inventory 5 Jan. 15 Purchase Cost per Unit 20.00 | $ Total Cost 4 20 $ 400.00 27 22.00 594.00 6 Jan. 20 Purchase 33 30.00 990.00 7 Goods Available for Sale 80 1,984.00 8 Less: January Sales 36 9. Ending Inventory 44 10 11 12 Required: 13 1) Calculate both the Ending Inventory and Cost of Goods Sold using Periodic FIFO. 14 15 FIFO Ending Inventory 16 Description # of Units Cost per Unit Total Cost 17 Jan. 20 Purchase 33 $ 30.00 | $ 990.00 18 Jan. 15 Purchase 19 44 !1 FIFO Cost of Goods Sold 12 # of Units Total Cost Description 3 Beginning Inventory Cost per Unit 20 $ 20.00 | $ 400.00 '4 Jan. 15 Purchase 15 36 7 2) Calculate both the Ending Inventory and Cost of Goods Sold using Periodic LIFO. :8 19 LIFO Ending Inventory Description 1 Beginning Inventory # of Units Cost per Unit Total Cost 12 Jan. 15 Purchase 13 44 14 15 LIFO Cost of Goods Sold 16 Description # of Units Cost per Unit Total Cost 17 Jan. 20 Purchase 18 Jan. 15 Purchase 19 36 1 3) Using Periodic Weighted Average, first calculate the cost per unit using the formula below. 2 Next, apply that same cost per unit to calculate both the Ending Inventory and Cost of Goods Sold. 2 Next, apply that same cost per unit to calculate both the Ending Inventory and Cost of Goods Sold. Weighted Cost of Goods Available for Sale Average Cost = Number of Units Available for Sale per un Weighted Average Ending Inventory # of Units Cost per Unit Total Cost Weighted Average Cost of Goods Sold # of Units Cost per Unit Total Cost 4) Use the given information and your calculated numbers to complete the Cost of Goods Sold 7 Equation below for all three inventory methods. (All numbers should be positive.) FIFO LIFO Wtd. Avg. - Beginning Inventory D Add: Purchases 1 Goods Available for Sale 2 Less: Ending Inventory 3 Cost of Goods Sold

1. Calculate cost of ending inventory and cost of goods sold using periodic FIIFO, LIFO, and Weighted Average Cost methods. 1 Better Bottles, Inc., uses a periodic inventory system and has the following information available: # of Units Description Beginning Inventory 5 Jan. 15 Purchase Cost per Unit 20.00 | $ Total Cost 4 20 $ 400.00 27 22.00 594.00 6 Jan. 20 Purchase 33 30.00 990.00 7 Goods Available for Sale 80 1,984.00 8 Less: January Sales 36 9. Ending Inventory 44 10 11 12 Required: 13 1) Calculate both the Ending Inventory and Cost of Goods Sold using Periodic FIFO. 14 15 FIFO Ending Inventory 16 Description # of Units Cost per Unit Total Cost 17 Jan. 20 Purchase 33 $ 30.00 | $ 990.00 18 Jan. 15 Purchase 19 44 !1 FIFO Cost of Goods Sold 12 # of Units Total Cost Description 3 Beginning Inventory Cost per Unit 20 $ 20.00 | $ 400.00 '4 Jan. 15 Purchase 15 36 7 2) Calculate both the Ending Inventory and Cost of Goods Sold using Periodic LIFO. :8 19 LIFO Ending Inventory Description 1 Beginning Inventory # of Units Cost per Unit Total Cost 12 Jan. 15 Purchase 13 44 14 15 LIFO Cost of Goods Sold 16 Description # of Units Cost per Unit Total Cost 17 Jan. 20 Purchase 18 Jan. 15 Purchase 19 36 1 3) Using Periodic Weighted Average, first calculate the cost per unit using the formula below. 2 Next, apply that same cost per unit to calculate both the Ending Inventory and Cost of Goods Sold. 2 Next, apply that same cost per unit to calculate both the Ending Inventory and Cost of Goods Sold. Weighted Cost of Goods Available for Sale Average Cost = Number of Units Available for Sale per un Weighted Average Ending Inventory # of Units Cost per Unit Total Cost Weighted Average Cost of Goods Sold # of Units Cost per Unit Total Cost 4) Use the given information and your calculated numbers to complete the Cost of Goods Sold 7 Equation below for all three inventory methods. (All numbers should be positive.) FIFO LIFO Wtd. Avg. - Beginning Inventory D Add: Purchases 1 Goods Available for Sale 2 Less: Ending Inventory 3 Cost of Goods Sold

Chapter10: Inventory

Section: Chapter Questions

Problem 11PA: Calculate a) cost of goods sold, b) ending inventory, and c) gross margin for A76 Company,...

Related questions

Question

Transcribed Image Text:1. Calculate cost of ending inventory and cost of goods sold using periodic FIIFO, LIFO, and Weighted Average Cost methods.

1 Better Bottles, Inc., uses a periodic inventory system and has the following information available:

# of Units

Description

Beginning Inventory

5 Jan. 15 Purchase

Cost per Unit

20.00 | $

Total Cost

4

20 $

400.00

27

22.00

594.00

6 Jan. 20 Purchase

33

30.00

990.00

7 Goods Available for Sale

80

1,984.00

8 Less: January Sales

36

9.

Ending Inventory

44

10

11

12 Required:

13 1) Calculate both the Ending Inventory and Cost of Goods Sold using Periodic FIFO.

14

15

FIFO Ending Inventory

16

Description

# of Units

Cost per Unit

Total Cost

17 Jan. 20 Purchase

33 $

30.00 | $

990.00

18 Jan. 15 Purchase

19

44

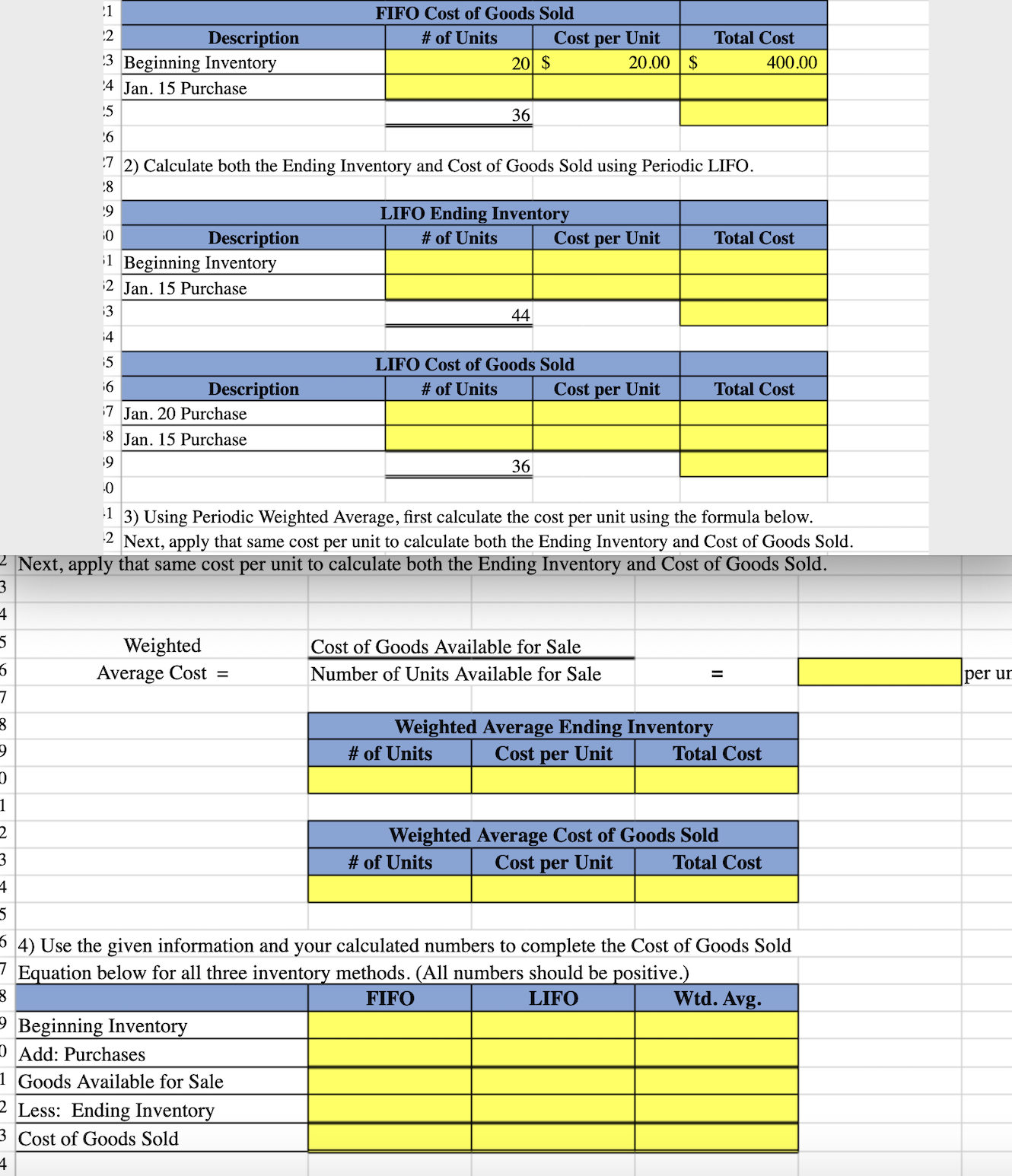

Transcribed Image Text:!1

FIFO Cost of Goods Sold

12

# of Units

Total Cost

Description

3 Beginning Inventory

Cost per Unit

20 $

20.00 | $

400.00

'4 Jan. 15 Purchase

15

36

7 2) Calculate both the Ending Inventory and Cost of Goods Sold using Periodic LIFO.

:8

19

LIFO Ending Inventory

Description

1 Beginning Inventory

# of Units

Cost per Unit

Total Cost

12 Jan. 15 Purchase

13

44

14

15

LIFO Cost of Goods Sold

16

Description

# of Units

Cost per Unit

Total Cost

17 Jan. 20 Purchase

18 Jan. 15 Purchase

19

36

1 3) Using Periodic Weighted Average, first calculate the cost per unit using the formula below.

2 Next, apply that same cost per unit to calculate both the Ending Inventory and Cost of Goods Sold.

2 Next, apply that same cost per unit to calculate both the Ending Inventory and Cost of Goods Sold.

Weighted

Cost of Goods Available for Sale

Average Cost =

Number of Units Available for Sale

per un

Weighted Average Ending Inventory

# of Units

Cost

per

Unit

Total Cost

Weighted Average Cost of Goods Sold

# of Units

Cost

per

Unit

Total Cost

4) Use the given information and your calculated numbers to complete the Cost of Goods Sold

7 Equation below for all three inventory methods. (All numbers should be positive.)

FIFO

LIFO

Wtd. Avg.

- Beginning Inventory

D Add: Purchases

1 Goods Available for Sale

2 Less: Ending Inventory

3 Cost of Goods Sold

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,