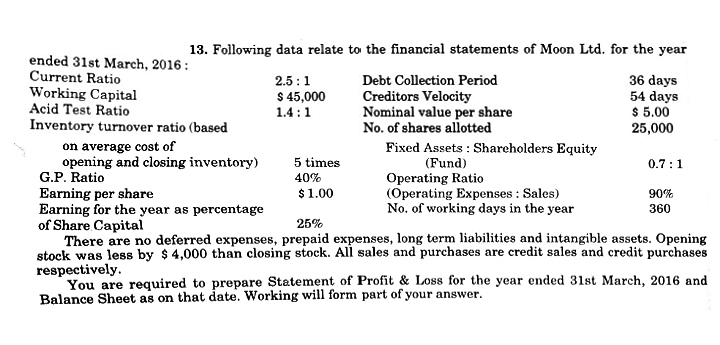

13. Following data relate to the financial statements of Moon Ltd. for the year ended 31st March, 2016 : Current Ratio Working Capital Acid Test Ratio Inventory turnover ratio (based on average cost of opening and closing inventory) G.P. Ratio Earning per share Earning for the year as percentage of Share Capital There are no deferred expenses, prepaid expenses, long term liabilities and intangible assets. Opening stock was less by $ 4,000 than closing stock. All sales and purchases are credit sales and credit purchases respectively. You are required to prepare Statement of Profit & Loss for the year ended 31st March, 2016 and Balance Sheet as on that date. Working will form part of your answer. 2.5:1 $ 45,000 Debt Collection Period Creditors Velocity Nominal value per share No. of shares allotted 36 days 54 days $ 5.00 25,000 1.4:1 Fixed Assets : Shareholders Equity (Fund) Operating Ratio (Operating Expenses : Sales) No. of working days in the year 5 times 0.7:1 40% $1.00 90% 360 25%

13. Following data relate to the financial statements of Moon Ltd. for the year ended 31st March, 2016 : Current Ratio Working Capital Acid Test Ratio Inventory turnover ratio (based on average cost of opening and closing inventory) G.P. Ratio Earning per share Earning for the year as percentage of Share Capital There are no deferred expenses, prepaid expenses, long term liabilities and intangible assets. Opening stock was less by $ 4,000 than closing stock. All sales and purchases are credit sales and credit purchases respectively. You are required to prepare Statement of Profit & Loss for the year ended 31st March, 2016 and Balance Sheet as on that date. Working will form part of your answer. 2.5:1 $ 45,000 Debt Collection Period Creditors Velocity Nominal value per share No. of shares allotted 36 days 54 days $ 5.00 25,000 1.4:1 Fixed Assets : Shareholders Equity (Fund) Operating Ratio (Operating Expenses : Sales) No. of working days in the year 5 times 0.7:1 40% $1.00 90% 360 25%

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.8E: Income Statement Ratio The income statement of Holly Enterprises shows operating revenues of...

Related questions

Question

Transcribed Image Text:13. Following data relate to the financial statements of Moon Ltd. for the year

ended 31st March, 2016 :

Current Ratio

Working Capital

Acid Test Ratio

Inventory turnover ratio (based

on average cost of

opening and closing inventory)

G.P. Ratio

2.5:1

$ 45,000

Debt Collection Period

Creditors Velocity

Nominal value per share

No. of shares allotted

36 days

54 days

$ 5.00

25,000

1.4 :1

Fixed Assets : Shareholders Equity

(Fund)

Operating Ratio

(Operating Expenses : Sales)

No. of working days in the year

5 times

0.7:1

40%

Earning per share

Earning for the year as percentage

of Share Capital

There are no deferred expenses, prepaid expenses, long term liabilities and intangible assets. Opening

stock was less by $ 4,000 than closing stock. All sales and purchases are credit sales and credit purchases

respectively.

You are required to prepare Statement of Profit & Loss for the year ended 31st March, 2016 and

Balance Sheet as on that date. Working will form part of your answer.

$1.00

90%

360

25%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning