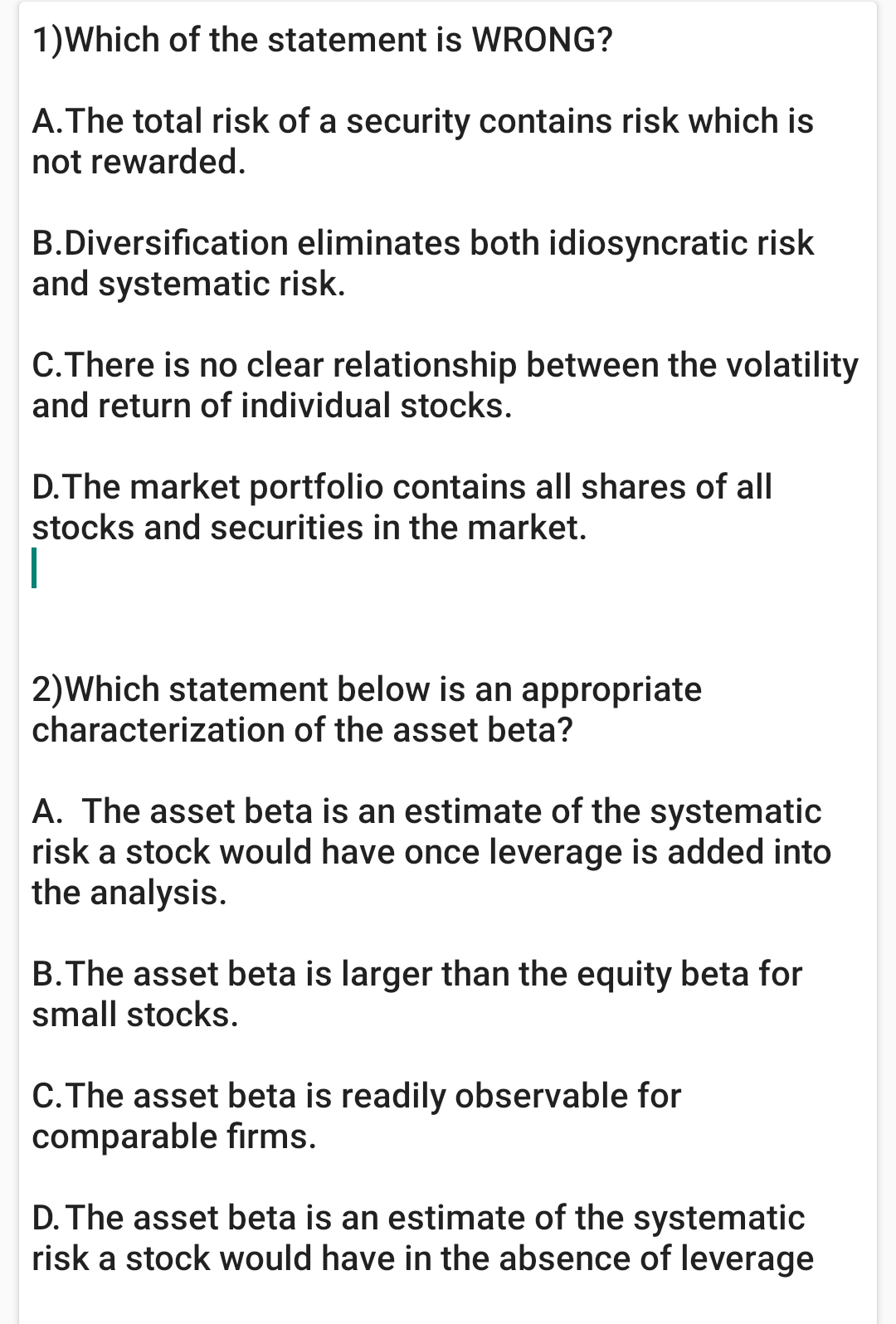

1)Which of the statement is WRONG? A.The total risk of a security contains risk which is not rewarded. B.Diversification eliminates both idiosyncratic risk and systematic risk. C.There is no clear relationship between the volatility and return of individual stocks. D.The market portfolio contains all shares of all stocks and securities in the market. | 2)Which statement below is an appropriate characterization of the asset beta? A. The asset beta is an estimate of the systematic risk a stock would have once leverage is added into the analysis. B.The asset beta is larger than the equity beta for small stocks. C.The asset beta is readily observable for comparable firms. D. The asset beta is an estimate of the systematic risk a stock would have in the absence of leverage

1)Which of the statement is WRONG? A.The total risk of a security contains risk which is not rewarded. B.Diversification eliminates both idiosyncratic risk and systematic risk. C.There is no clear relationship between the volatility and return of individual stocks. D.The market portfolio contains all shares of all stocks and securities in the market. | 2)Which statement below is an appropriate characterization of the asset beta? A. The asset beta is an estimate of the systematic risk a stock would have once leverage is added into the analysis. B.The asset beta is larger than the equity beta for small stocks. C.The asset beta is readily observable for comparable firms. D. The asset beta is an estimate of the systematic risk a stock would have in the absence of leverage

Chapter7: Uncertainty

Section: Chapter Questions

Problem 7.13P

Related questions

Question

Transcribed Image Text:1)Which of the statement is WRONG?

A.The total risk of a security contains risk which is

not rewarded.

B.Diversification eliminates both idiosyncratic risk

and systematic risk.

C.There is no clear relationship between the volatility

and return of individual stocks.

D.The market portfolio contains all shares of all

stocks and securities in the market.

2)Which statement below is an appropriate

characterization of the asset beta?

A. The asset beta is an estimate of the systematic

risk a stock would have once leverage is added into

the analysis.

B.The asset beta is larger than the equity beta for

small stocks.

C.The asset beta is readily observable for

comparable firms.

D. The asset beta is an estimate of the systematic

risk a stock would have in the absence of leverage

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning