17-39 Transferred-in costs, weighted-average method (related to 17-36–17-38). Larsen Company, as you know, is a manufacturer of car seats. Each car seat passes through the assembly department and testing department. This problem focuses on the testing department. Direct materials are added when the testing department process is 90 % complete. Conversion costs are added evenly during the testing department's process. As work in assembly is completed, each unit is immediately transferred to testing. As each unit is completed in testing, it is immediately transferred to Finished Goods. Larsen Company uses the weighted-average method of process costing. Data for the testing depart- ment for October 2017 are as follows: Physical Units Transferred- (Car Seats) Direct Conversion In Costs Materials Costs Work in process, October 1 Started during October 2017 Completed during October 2017 Work in process, October 31 Total costs added during October 2017 7,500 $2,932,500 $ 0 $ 835,460 ? 26,300 3,700 $7,717,500 $9,704,700 $3,955,900 Degree of completion: transferred-in costs,?%; direct materials,?%; conversion costs, 70%. "Degree of completion: transferred-in costs,?%; direct materials, ?%; conversion costs, 60%. ASSIGNMENT MATERIAL 73 1. What is the percentage of completion for (a) transferred-in costs and direct materials in beginning work-in-process inventory and (b) transferred-in costs and direct materials in ending work-in-process inventory? 2. For each cost category, compute equivalent units in the testing department. Show physical units in the Required first column of your schedule. 3. For each cost category, summarize total testing department costs for October 2017, calculate the cost per equivalent unit, and assign costs to units completed (and transferred out) and to units in ending work in process. 4. Prepare journal entries for October transfers from the assembly department to the testing department and from the testing department to Finished Goods. 17-40 Transferred-in costs, FIFO method (continuation of 17-39). Refer to the information in Problem 17-39. Suppose that Larsen Company uses the FIFO method inste ad of the weighted-average method in all of its depart- ments. The only changes to Problem 17-39 under the FIFO method are that total transferred-in costs of beginning work in process on October 1 are $2,800,000 (instead of $2,932,500) and that total transferred-in costs added dur- ing October are $7,735,250 (instead of $7,717,500). Using the FIFO process-costing method, complete Problem 17-39. Required

17-39 Transferred-in costs, weighted-average method (related to 17-36–17-38). Larsen Company, as you know, is a manufacturer of car seats. Each car seat passes through the assembly department and testing department. This problem focuses on the testing department. Direct materials are added when the testing department process is 90 % complete. Conversion costs are added evenly during the testing department's process. As work in assembly is completed, each unit is immediately transferred to testing. As each unit is completed in testing, it is immediately transferred to Finished Goods. Larsen Company uses the weighted-average method of process costing. Data for the testing depart- ment for October 2017 are as follows: Physical Units Transferred- (Car Seats) Direct Conversion In Costs Materials Costs Work in process, October 1 Started during October 2017 Completed during October 2017 Work in process, October 31 Total costs added during October 2017 7,500 $2,932,500 $ 0 $ 835,460 ? 26,300 3,700 $7,717,500 $9,704,700 $3,955,900 Degree of completion: transferred-in costs,?%; direct materials,?%; conversion costs, 70%. "Degree of completion: transferred-in costs,?%; direct materials, ?%; conversion costs, 60%. ASSIGNMENT MATERIAL 73 1. What is the percentage of completion for (a) transferred-in costs and direct materials in beginning work-in-process inventory and (b) transferred-in costs and direct materials in ending work-in-process inventory? 2. For each cost category, compute equivalent units in the testing department. Show physical units in the Required first column of your schedule. 3. For each cost category, summarize total testing department costs for October 2017, calculate the cost per equivalent unit, and assign costs to units completed (and transferred out) and to units in ending work in process. 4. Prepare journal entries for October transfers from the assembly department to the testing department and from the testing department to Finished Goods. 17-40 Transferred-in costs, FIFO method (continuation of 17-39). Refer to the information in Problem 17-39. Suppose that Larsen Company uses the FIFO method inste ad of the weighted-average method in all of its depart- ments. The only changes to Problem 17-39 under the FIFO method are that total transferred-in costs of beginning work in process on October 1 are $2,800,000 (instead of $2,932,500) and that total transferred-in costs added dur- ing October are $7,735,250 (instead of $7,717,500). Using the FIFO process-costing method, complete Problem 17-39. Required

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter6: Process Costing

Section: Chapter Questions

Problem 45E: Cassien Inc. manufactures products that pass through two or more processes. During June, equivalent...

Related questions

Question

Number 17-40

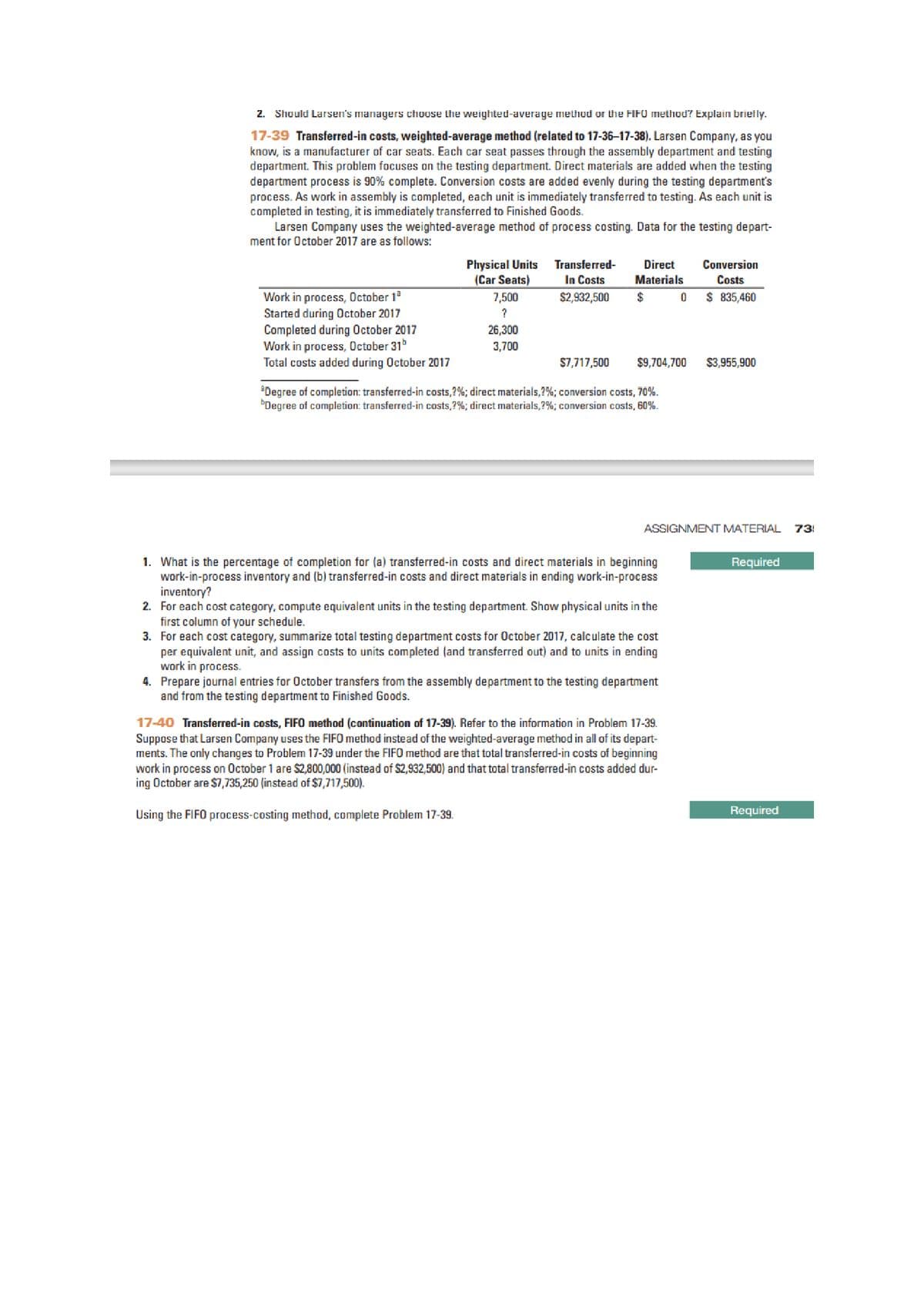

Transcribed Image Text:2. Should Larsen's managers choose the weighted-average methud or the FIFO method? Explain brietly.

17-39 Transferred-in costs, weighted-average method (related to 17-36-17-38). Larsen Company, as you

know, is a manufacturer of car seats. Each car seat passes through the assembly department and testing

department. This problem focuses on the testing department. Direct materials are added when the testing

department process is 90% complete. Conversion costs are added evenly during the testing department's

process. As work in assembly is completed, each unit is immediately transferred to testing. As each unit is

completed in testing, it is immediately transferred to Finished Goods.

Larsen Company uses the weighted-average method of process costing. Data for the testing depart-

ment for October 2017 are as follows:

Physical Units

(Car Seats)

Transferred-

In Costs

Direct

Conversion

Materials

Costs

$ 835,460

Work in process, October 1

Started during October 2017

Completed during October 2017

Work in process, October 31

Total costs added during October 2017

7,500

$2,932,500

$

26,300

3,700

$7,717,500

$9,704,700

$3,955,900

'Degree of completion: transferred-in costs,?%; direct materials,7%; conversion costs, 70%.

"Degree of completion: transferred-in costs,?%; direct materials,?%; conversion costs, 60%.

ASSIGNMENT MATERIAL

73!

1. What is the percentage of completion for (a) transferred-in costs and direct materials in beginning

work-in-process inventory and (b) transferred-in costs and direct materials in ending work-in-process

inventory?

2. For each cost category, compute equivalent units in the testing department. Show physical units in the

first column of your schedule.

3. For each cost category, summarize total testing department costs for October 2017, calculate the cost

per equivalent unit, and assign costs to units completed (and transferred out) and to units in ending

work in process.

4. Prepare journal entries for October transfers from the assembly department to the testing department

and from the testing department to Finished Goods.

Required

17-40 Transferred-in costs, FIFO method (continuation of 17-39). Refer to the information in Problem 17-39.

Suppose that Larsen Company uses the FIFO method instead of the weighted-average method in all of its depart-

ments. The only changes to Problem 17-39 under the FIFO method are that total transferred-in costs of beginning

work in process on October 1 are $2,800,000 (instead of $2,932,500) and that total transferred-in costs added dur-

ing October are $7,735,250 (instead of $7,717,500).

Using the FIFO process-costing method, complete Problem 17-39.

Required

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College