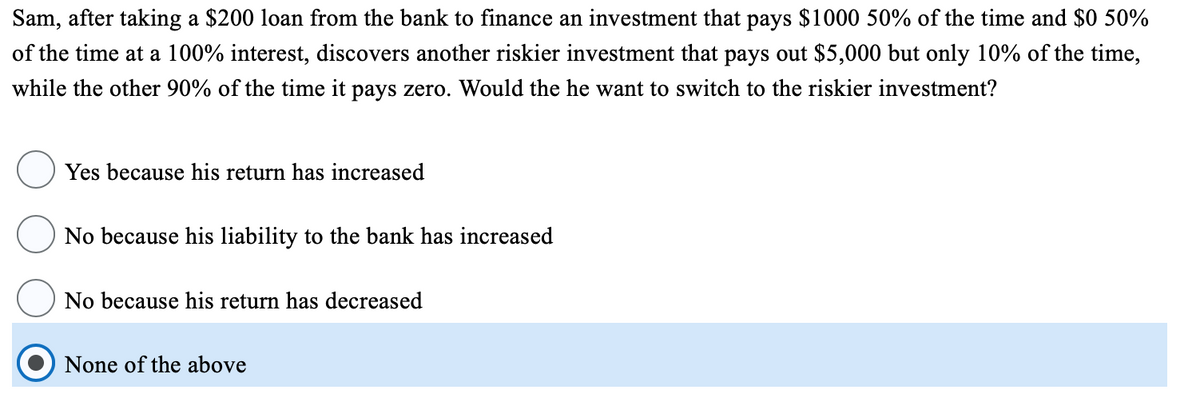

Sam, after taking a $200 loan from the bank to finance an investment that pays $1000 50% of the time and $0 50% of the time at a 100% interest, discovers another riskier investment that pays out $5,000 but only 10% of the time, while the other 90% of the time it pays zero. Would the he want to switch to the riskier investment? Question 4 options: Yes because his return has increased No because his liability to the bank has increased No because his return has decreased None of the above

Sam, after taking a $200 loan from the bank to finance an investment that pays $1000 50% of the time and $0 50% of the time at a 100% interest, discovers another riskier investment that pays out $5,000 but only 10% of the time, while the other 90% of the time it pays zero. Would the he want to switch to the riskier investment? Question 4 options: Yes because his return has increased No because his liability to the bank has increased No because his return has decreased None of the above

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter17: Financial Markets

Section: Chapter Questions

Problem 5SCQ: Investors sometimes fear that a high-risk investment is especially likely to have low returns. Is...

Related questions

Question

Sam, after taking a $200 loan from the bank to finance an investment that pays $1000 50% of the time and $0 50% of the time at a 100% interest, discovers another riskier investment that pays out $5,000 but only 10% of the time, while the other 90% of the time it pays zero. Would the he want to switch to the riskier investment?

Question 4 options:

|

|

Yes because his return has increased

No because his liability to the bank has increased

No because his return has decreased

None of the above

|

Transcribed Image Text:Sam, after taking a $200 loan from the bank to finance an investment that pays $1000 50% of the time and $0 50%

of the time at a 100% interest, discovers another riskier investment that pays out $5,000 but only 10% of the time,

while the other 90% of the time it pays zero. Would the he want to switch to the riskier investment?

Yes because his return has increased

No because his liability to the bank has increased

No because his return has decreased

None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning