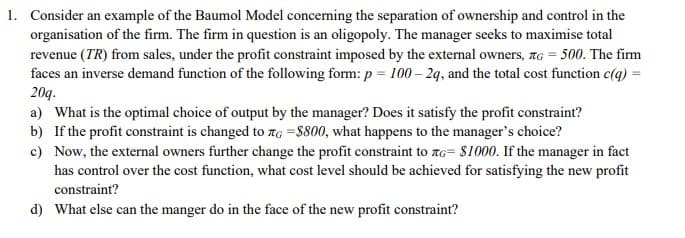

1. Consider an example of the Baumol Model concerning the separation of ownership and control in the organisation of the firm. The firm in question is an oligopoly. The manager seeks to maximise total revenue (TR) from sales, under the profit constraint imposed by the external owners, G = 500. The firm faces an inverse demand function of the following form: p = 100-2q, and the total cost function c(q) = 20g. a) What is the optimal choice of output by the manager? Does it satisfy the profit constraint? b) If the profit constraint is changed to G =$800, what happens to the manager's choice? c) Now, the external owners further change the profit constraint to = $1000. If the manager in fact has control over the cost function, what cost level should be achieved for satisfying the new profit constraint? d) What else can the manger do in the face of the new profit constraint?

1. Consider an example of the Baumol Model concerning the separation of ownership and control in the organisation of the firm. The firm in question is an oligopoly. The manager seeks to maximise total revenue (TR) from sales, under the profit constraint imposed by the external owners, G = 500. The firm faces an inverse demand function of the following form: p = 100-2q, and the total cost function c(q) = 20g. a) What is the optimal choice of output by the manager? Does it satisfy the profit constraint? b) If the profit constraint is changed to G =$800, what happens to the manager's choice? c) Now, the external owners further change the profit constraint to = $1000. If the manager in fact has control over the cost function, what cost level should be achieved for satisfying the new profit constraint? d) What else can the manger do in the face of the new profit constraint?

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter12: Price And Output Determination: Oligopoly

Section: Chapter Questions

Problem 2E

Related questions

Question

Solve the following question

Transcribed Image Text:1. Consider an example of the Baumol Model concerning the separation of ownership and control in the

organisation of the firm. The firm in question is an oligopoly. The manager seeks to maximise total

revenue (TR) from sales, under the profit constraint imposed by the external owners, G = 500. The firm

faces an inverse demand function of the following form: p = 100-2q, and the total cost function c(q) =

20q.

a) What is the optimal choice of output by the manager? Does it satisfy the profit constraint?

b) If the profit constraint is changed to G =$800, what happens to the manager's choice?

c)

Now, the external owners further change the profit constraint to G= $1000. If the manager in fact

has control over the cost function, what cost level should be achieved for satisfying the new profit

constraint?

d) What else can the manger do in the face of the new profit constraint?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning