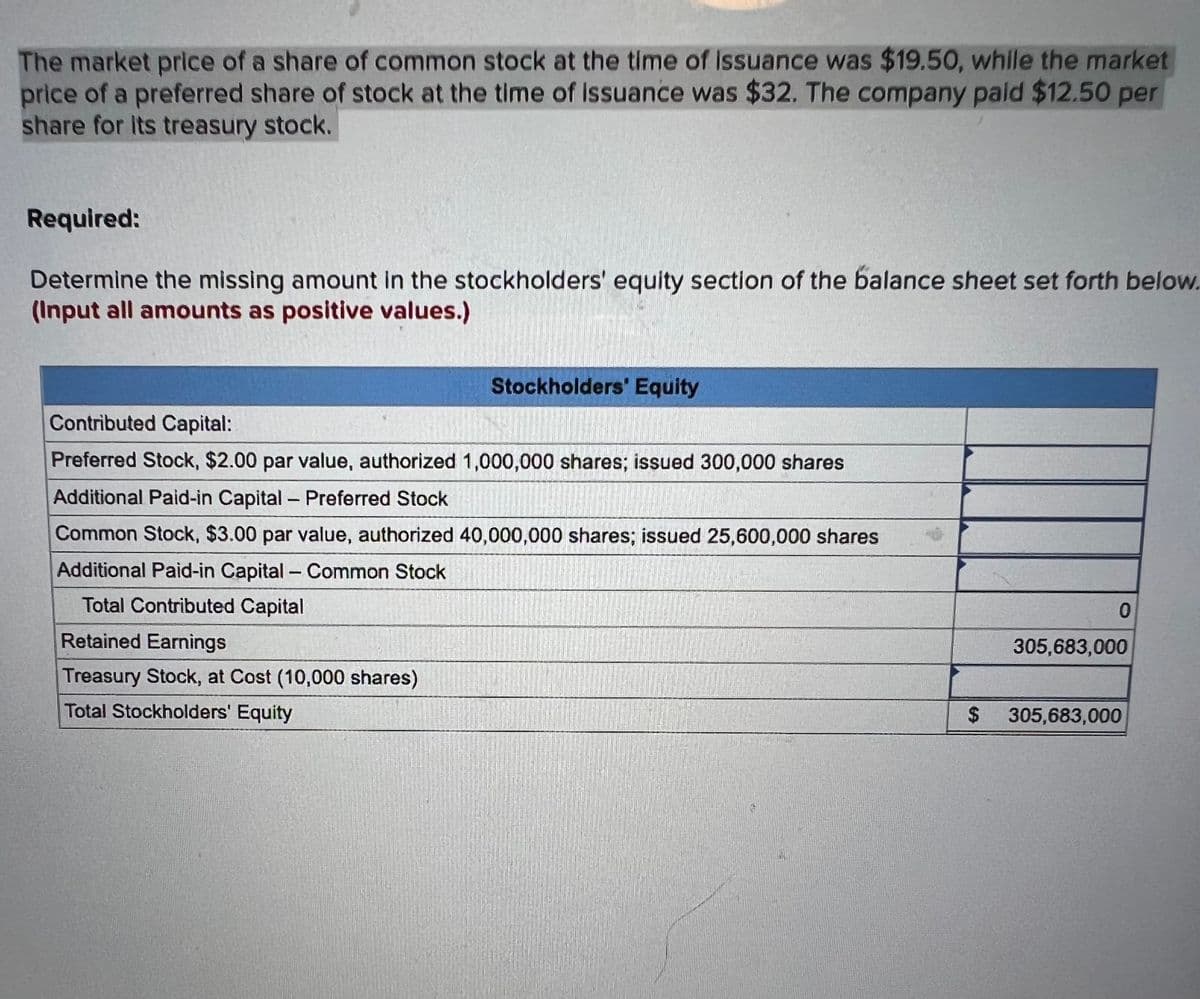

The market price of a share of common stock at the time of issuance was $19.50, while the market price of a preferred share of stock at the time of issuance was $32. The company paid $12.50 per share for its treasury stock. Required: Determine the missing amount in the stockholders' equity section of the balance sheet set forth belo (Input all amounts as positive values.) Stockholders' Equity

The market price of a share of common stock at the time of issuance was $19.50, while the market price of a preferred share of stock at the time of issuance was $32. The company paid $12.50 per share for its treasury stock. Required: Determine the missing amount in the stockholders' equity section of the balance sheet set forth belo (Input all amounts as positive values.) Stockholders' Equity

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter12: Statement Of Stockholders’ Equity (stockeq)

Section: Chapter Questions

Problem 3R: Chen Corporation began 2012 with the following stockholders equity balances: The following selected...

Related questions

Question

Transcribed Image Text:The market price of a share of common stock at the time of issuance was $19.50, while the market

price of a preferred share of stock at the time of issuance was $32. The company paid $12.50 per

share for its treasury stock.

Required:

Determine the missing amount in the stockholders' equity section of the balance sheet set forth below.

(Input all amounts as positive values.)

Stockholders' Equity

Contributed Capital:

Preferred Stock, $2.00 par value, authorized 1,000,000 shares; issued 300,000 shares

Additional Paid-in Capital - Preferred Stock

Common Stock, $3.00 par value, authorized 40,000,000 shares; issued 25,600,000 shares

Additional Paid-in Capital - Common Stock

Total Contributed Capital

Retained Earnings

Treasury Stock, at Cost (10,000 shares)

Total Stockholders' Equity

$

0

305,683,000

305,683,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT