1. Present the probability distribution for the sum of two six-sided dice (i.e., list the possible values of the random variable, X and each value’s corresponding probability). Use the x-axis above and rules of theoretical probability to help you calculate your probabilities. (Hint: there are 36 outcomes.) Present the probabilities as fractions (simplified or not simplified) or decimals (rounded to four decimal places) in a table.

1. Present the probability distribution for the sum of two six-sided dice (i.e., list the possible values of the random variable, X and each value’s corresponding probability). Use the x-axis above and rules of theoretical probability to help you calculate your probabilities. (Hint: there are 36 outcomes.) Present the probabilities as fractions (simplified or not simplified) or decimals (rounded to four decimal places) in a table.

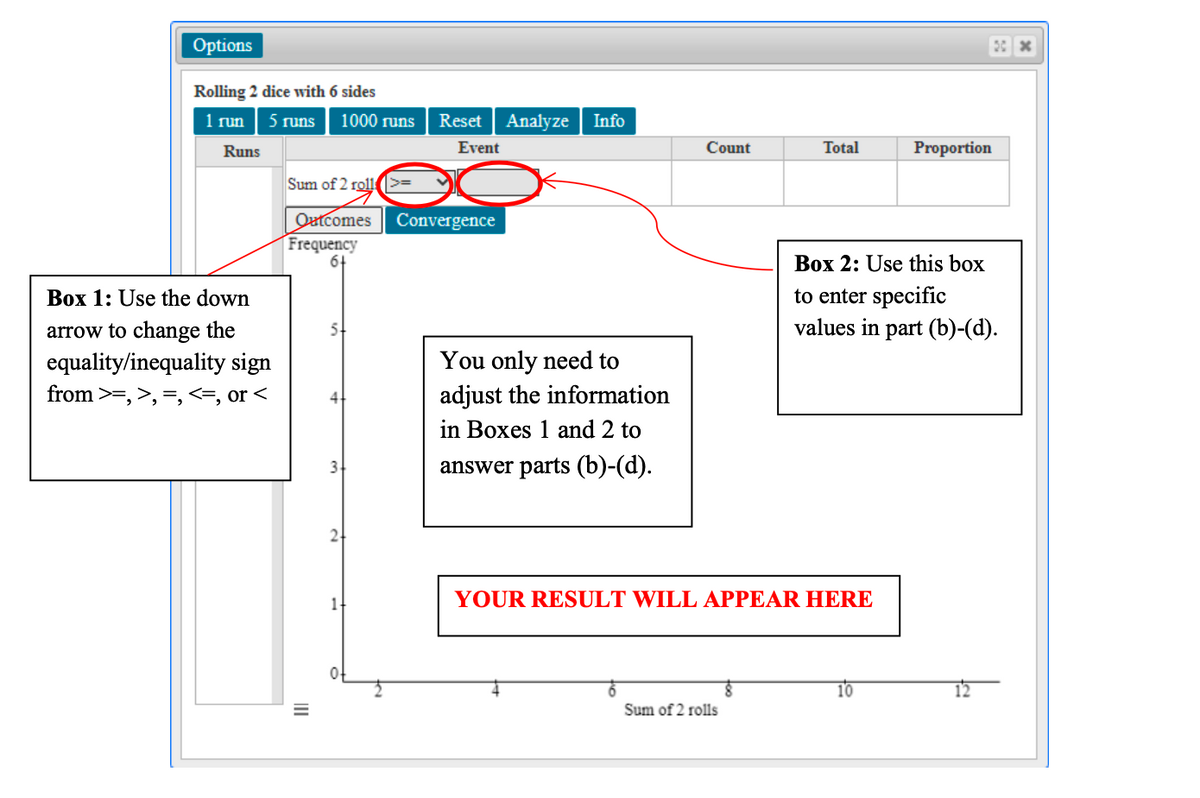

2. Now calculate the theoretical probability that the player lands on “Reading Railroad” on their first turn. Using the probability distribution built in number 1, state this probability as a decimal rounded to four decimal places in a sentence.

3. Calculate the theoretical probability that the player will move no farther than “Reading Railroad” on the first turn. Using the probability distribution built in number 1, state this probability as a decimal rounded to four decimal places in a sentence.

4. Calculate the theoretical probability that the player moves farther than “Reading Railroad” on their first turn. Using the probability distribution built in number 1 state this probability as a decimal rounded to four decimal places in a sentence.

Trending now

This is a popular solution!

Step by step

Solved in 7 steps with 8 images