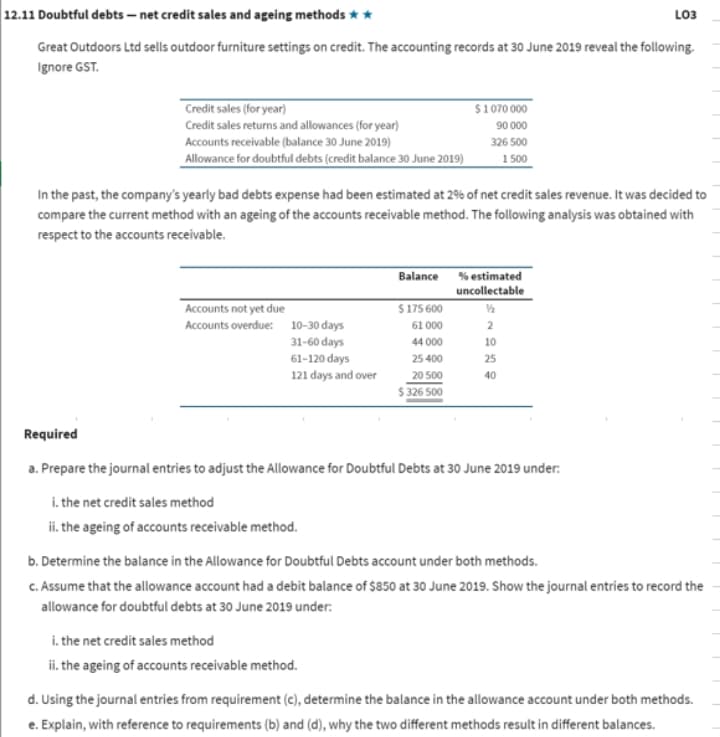

12.11 Doubtful debts – net credit sales and ageing methods ** LO3 Great Outdoors Ltd sells outdoor furniture settings on credit. The accounting records at 30 June 2019 reveal the following. Ignore GST. Credit sales (for year) Credit sales returns and allowances (for year) Accounts receivable (balance 30 June 2019) Allowance for doubtful debts (credit balance 30 June 2019) $1070 000 90 000 326 500 1 500 In the past, the company's yearly bad debts expense had been estimated at 29% of net credit sales revenue. It was decided to compare the current method with an ageing of the accounts receivable method. The following analysis was obtained with respect to the accounts receivable. Balance % estimated uncollectable Accounts not yet due Accounts overdue: 10-30 days $175 600 61 000 2 31-60 days 44 000 10 61-120 days 121 days and over 25 400 25 20 500 $ 326 500 40 Required a. Prepare the journal entries to adjust the Allowance for Doubtful Debts at 30 June 2019 under: i. the net credit sales method ii. the ageing of accounts receivable method. b. Determine the balance in the Allowance for Doubtful Debts account under both methods. C. Assume that the allowance account had a debit balance of $850 at 30 June 2019. Show the journal entries to record the allowance for doubtful debts at 30 June 2019 under: i. the net credit sales method ii. the ageing of accounts receivable method. d. Using the journal entries from requirement (c), determine the balance in the allowance account under both methods. e. Explain, with reference to requirements (b) and (d), why the two different methods result in different balances.

12.11 Doubtful debts – net credit sales and ageing methods ** LO3 Great Outdoors Ltd sells outdoor furniture settings on credit. The accounting records at 30 June 2019 reveal the following. Ignore GST. Credit sales (for year) Credit sales returns and allowances (for year) Accounts receivable (balance 30 June 2019) Allowance for doubtful debts (credit balance 30 June 2019) $1070 000 90 000 326 500 1 500 In the past, the company's yearly bad debts expense had been estimated at 29% of net credit sales revenue. It was decided to compare the current method with an ageing of the accounts receivable method. The following analysis was obtained with respect to the accounts receivable. Balance % estimated uncollectable Accounts not yet due Accounts overdue: 10-30 days $175 600 61 000 2 31-60 days 44 000 10 61-120 days 121 days and over 25 400 25 20 500 $ 326 500 40 Required a. Prepare the journal entries to adjust the Allowance for Doubtful Debts at 30 June 2019 under: i. the net credit sales method ii. the ageing of accounts receivable method. b. Determine the balance in the Allowance for Doubtful Debts account under both methods. C. Assume that the allowance account had a debit balance of $850 at 30 June 2019. Show the journal entries to record the allowance for doubtful debts at 30 June 2019 under: i. the net credit sales method ii. the ageing of accounts receivable method. d. Using the journal entries from requirement (c), determine the balance in the allowance account under both methods. e. Explain, with reference to requirements (b) and (d), why the two different methods result in different balances.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter7: Receivables And Investments

Section: Chapter Questions

Problem 7.2E: Allowance Method of Accounting for Bad Debts—Comparison of the Two Approaches Kandel Company had...

Related questions

Question

Answer b,d only

Transcribed Image Text:12.11 Doubtful debts – net credit sales and ageing methods **

LO3

Great Outdoors Ltd sells outdoor furniture settings on credit. The accounting records at 30 June 2019 reveal the following.

Ignore GST.

Credit sales (for year)

$1070 000

Credit sales returns and allowances (for year)

90 000

Accounts receivable (balance 30 June 2019)

326 500

Allowance for doubtful debts (credit balance 30 June 2019)

1 500

In the past, the company's yearly bad debts expense had been estimated at 29% of net credit sales revenue. It was decided to

compare the current method with an ageing of the accounts receivable method. The following analysis was obtained with

respect to the accounts receivable.

Balance % estimated

uncollectable

Accounts not yet due

$ 175 600

Accounts overdue: 10-30 days

61 000

2

31-60 days

44 000

10

61-120 days

25 400

25

121 days and over

20 500

$ 326 500

40

Required

a. Prepare the journal entries to adjust the Allowance for Doubtful Debts at 30 June 2019 under:

i. the net credit sales method

ii. the ageing of accounts receivable method.

b. Determine the balance in the Allowance for Doubtful Debts account under both methods.

C. Assume that the allowance account had a debit balance of $850 at 30 June 2019. Show the journal entries to record the

allowance for doubtful debts at 30 June 2019 under:

i. the net credit sales method

ii. the ageing of accounts receivable method.

d. Using the journal entries from requirement (c), determine the balance in the allowance account under both methods.

e. Explain, with reference to requirements (b) and (d), why the two different methods result in different balances.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning