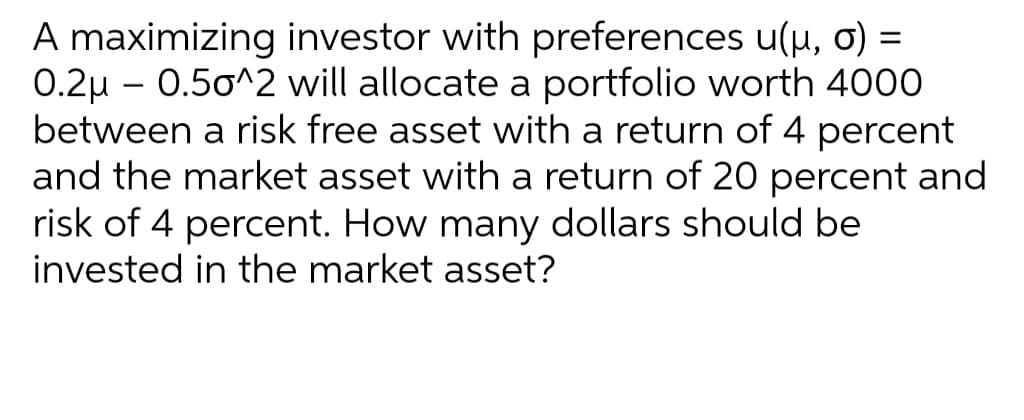

A maximizing investor with preferences u(u, ơ) = 0.2µ – 0.50^2 will allocate a portfolio worth 4000 between a risk free asset with a return of 4 percent and the market asset with a return of 20 percent and risk of 4 percent. How many dollars should be invested in the market asset?

Q: For a well diversified portfolio, ranking of portfolios as per Sharpe’s measure and Treynor’s…

A: Both the Sharpe and Treynor ratios are used to calculate the risk-adjusted rate of return. The…

Q: which one is correct? QUESTION 12 Exhibit 6B.1 USE THE INFORMATION BELOW FOR THE FOLLOWING…

A: W1 = [E(σ1)2 − r1.2 E(σ1) E(σ2)]/[E(σ1)2 + E(σ2)2 − 2 r1.2 E(σ1) E(σ2)] when, r1.2 = -1 W1 = E(σ1)2…

Q: Q2. (i) Consider a risk averse investor who must decide how much of his initial wealth w to put into…

A: Decreasing absolute risk aversion represents that when wealth increases the amount invested in risky…

Q: Stock X has a 9.5% expected return, a beta coefficient of 0.8, and a 30% standard deviation of…

A: The required rate of return (RRR) is the minimum return an investor will accept for owning a…

Q: True or False: Increasing the number of stocks in a portfolio reduces firm-specific risk. True…

A: Risks implies to the future uncertainty about the deviation of the earning an individual might earn…

Q: Why does the risk-adjusted discount rate reduce the investment's appeal?

A: Risk adjusted discount rate refers to the summation of risk free rat and the risk premium. Risk…

Q: Which of the following statements is most correct? If you add enough randomly selected stocks to a…

A: The beta value is indicating the volatile of the stock. If the beta value is greater than 1, then…

Q: In order to benefit from diversification, the returns on assets in a portfolio must: a. Not be…

A: Diversification is a strategy where the investor diversify their portfolio, i.e. invest in a variety…

Q: The expected return on Stock X is 9.5%, the standard deviation of expected returns is 30%, and the…

A: There are two sorts of stocks: ordinary and preferred. The distinction is that whereas the owner of…

Q: You are in the market for a new refrigerator for your company's lounge, and you have narrowed the…

A: The process of calculating the actual value of potential money flows provided from a task, such as…

Q: (c) Construct risk-neutral probabilitiès för and verify the risk-neutral value for the call option…

A: I have used formula which is given in the following step for finding answers.

Q: Portfolios A, B, and C all lie on the efficient frontier that allows for risk-free borrowing and…

A: Given that Portfolios A, B, and C all lie on the efficient frontier that allows for risk-free…

Q: The value of Jon’s stock portfolio is given by the function v(t) = 50 + 77t + 3t2, where v is the…

A: The value of Jon’s stock portfolio is given by the function v(t) = 50 + 77t + 3t2,

Q: based on the utility curves

A: An optimal portfolio is one which either tends to minimize your risk for a given return level or…

Q: You are considering two portfolios. Portfolio A has an expected return of 15% and a standard…

A: A portfolio's certainty equivalent is the rate of return on a risk-free investment at which prudent…

Q: Given the following information, what is the standard deviation of the returns on a portfolio that…

A: According to the given information:

Q: Assume expected returns and deviations for all securities, as well as the risk-free rate for lending…

A: If the borrowing and lending interest rates are not equivalent, distinctive optimal risky portfolios…

Q: Consider an economy with three dates (T-0, 1, 2) and the following investment opportunity. If an…

A: Given: time periods - 0,1,2 If invests $1 in T=0, it becomes $4 in T=2 but in T=1 liquidated at $1…

Q: Portfolio ABZ has a daily expected return of 0.0634% and a daily standard deviation of 1.1213%.…

A: Introduction Value at risk ( VaR) is the measurement of worst case downside risk to an investment or…

Q: As Uncertainty (Volatility) decreases with all else being equal, A. The price of the option…

A: The variability of returns for a particular stock or market index is measured. The more changeable…

Q: An investment is valued approximately by the function f (t) = 50, 000e0:2v If the annual discount…

A: We are going to find the PW of investment to answer this question.

Q: You are provided with information on expected returns, standard deviations and correlation…

A: The expected returns of a portfolio are calculated by the sum of weights of each asset times the…

Q: Suppose you have a portfolio that has a long position in call Ce(So, T, X1) and a short position in…

A: When an investor holds long positions, it signifies that he or she has purchased and owns the stocks…

Q: The beta of an active portfolio is 1.45. The standard deviation of the returns on the market inde is…

A: Answer; Option (e) is Correct

Q: In the mean-standard deviation graph, the line that connects the risk-free rate and the optimal…

A: Answer: In the mean-standard deviation graph, the line that connects the risk-free rate and the…

Q: Consider a certain butterfly spread on IBM: this is a portfolio that is long one call at $250, long…

A: A call option is an agreement among a purchaser and a dealer to acquire a specific stock at a…

Q: You have been hired as a portfolio manager for a fancy hedge fund. Your first job is to invest…

A: Safe assets are assets that, on their own, do not carry a high risk of loss across all market…

Q: Using the Utility Function in Portfolio Management, where the utility function is the constant…

A: The certainty equivalent is a return that is assured and somebody would prefer to receive now over…

Q: Robin Hood is 23 years old and has accumulated $4,000 in her self-directed defined contribution…

A: Since it is an estimation of future value of the asset and their is an element of uncertainty, it…

Q: Which statement about portfolio diversification is CORRECT? i) Typically, as more securities are…

A: i) Typically, as more securities are added to a portfolio, total risk would be expected to decrease…

Q: The risk-return tradeoff is -- an analysis of your risk tolerance an analysis of the risk of a…

A: The Risk-return tradeoff refers to an investment principle that shows the higher risk, higher the…

Q: An executive at a publishing house has just been given two stock options as a bonus. Each option…

A: In both cases, subgame perfect equilibrium is an exercise for both the options tomorrow. Hence,…

Q: A risk-averse investor will: a. Always accept a greater risk with a greater expected return b. Only…

A: Risk-averse people are those who prefer not to take any risk or want to reduce the uncertainty.

Q: Elizabeth has decided to form a portfolio by putting 30% of her money into stock 1 and 70% into…

A: Standard deviation: It means a measure of how spread out numbers are

Q: From the following equation for expected returns, explain what may cause stock prices to decrease in…

A: During economic recession from the following equation is increase variation in the market (Var(r))…

Q: The beta of an active portfolio is 1.45. The standard deviation of the returns on the market inde>…

A: here calculating the standard deviation of the returns on the active portfolio as follow

Q: If the risk-free rate is 3 percent and the risk premium is 5 percent, what is the required return?

A: The required return = return on risk free invested + risk premium So if the risk premium is 5…

Q: INV 1 4c You have invested in a portfolio of 60% in risky assets (Portfolio R) and 40% in T-bills.…

A: Risk aversion is the propensity of individuals to lean toward results with low vulnerability to…

Q: A risk-averse investor will: Answer a. Always accept a greater risk with a greater expected return…

A: Risk-averse describes investors who choose preservations of capital over the potential for a…

Q: Investments that have a positive net present value should be considered for acceptance. Select one:…

A: Investments are assets or wealth that have been accumulated over time by saving money. Investment…

Q: If the market risk decreases, while everything else stays the same, then Select one: O A. the budget…

A: If the market risk decreases, while everything else stays the same, then A) the budget line of the…

Q: Suppose XYZ Corporation's stock price rises or falls with equal probability by $25 each month,…

A: A stock refers to a financial instrument that represents the ownership share in a firm.This allows…

Q: Elizabeth has decided to form a portfolio by putting 30% of her money into stock 1 and 70% into…

A: Expected return means expected value return on investment

Q: Consider an economy where Capital Asset Pricing Model holds. In this economy, stocks A and B have…

A:

Q: An investor believes that the U.S. dollar will rise in value relative to the Japanese yen. The same…

A: The value of a currency in the foreign exchange market is determined by the demand and supply for…

Q: For a diversified portfolio including a large number of stocks: А. the weighted average of the betas…

A: The answer is -B. The weighted average of unsystematic risk goes to zero.

Step by step

Solved in 2 steps with 2 images

- A company is considering implementing a project that generates a guaranteed income of 1000 from next year and every year thereafter, while the project has an investment cost of 10,000 today. In addition, there is a one-off maintenance cost of 20 000 in exactly 10 years time. Assume that the risk-free interest rate is 3 percent. Is the project profitable to implement?Q2 - Returns on stocks X and Y are listed below: Period 1 2 3 4 5 6 7Stock X 4% -2% 5% -1% 10% 7% 12%Stock Y -3% 7% 4% 2% 2% 8% -3% Consider a portfolio of 10% stock X and 90% stock Y. What is the mean of portfolio returns? Please specify your answer in decimal terms and round your answer to the nearest thousandth (e.g., enter 12.3 percent as 0.123).An entrepreneur recently learned about a new hotel business that requires an initial investment of $12M and annual cash flow of $2M in perpetuity. The appropriate discount rate is 20%. Now, consider a pretty similar scenario: an Initial investment $12M. Now, in good state, $6M annual cash flows. In a bad state, -$2M annual cash flows. Furthermore, assume that the entrepreneur wants to own at most, 1 hotel (no option to expand). - But things change when we consider the abandonment option. At date 1, the entrepreneur will know which forecast has come true. If the world is in the good state, he will keep the project alive. If bad state, he will abandon the hotel after period 1. - Now, what is the NPV of the project? - What is the value of the option to abandon?

- suppose that you invest $100 today in a risk-free investment and let the 4 percent annual intrest rate compound. Rounded to the full dollars, what will be the value of your investment 4 years from now?A project has an initial cost of $26,000, a discount rate of 11.7 percent, a life of 5 years, and an NPV of $11,216. Given this, you know that the project is expected to earn a return: A equal to 11.7 percent of $26,000 plus an additional $11,216. B of $11,216 in total. C equal to 11.7 percent of $37,216 (= $26,000 + 11,216). D of 11.7 percent of $11,216. E of $26,000 minus $11,216.Consider the following portfolio choice problem. The investor has initial wealth w andutility u(x) = (x^n) /n. There is a safe asset (such as a US government bond) that has netreal return of zero. There is also a risky asset with a random net return that has onlytwo possible returns, R1 with probability 1 − q and R0 with probability q. We assumeR1 < 0, R0 > 0. Let A be the amount invested in the risky asset, so that w − A isinvested in the safe asset.a) What are risk preferences of this investor, are they risk-averse, riskneutral or risk-loving?b) Find A as a function of w.

- Consider the following portfolio choice problem. The investor has initial wealth w andutility u(x) = (x^n) /n. There is a safe asset (such as a US government bond) that has netreal return of zero. There is also a risky asset with a random net return that has onlytwo possible returns, R1 with probability 1 − q and R0 with probability q. We assumeR1 < 0, R0 > 0. Let A be the amount invested in the risky asset, so that w − A isinvested in the safe asset.1) What are risk preferences of this investor, are they risk-averse, riskneutral or risk-loving?2) Find A as a function of w.Consider the following portfolio choice problem. The investor has initial wealth w andutility u(x) = (x^n) /n. There is a safe asset (such as a US government bond) that has netreal return of zero. There is also a risky asset with a random net return that has onlytwo possible returns, R1 with probability 1 − q and R0 with probability q. We assumeR1 < 0, R0 > 0. Let A be the amount invested in the risky asset, so that w − A isinvested in the safe asset. Calculate relative risk aversion for this investor. How does relative risk aversion depend on wealth?In a financial market a stock is traded with a current price of 50. Next period the price of the stock can either go up with 30 per cent or go down with 25 per cent. Risk-free debt is available with an interest rate of 8 per cent. Also traded are European options on the stock with an exercise price of 45 and a time to maturity of 1, i.e. they mature next period. Find prices of Arrow-Debreu securities.

- The table below shows information for 3 stocks. Security Beta Risk-free rate Expected market return Stock 1 1.9 0.02 0.09 Stock 2 1.2 0.035 0.09 Stock 3 0.2 0.015 0.09 The risk-free rates are different because they were measured in different years. Calculate the expected (or required) return for each stock, using the Capital Asset Pricing Model (CAPM). What is the required return for stock 1? What is the required return for stock 2? What is the required return for stock 3?As a manager of your company, you are considering to go for a project, with an initial outlay of $200,000. The project has a life of three years and yields (year-end) cash inflows of $ 100,000 in year-1, $150,000 in year-2 and $200,000 in year 3. What is the net present value of the project if the interest rate is 10 percent? Show your steps. Should you recommend to go for the project? Explain in details.You observe the E[IBM] = 8%, E[AAPL] = 12%, B(AAPL)=B(IBM)+2/3, Risk-free rate is 4%. What is the expected return on the market portfolio assuming the CAPM is true.