13. On August 1, XYZ Inc. paid $5,000 in advance for September, October, and November rent. What would be the effect on the accounting equation for the transaction? a Increase Equity and decrease equity b. Increase Assets and decrease assets Increase Liabilities decrease assets d. There is no effect on the accounting equation

13. On August 1, XYZ Inc. paid $5,000 in advance for September, October, and November rent. What would be the effect on the accounting equation for the transaction? a Increase Equity and decrease equity b. Increase Assets and decrease assets Increase Liabilities decrease assets d. There is no effect on the accounting equation

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter2: Analyzing Transactions: The Accounting Equation

Section: Chapter Questions

Problem 4SEB: EFFECTS OF TRANSACTIONS (BALANCE SHEET ACCOUNTS) Jon Wallace started a business. During the first...

Related questions

Question

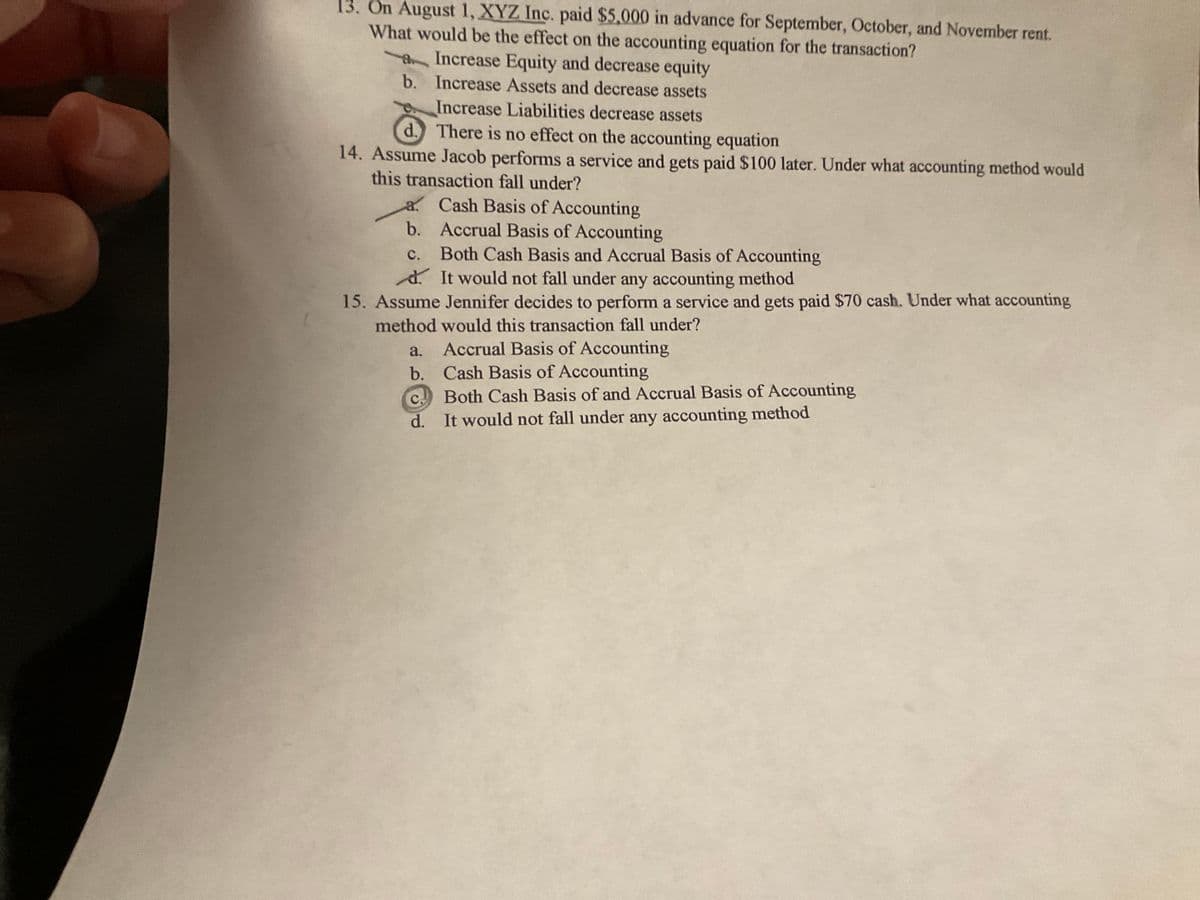

Transcribed Image Text:13. On August 1, XYZ Inc. paid $5,000 in advance for September, October, and November rent.

What would be the effect on the accounting equation for the transaction?

a Increase Equity and decrease equity

b.

Increase Assets and decrease assets

Increase Liabilities decrease assets

d. There is no effect on the accounting equation

14. Assume Jacob performs a service and gets paid $100 later. Under what accounting method would

this transaction fall under?

a. Cash Basis of Accounting

b.

Accrual Basis of Accounting

C.

Both Cash Basis and Accrual Basis of Accounting

d. It would not fall under any accounting method

15. Assume Jennifer decides to perform a service and gets paid $70 cash. Under what accounting

method would this transaction fall under?

a.

Accrual Basis of Accounting

b. Cash Basis of Accounting

C.

Both Cash Basis of and Accrual Basis of Accounting

d. It would not fall under any accounting method

Expert Solution

Step 1

Hi student

Since there are multiple questions, we will answer only first question.

Accounting equation is one of the fundamental concept in accounting. It says that total assets in the business must be equal to total liabilities and equity.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College