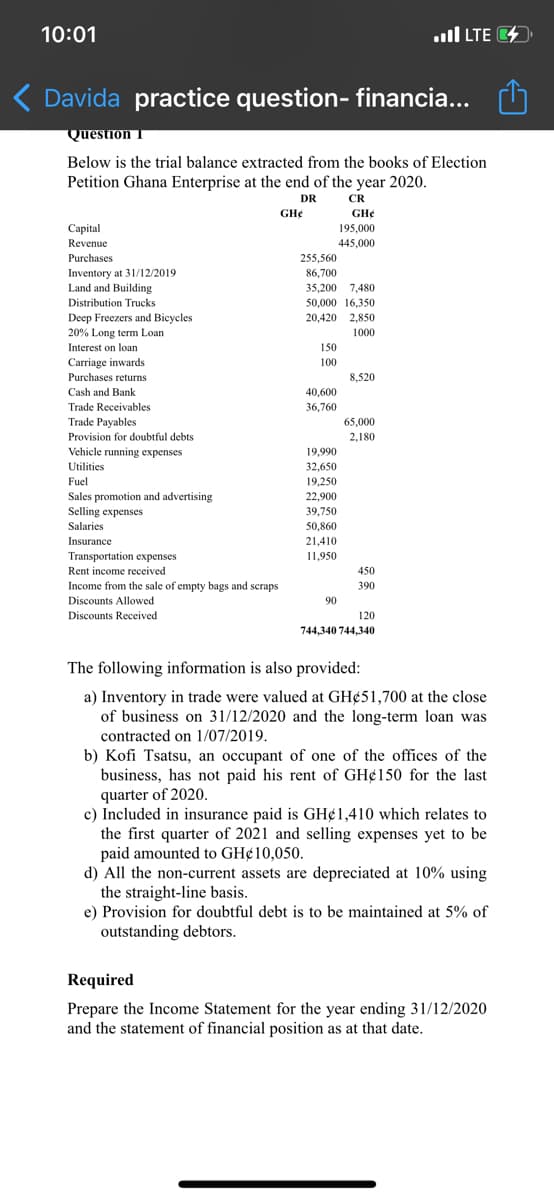

10:01 ull LTE 4 ( Davida practice question- financia... Question I Below is the trial balance extracted from the books of Election Petition Ghana Enterprise at the end of the year 2020. DR CR GH¢ GHe Capital Revenue Purchases 195,000 445,000 255,560 86,700 Inventory at 31/12/2019 Land and Building Distribution Trucks 35,200 7,480 50,000 16,350 20,420 2,850 Deep Freezers and Bicycles 20% Long term Loan 1000 Interest on loan 150 Carriage inwards Purchases returms 100 8,520 Cash and Bank 40,600 Trade Receivables Trade Payables 36,760 65,000 Provision for doubtful debts 2,180 19,990 32,650 19,250 Vehicle running expenses Utilities Fuel Sales promotion and advertising Selling expenses 22,900 39,750 50,860 Salaries Insurance 21,410 Transportation expenses Rent income received Income from the sale of empty bags and scraps 11,950 450 390 Discounts Allowed 90 Discounts Received 120 744,340 744,340 The following information is also provided: a) Inventory in trade were valued at GH¢51,700 at the close of business on 31/12/2020 and the long-term loan was contracted on 1/07/2019. b) Kofi Tsatsu, an occupant of one of the offices of the business, has not paid his rent of GH¢150 for the last quarter of 2020. c) Included in insurance paid is GH¢1,410 which relates to the first quarter of 2021 and selling expenses yet to be paid amounted to GH¢10,050. d) All the non-current assets are depreciated at 10% using the straight-line basis. e) Provision for doubtful debt is to be maintained at 5% of outstanding debtors. Required Prepare the Income Statement for the year ending 31/12/2020 and the statement of financial position as at that date.

10:01 ull LTE 4 ( Davida practice question- financia... Question I Below is the trial balance extracted from the books of Election Petition Ghana Enterprise at the end of the year 2020. DR CR GH¢ GHe Capital Revenue Purchases 195,000 445,000 255,560 86,700 Inventory at 31/12/2019 Land and Building Distribution Trucks 35,200 7,480 50,000 16,350 20,420 2,850 Deep Freezers and Bicycles 20% Long term Loan 1000 Interest on loan 150 Carriage inwards Purchases returms 100 8,520 Cash and Bank 40,600 Trade Receivables Trade Payables 36,760 65,000 Provision for doubtful debts 2,180 19,990 32,650 19,250 Vehicle running expenses Utilities Fuel Sales promotion and advertising Selling expenses 22,900 39,750 50,860 Salaries Insurance 21,410 Transportation expenses Rent income received Income from the sale of empty bags and scraps 11,950 450 390 Discounts Allowed 90 Discounts Received 120 744,340 744,340 The following information is also provided: a) Inventory in trade were valued at GH¢51,700 at the close of business on 31/12/2020 and the long-term loan was contracted on 1/07/2019. b) Kofi Tsatsu, an occupant of one of the offices of the business, has not paid his rent of GH¢150 for the last quarter of 2020. c) Included in insurance paid is GH¢1,410 which relates to the first quarter of 2021 and selling expenses yet to be paid amounted to GH¢10,050. d) All the non-current assets are depreciated at 10% using the straight-line basis. e) Provision for doubtful debt is to be maintained at 5% of outstanding debtors. Required Prepare the Income Statement for the year ending 31/12/2020 and the statement of financial position as at that date.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 18E: Errors During the course of your examination of the financial statements of Burnett Co., a new...

Related questions

Question

Transcribed Image Text:10:01

ull LTE 4

Davida practice question- financia...

Question I

Below is the trial balance extracted from the books of Election

Petition Ghana Enterprise at the end of the year 2020.

DR

CR

GH¢

GHe

195,000

445,000

Capital

Revenue

Purchases

255,560

Inventory at 31/12/2019

Land and Building

86,700

35,200 7,480

50,000 16,350

20,420 2,850

Distribution Trucks

Deep Freezers and Bicycles

20% Long term Loan

1000

Interest on loan

150

Carriage inwards

100

Purchases returns

8,520

40,600

36,760

Cash and Bank

Trade Receivables

65,000

2,180

Trade Payables

Provision for doubtful debts

Vehicle running expenses

Utilities

19,990

32,650

19,250

22,900

39,750

50,860

Fuel

Sales promotion and advertising

Selling expenses

Salaries

Insurance

21,410

Transportation expenses

11,950

Rent income received

450

Income from the sale of empty bags and scraps

390

Discounts Allowed

90

Discounts Received

120

744,340 744,340

The following information is also provided:

a) Inventory in trade were valued at GH¢51,700 at the close

of business on 31/12/2020 and the long-term loan was

contracted on 1/07/2019.

b) Kofi Tsatsu, an occupant of one of the offices of the

business, has not paid his rent of GH¢150 for the last

quarter of 2020.

c) Included in insurance paid is GH¢1,410 which relates to

the first quarter of 2021 and selling expenses yet to be

paid amounted to GH¢10,050.

d) All the non-current assets are depreciated at 10% using

the straight-line basis.

e) Provision for doubtful debt is to be maintained at 5% of

outstanding debtors.

Required

Prepare the Income Statement for the year ending 31/12/2020

and the statement of financial position as at that date.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT