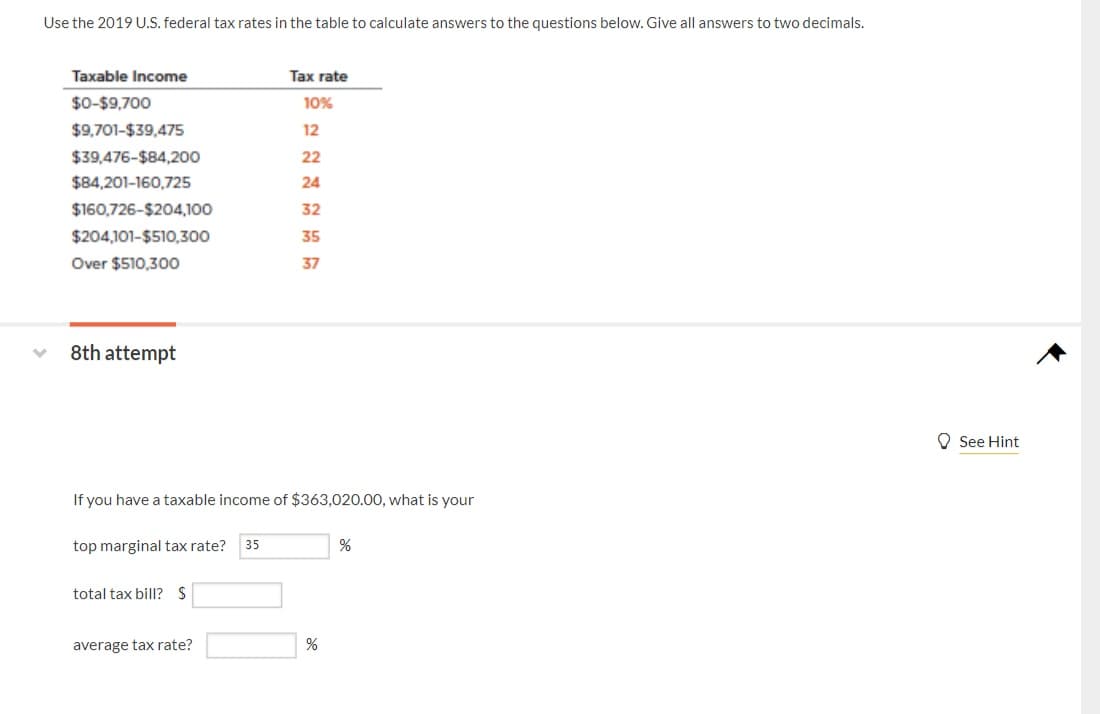

Use the 2019 U.S. federal tax rates in the table to calculate answers to the questions below. Give all answers to two decimals. Taxable Income Tax rate $0-$9,700 10% $9,701-$39,475 12 $39,476-$84,200 22 $84,201-160,725 24 $160,726-$204,100 32 $204,101-$510,300 35 Over $510,30O 37 8th attempt O See Hint If you have a taxable income of $363,020.00, what is your top marginal tax rate? 35 total tax bilI? S average tax rate?

Use the 2019 U.S. federal tax rates in the table to calculate answers to the questions below. Give all answers to two decimals. Taxable Income Tax rate $0-$9,700 10% $9,701-$39,475 12 $39,476-$84,200 22 $84,201-160,725 24 $160,726-$204,100 32 $204,101-$510,300 35 Over $510,30O 37 8th attempt O See Hint If you have a taxable income of $363,020.00, what is your top marginal tax rate? 35 total tax bilI? S average tax rate?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 14P

Related questions

Question

Transcribed Image Text:Use the 2019 U.S. federal tax rates in the table to calculate answers to the questions below. Give all answers to two decimals.

Taxable Income

Tax rate

$0-$9,700

10%

$9,701-$39,475

12

$39,476-$84,200

22

$84,201-160,725

24

$160,726-$204,100

32

$204,101-$510,300

35

Over $510,30O

37

8th attempt

O See Hint

If you have a taxable income of $363,020.00, what is your

top marginal tax rate?

35

total tax bill?S

average tax rate?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning