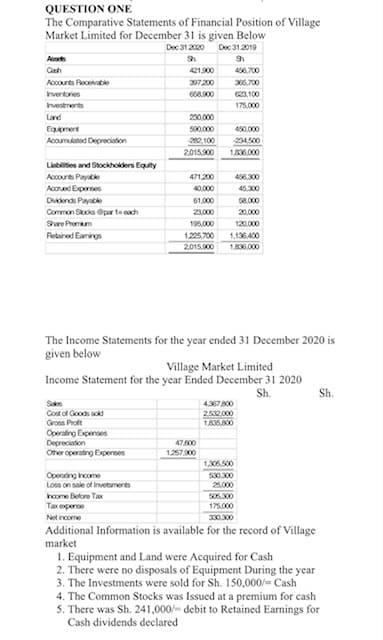

QUESTION ONE The Comparative Statements of Financial Position of Village Market Limited for December 31 is given Below Dec 312000 Dec 312019 A 2100 46700 Accourts Receae 307200 Invertres 100 Investmerts 175000 Lad Eanert 200.000 500.000 450.000 20 100 201500 Acoumted Depreciaion 1800.000 Libes ad Sockhoers Equty Accourts Payate 471200 46300 Acand Eprs 40000 4500 Dends Payate 61.000 Commen Ss Opa teach 20.000 195000 122700 Sare Prom 120.000 Retaired Earg 1.13.400 201500 1.000 The Income Statements for the year ended 31 December 2020 is given below Village Market Limited Income Statement for the year Ended December 31 2020 Sh. Sh. S 400 Cost of Goodss Gros Proft 2000 Operating Epenses Depreciation 4700 Oter operating Experees 125700 1306.500 Operating oome Los on sale of invetumerts 53000 25.000 hone Beore Tax Taepere 50600 175.000 Netinome 300.00 Additional Information is available for the record of Village market 1. Equipment and Land were Acquired for Cash 2. There were no disposals of Equipment During the year 3. The Investments were sold for Sh. 150,000/- Cash 4. The Common Stocks was Issued at a premium for cash 5. There was Sh. 241,000/- debit to Retained Earnings for Cash dividends declared

QUESTION ONE The Comparative Statements of Financial Position of Village Market Limited for December 31 is given Below Dec 312000 Dec 312019 A 2100 46700 Accourts Receae 307200 Invertres 100 Investmerts 175000 Lad Eanert 200.000 500.000 450.000 20 100 201500 Acoumted Depreciaion 1800.000 Libes ad Sockhoers Equty Accourts Payate 471200 46300 Acand Eprs 40000 4500 Dends Payate 61.000 Commen Ss Opa teach 20.000 195000 122700 Sare Prom 120.000 Retaired Earg 1.13.400 201500 1.000 The Income Statements for the year ended 31 December 2020 is given below Village Market Limited Income Statement for the year Ended December 31 2020 Sh. Sh. S 400 Cost of Goodss Gros Proft 2000 Operating Epenses Depreciation 4700 Oter operating Experees 125700 1306.500 Operating oome Los on sale of invetumerts 53000 25.000 hone Beore Tax Taepere 50600 175.000 Netinome 300.00 Additional Information is available for the record of Village market 1. Equipment and Land were Acquired for Cash 2. There were no disposals of Equipment During the year 3. The Investments were sold for Sh. 150,000/- Cash 4. The Common Stocks was Issued at a premium for cash 5. There was Sh. 241,000/- debit to Retained Earnings for Cash dividends declared

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 90PSA

Related questions

Question

100%

cashflow statement for year 2020 using the indirect method

Transcribed Image Text:QUESTION ONE

The Comparative Statements of Financial Position of Village

Market Limited for December 31 is given Below

Dec 31.2000

Dec 31.2019

Ats

Cah

421.900

456.700

Accourts Recevabie

397 200

36,700

Invertories

668.900

623,100

Investments

175.000

Land

230.000

Eqpment

Acoumulated Depreciation

500,000

450,000

20, 100

234,500

2015900

1806000

Lisbilites and Stockhoiders Equity

Accourts Payatke

471200

456.300

Acorued Experces

40.000

45.300

Dividends Payable

61.000

58.000

Common Soks par t cach

23.000

20,000

Share Promm

195.000

120.000

Rebired Eamings

1225,700

1,136,400

2015.900

1836.000

The Income Statements for the year ended 31 December 2020 is

given below

Village Market Limited

Income Statement for the year Ended December 31 2020

Sh.

Sh.

Sa

436700

252 000

1,83600

Cost of Goods sokd

Groes Proft

Operating Expenses

Depreciation

Oher operating Experses

47600

125700

1,306.500

Operaing income

Loss on sale of Invetsments

530.300

25.000

hcome Belore Tax

506.300

Tax expere

175.000

Net income

330.300

Additional Information is available for the record of Village

market

1. Equipment and Land were Acquired for Cash

2. There were no disposals of Equipment During the year

3. The Investments were sold for Sh. 150,000/= Cash

4. The Common Stocks was Issued at a premium for cash

5. There was Sh. 241,000/- debit to Retained Earnings for

Cash dividends declared

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning