Tanaka Manufacturing Co. uses the

Required:

- 1. Prepare cost of production summaries for the Mixing, Blending, and Bottling (Hint: You must calculate the adjusted unit cost from Blending.) departments.

- 2. Prepare a departmental cost work sheet.

- 3. Draft the

journal entries required to record the month’s operations. - 4. Prepare a statement of cost of goods manufactured for December. (Hint: Goods finished but not transferred to finished goods are considered part of work in process inventory.)

1.

Prepare cost of production summaries for the mixing, blending and bottling.

Explanation of Solution

Prepare cost of production summaries for the mixing, blending and bottling.

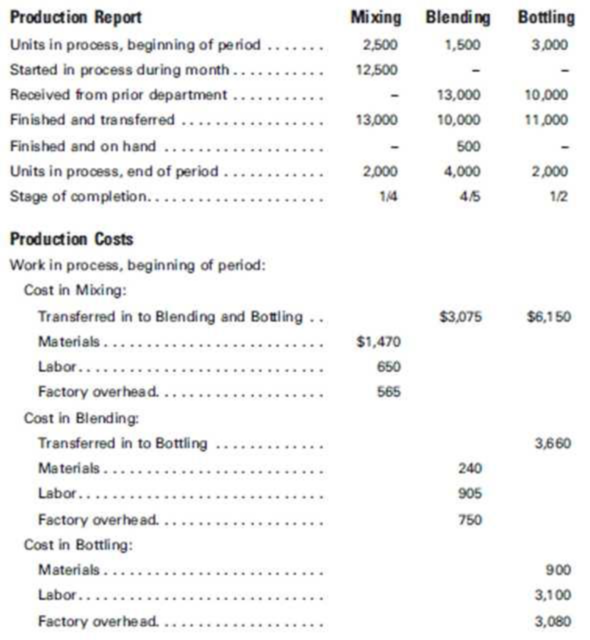

| Company T | ||

| Cost of Production Summary-Mixing | ||

| For the Month Ended December 31 | ||

| Cost of work in process, beginning of month: | ||

| Materials | $1,470 | |

| Labor | $650 | |

| Factory overhead | $565 | $2,685 |

| Cost of production for month: | ||

| Materials | $15,000 | |

| Labor | $4,750 | |

| Factory overhead | $5,240 | $24,990 |

| Total costs to be accounted for | $27,675 | |

| Unit output for month: | ||

| Finished and transferred to Blending during month | $13,000 | |

| Equivalent units of work in process, end of month | ||

| (2,000 units, one-fourth completed) | $500 | |

| Total equivalent production | $13,500 | |

| Unit cost for month: | ||

| Materials | $1.22 | |

| Labor | $0.4 | |

| Factory overhead | $0.43 | |

| Total | $2.05 | |

| Inventory costs: | ||

| Costs of goods finished and transferred to Blending | $26,650 | |

| during month | ||

| Cost of work in process, end of month: | ||

| Materials | $610 | |

| Labor | $200 | |

| Factory overhead | $215 | $1,025 |

| Total production costs accounted for | $27,675 | |

Table (1)

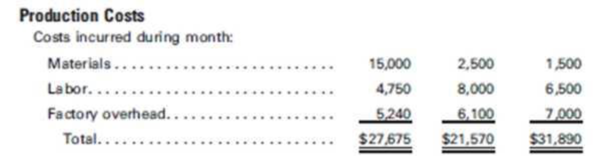

| Company T | |||

| Cost of Production Summary-Blending | |||

| For the Month Ended December 31 | |||

| Cost of work in process, beginning of month: | |||

| Cost in Mixing | $3,075 | ||

| Cost in Blending: | |||

| Materials | $240 | ||

| Labor | $905 | ||

| Factory overhead | $750 | $1,895 | $4,970 |

| Cost of goods received from Mixing during month | $26,650 | ||

| Cost of production for month: | |||

| Materials | $2,500 | ||

| Labor | $8,000 | ||

| Factory overhead | $6,100 | $16,600 | |

| Total costs to be accounted for | $48,220 | ||

| Unit output for month: | |||

| Finished and transferred to Bottling during month | $10,000 | ||

| Finished and on hand | $500 | ||

| Equivalent units of work in process, end of month | |||

| (4,000 units, four-fifths completed) | $3,200 | ||

| Total equivalent production | $13,700 | ||

| Unit cost for month: | |||

| Materials | $.20 | ||

| Labor | $.65 | ||

| Factory overhead | $.50 | ||

| Total | $1.35 | ||

| Inventory costs: | |||

| Costs of goods finished and transferred to Bottling | |||

| during month: | |||

| Cost in Mixing | $20,500 | ||

| Cost in Blending | $13,500 | ||

| | $34,000 | ||

| Cost of goods finished and on hand: | |||

| Cost in Mixing | $1,025 | ||

| Cost in Blending | $675 | ||

| | $1,700 | ||

| Cost of work in process, end of month: | |||

| Cost in Mixing | $8,200 | ||

| Cost in Blending: | |||

| Materials | $640 | ||

| Labor | $2,080 | ||

| Factory overhead | $1,600 | $4,320 | $12,520 |

| Total production costs accounted for | $48,220 | ||

Table (2)

| Company T | |||

| Cost of Production Summary-Bottling | |||

| For the Month Ended December 31 | |||

| Cost of work in process, beginning of month: | |||

| Cost in Mixing | $6,150 | ||

| Cost in Blending | $3,660 | ||

| $9,810 | |||

| Cost in Bottling: | |||

| Materials | $900 | ||

| Labor | $3,100 | ||

| Factory overhead | $3,080 | $7,080 | $16,890 |

| Cost of goods received from Blending | $34,000 | ||

| Cost of production for month: | |||

| Materials | $1,500 | ||

| Labor | $6,500 | ||

| Factory overhead | $7,000 | $15,000 | |

| Total costs to be accounted for | $65,890 | ||

| Unit output for month: | $11,000 | ||

| Finished and transferred to finished goods | |||

| Equivalent units of work in process, end of month | |||

| (2,000 units, one-half completed) | $1,000 | ||

| Total equivalent production | $12,000 | ||

| Unit cost for month: | |||

| Materials | $.20 | ||

| Labor | $.80 | ||

| Factory overhead | $.84 | ||

| Total | $ 1.84 | ||

| Inventory costs: | |||

| Costs of goods finished and transferred: | |||

| Cost in Mixing | $22,500 | ||

Cost in Blending  | $14,520 | ||

| Cost in Bottling | $20,240 | ||

| | $57,310 | ||

| Cost in work in process, end of month: | |||

| Cost in Mixing | $4,100 | ||

| Cost in Blending | $2,640 | ||

| Cost in Bottling: | |||

| Materials | $200 | ||

| Labor | $800 | ||

| Factory overhead | $840 | $1,840 | $8,580 |

| Total production costs accounted for | $65,890 | ||

Table (3)

Working note:

(1)Prepare unit cost of blending:

| Particulars | Units | Blending |

| Units in process, beginning of month | 3,000 | $3,660 |

| Units received during month | 10,000 | 13,500 |

| Total | 13,000 | $17,160 |

| Unit cost | $1.32 |

Table (4)

2.

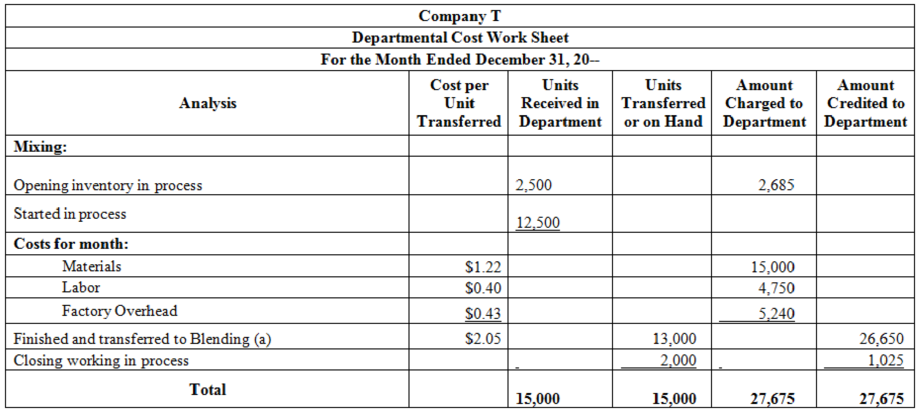

Prepare a departmental cost work sheet.

Explanation of Solution

Prepare a departmental cost work sheet for mixing department.

Figure (1)

Prepare a departmental cost work sheet for blending department.

Figure (2)

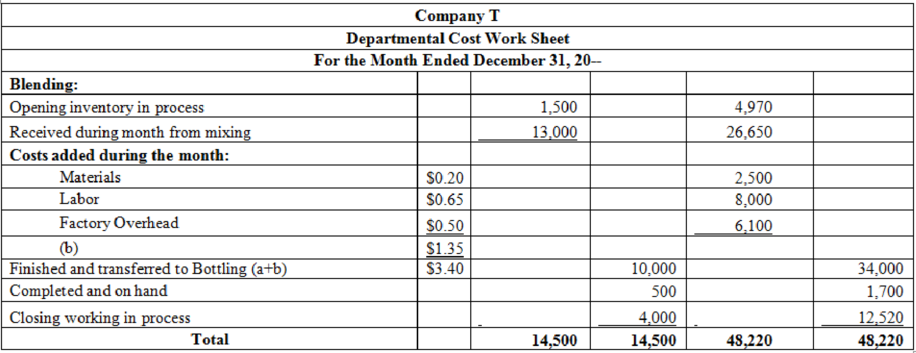

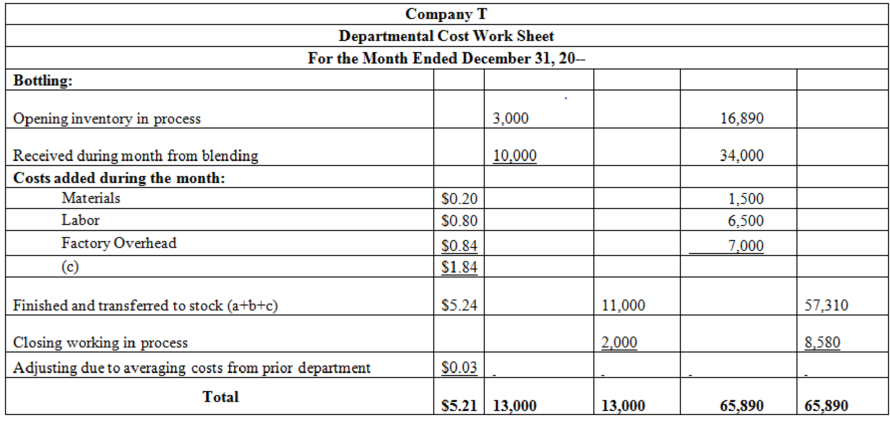

Prepare a departmental cost work sheet for bottling department.

Figure (3)

Prepare summary:

| Summary: | Amount | Amount |

| Materials: | ||

| Mixing | $15,000 | |

| Blending | $2,500 | |

| Bottling | $1,500 | $19,000 |

| Labor: | ||

| Mixing | $4,750 | |

| Blending | $8,000 | |

| Bottling | $6,500 | $19,250 |

| Factory overhead: | ||

| Mixing | $5,240 | |

| Blending | $6,100 | |

| Bottling | $7,000 | $18,340 |

| Total production costs for December | ||

| Add work in process, beginning of month: | ||

| Mixing | $2,685 | |

| Blending | $4,970 | |

| Bottling | $16,890 | $24,545 |

| Total | $81,135 | |

| Deduct work in process, end of month: | ||

| Mixing | $1,025 | |

| Blending (includes $1,700 finished and on hand) | $14,220 | |

| Bottling | $8,580 | $23,825 |

| Cost of production, goods fully manufactured during | ||

| December | $57,310 |

Table (5)

3.

Prepare journal entries to record the month’s operations.

Explanation of Solution

Prepare journal entries to record the month’s operations.

| Date | Account Title and Explanation | Debit ($) | Credit ($) | |

| Work in Process-Mixing | 15,000 | |||

| Work in Process-Blending | 2,500 | |||

| Work in Process-Bottling | 1,500 | |||

| Materials | 19,000 | |||

| Work in Process-Mixing | 4,750 | |||

| Work in Process-Blending | 8,000 | |||

| Work in Process-Bottling | 6,500 | |||

| Payroll | 19,250 | |||

| Work in Process-Mixing | 5,240 | |||

| Work in Process-Blending | 6,100 | |||

| Work in Process-Bottling | 7,000 | |||

| Factory Overhead | 18,340 | |||

| Work in Process-Blending | 26,650 | |||

| Work in Process-Mixing | 26,650 | |||

| Work in Process-Bottling | 34,000 | |||

| Work in Process-Blending | 34,000 | |||

| Finished Goods | 57,310 | |||

| Work in Process-Bottling | 57,310 | |||

Table (6)

4.

Prepare statement of cost of goods manufactured.

Explanation of Solution

Prepare statement of cost of goods manufactured.

| Company T | |

| Statement of Cost of Goods Manufactured | |

| For the Month Ended December 31 | |

| Materials | $19,000 |

| Labor | $19,250 |

| Factory overhead | $18,340 |

| Total | $56,590 |

| Add work in process inventories, December 1 | $24,545 |

| Total | $81,135 |

| Less work in process inventories, December 31 | $23,825 |

| Cost of goods manufactured during the month | $57,310 |

Table (7)

Want to see more full solutions like this?

Chapter 5 Solutions

Principles of Cost Accounting

- Premier Products Inc. has three departments and uses the process cost system of accounting. A portion of the departmental cost work sheet prepared by the cost accountant at the end of July is reproduced below. Using the data in P5-7: 1. Draft the necessary entries to charge the materials and labor costs to the appropriate work in process accounts, to apply factory overhead to work in process, and to record the transfer of costs from one department to another. 2. Prepare a statement of cost of goods manufactured for the month ended July 31.arrow_forwardPremier Products Inc. has three departments and uses the process cost system of accounting. A portion of the departmental cost work sheet prepared by the cost accountant at the end of July is reproduced below. Required: Prepare a cost of production summary for each department. (Round unit costs to three decimal places and totals to the nearest whole dollar.)arrow_forwardPrepare a cost of production report for the Cutting Department of Dalton Carpet Company for January. Assuming that direct materials are placed in process during production, use the weighted average method with the following data:arrow_forward

- Dublin Brewing Co. uses the process cost system. The following data, taken from the organizations books, reflect the results of manufacturing operations during October: Production Costs Work in process, beginning of period: Costs incurred during month: Production Data: 13,000 units finished and transferred to stockroom Work in process, end of period, 2,000 units one-half completed Required: Prepare a cost of production summary for October.arrow_forwardAero Aluminum Inc. uses a process cost system. The records for May show the following information: Required: Prepare a cost of production summary for each department. (Hint: When preparing the Converting production summary, refer to the Rolling production summary for the costs transferred in during the month.)arrow_forwardKokomo Kayak Inc. uses the process cost system. The following data, taken from the organizations books, reflect the results of manufacturing operations during the month of March: Production Costs Work in process, beginning of period: Costs incurred during month: Production Data: 18,000 units finished and transferred to stockroom. Work in process, end of period, 3,000 units, two-thirds completed. Required: Prepare a cost of production summary for March.arrow_forward

- Shorts Company has three process departments: Mixing, Encapsulating, and Bottling. At the beginning of the year, there were no work-in-process or finished goods inventories. The following data are available for the month of July: Includes only the direct materials, direct labor, and the overhead used to process the partially finished goods received from the prior department. The transferred-in cost is not included. Required: 1. Prepare journal entries that show the transfer of costs from one department to the next (including the entry to transfer the costs of the final department). 2. Prepare T-accounts for the entries made in Requirement 1. Use arrows to show the flow of costs.arrow_forwardThe following information concerns production in the Finishing Department for May. The Finishing Department uses the weighted average method. a. Determine the number of units in work in process inventory at the end of the month. b. Determine the number of whole units to be accounted for and to be assigned costs and the equivalent units of production for May. Assume that direct materials are placed in process during production.arrow_forwardSonoma Products Inc. manufactures a liquid product in one department. Due to the nature of the product and the process, units are regularly lost during production. Materials and conversion costs are added evenly throughout the process. The following summaries were prepared for March: Calculate the unit cost for materials, labor, and factory overhead for March and show the costs of units transferred to finished goods and to ending work in process inventory.arrow_forward

- Morrison Company had the equivalent units schedule and cost information for its Sewing Department for the month of December, as shown on the next page. Required: 1. Calculate the unit cost for December, using the weighted average method. 2. Calculate the cost of goods transferred out, calculate the cost of EWIP, and reconcile the costs assigned with the costs to account for. 3. What if you were asked to show that the weighted average unit cost for materials is the blend of the November unit materials cost and the December unit materials cost? The November unit materials cost is 6.60 (66,000/10,000), and the December unit materials cost is 12.22 (550,000/45,000). The equivalent units in BWIP are 10,000, and the FIFO equivalent units are 45,000. Calculate the weighted average unit materials cost using weights defined as the proportion of total units completed from each source (BWIP output and current output).arrow_forwardUnits of production data for the two departments of Atlantic Cable and Wire Company for July of the current fiscal year are as follows: Each department uses the weighted average method. For each department, assume that direct Materials are placed in process during production. a. Determine the number of whole units to be accounted for and to be assigned costs and the equivalent units of production for the Drawing Department. b. Determine the number of whole units to be accounted for and to be assigned costs and the equivalent units of production for the Winding Department.arrow_forwardUsing the same data found in Exercise 6.22, assume the company uses the FIFO method. Required: Prepare a schedule of equivalent units, and compute the unit cost for the month of December. Fordman Company has a product that passes through two processes: Grinding and Polishing. During December, the Grinding Department transferred 20,000 units to the Polishing Department. The cost of the units transferred into the second department was 40,000. Direct materials are added uniformly in the second process. Units are measured the same way in both departments. The second department (Polishing) had the following physical flow schedule for December: Costs in beginning work in process for the Polishing Department were direct materials, 5,000; conversion costs, 6,000; and transferred in, 8,000. Costs added during the month: direct materials, 32,000; conversion costs, 50,000; and transferred in, 40,000.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,