Question 1 Zicco owns a provision shop at Keta. On 31" December, 2020 the following trial balance was extracted from her books: Dr. Cr. GHC GHE Capital (1/1/2020) 960,000 680,000 Motor van(cost) Equipment (cost) 320,000 Accumulated Motor van Equipment 104,000 Inventory (1/1/2020) Purchases and sales 450,000 Returns 12,000 Carriage outwards Carriage inwards Trade Receivables Trade payables 120,000 Allowance for depreciation: 128,000 1520,000 27,000 120,000 48,000 20,400 290,000

Question 1 Zicco owns a provision shop at Keta. On 31" December, 2020 the following trial balance was extracted from her books: Dr. Cr. GHC GHE Capital (1/1/2020) 960,000 680,000 Motor van(cost) Equipment (cost) 320,000 Accumulated Motor van Equipment 104,000 Inventory (1/1/2020) Purchases and sales 450,000 Returns 12,000 Carriage outwards Carriage inwards Trade Receivables Trade payables 120,000 Allowance for depreciation: 128,000 1520,000 27,000 120,000 48,000 20,400 290,000

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 44P

Related questions

Question

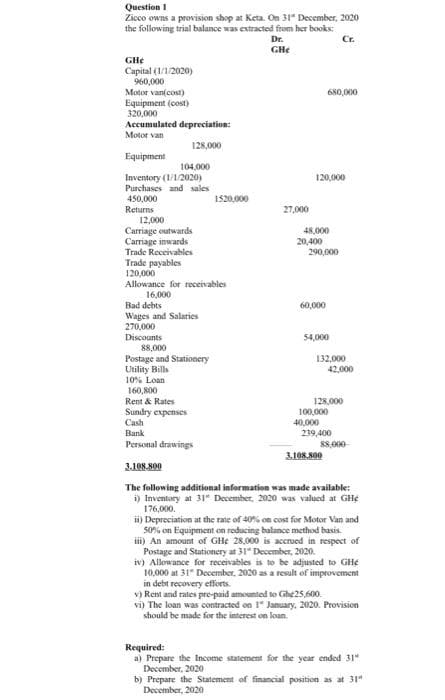

Transcribed Image Text:Question 1

Zicco owns a provision shop at Keta. On 31 December, 2020

the following trial balance was extracted from her books:

Cr.

Dr.

GHE

GHE

Capital (1/1/2020)

960,000

Motor van(cost)

680,000

Equipment (cost)

320,000

Accumulated depreciation:

Motor van

128,000

Equipment

104,000

Inventory (1/1/2020)

Purchases and sales

450,000

Returns

12,000

Carriage outwards

Carriage inwards

Trade Receivables

Trade payables

120,000

Allowance for receivables

16,000

Bad debts

Wages and Salaries

270,000

Discounts

88,000

Postage and Stationery

Utility Bills

10% Loan

160,800

Rent & Rates

Sundry expenses

Cash

Bank

Personal drawings

$8,000

3.108.800

3.108.800

The following additional information was made available:

i) Inventory at 31 December, 2020 was valued at Ghe

176,000.

ii) Depreciation at the rate of 40% on cost for Motor Van and

50% on Equipment on reducing balance method basis.

iii) An amount of GHe 28,000 is accrued in respect of

Postage and Stationery at 31 December, 2020.

iv) Allowance for receivables is to be adjusted to GH

10,000 at 31 December, 2020 as a result of improvement

in debt recovery efforts.

v) Rent and rates pre-paid amounted to Ghr25,600

vi) The loan was contracted on 1 January, 2020. Provision

should be made for the interest on loan.

Required:

a) Prepare the Income statement for the year ended 31"

December, 2020

b) Prepare the Statement of financial position as at 31"

December, 2020

1520,000

27,000

120,000

48,000

20,400

290,000

60,000

54,000

132,000

42,000

128,000

100,000

40,000

239,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning