15. Consider a single competitive firm that starts off with zero capital in time 1. It's trying to decide hov much capital to acquire in the next period, time 2. Like any real-world competitive firm, it's trying to maximize the net present value of its profits. It'll have to rent that capital from the market at price r>0 per unit of capital when time 2 arrives. We don't have to worry about depreciation-the rental rate is the only price we need to worry about. Output in time 2 is made this way: Y₂ = ZK₂² Where the exponent a is strictly between zero and one and z is strictly positive. This is an entirely conventional firm net present value maximization problem. a. Solve for the optimal level of time 2 capital solely as a function of exogenous parameters b. What is the elasticity of optimal capital with respect to the interest rate? Answer as a function of exogenous parameters: c. In this model, is there such a thing as too much productivity? In other words, can the derivative

15. Consider a single competitive firm that starts off with zero capital in time 1. It's trying to decide hov much capital to acquire in the next period, time 2. Like any real-world competitive firm, it's trying to maximize the net present value of its profits. It'll have to rent that capital from the market at price r>0 per unit of capital when time 2 arrives. We don't have to worry about depreciation-the rental rate is the only price we need to worry about. Output in time 2 is made this way: Y₂ = ZK₂² Where the exponent a is strictly between zero and one and z is strictly positive. This is an entirely conventional firm net present value maximization problem. a. Solve for the optimal level of time 2 capital solely as a function of exogenous parameters b. What is the elasticity of optimal capital with respect to the interest rate? Answer as a function of exogenous parameters: c. In this model, is there such a thing as too much productivity? In other words, can the derivative

Chapter11: The Firm: Production And Costs

Section: Chapter Questions

Problem 3P

Related questions

Question

10

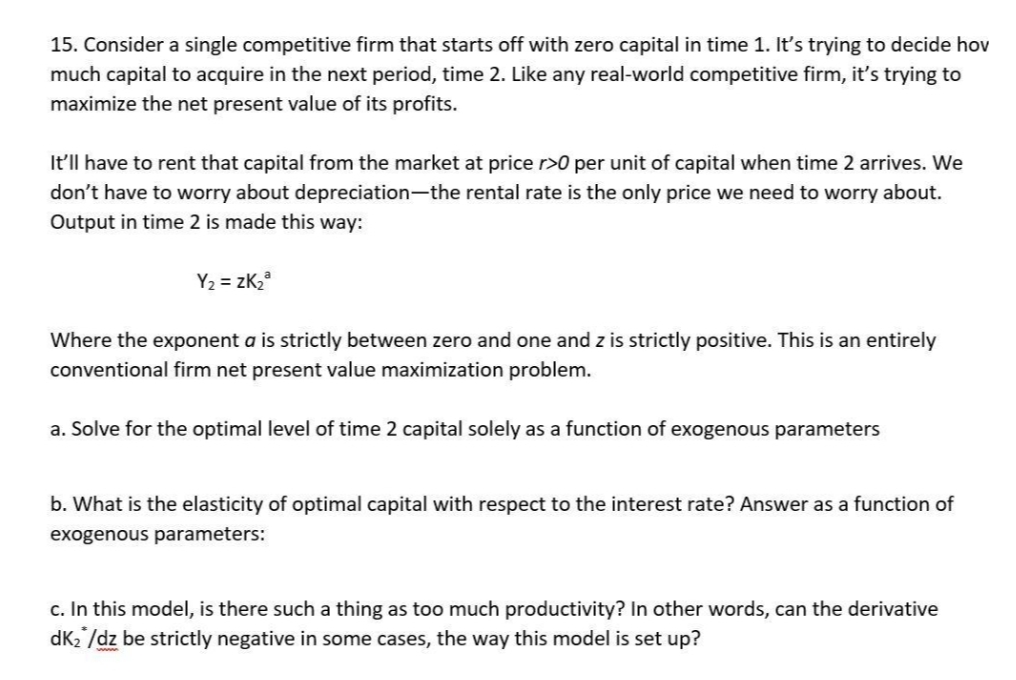

Transcribed Image Text:15. Consider a single competitive firm that starts off with zero capital in time 1. It's trying to decide hov

much capital to acquire in the next period, time 2. Like any real-world competitive firm, it's trying to

maximize the net present value of its profits.

It'll have to rent that capital from the market at price r>0 per unit of capital when time 2 arrives. We

don't have to worry about depreciation-the rental rate is the only price we need to worry about.

Output in time 2 is made this way:

Y₂ = ZK₂³

Where the exponent a is strictly between zero and one and z is strictly positive. This is an entirely

conventional firm net present value maximization problem.

a. Solve for the optimal level of time 2 capital solely as a function of exogenous parameters

b. What is the elasticity of optimal capital with respect to the interest rate? Answer as a function of

exogenous parameters:

c. In this model, is there such a thing as too much productivity? In other words, can the derivative

dk₂/dz be strictly negative in some cases, the way this model is set up?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax