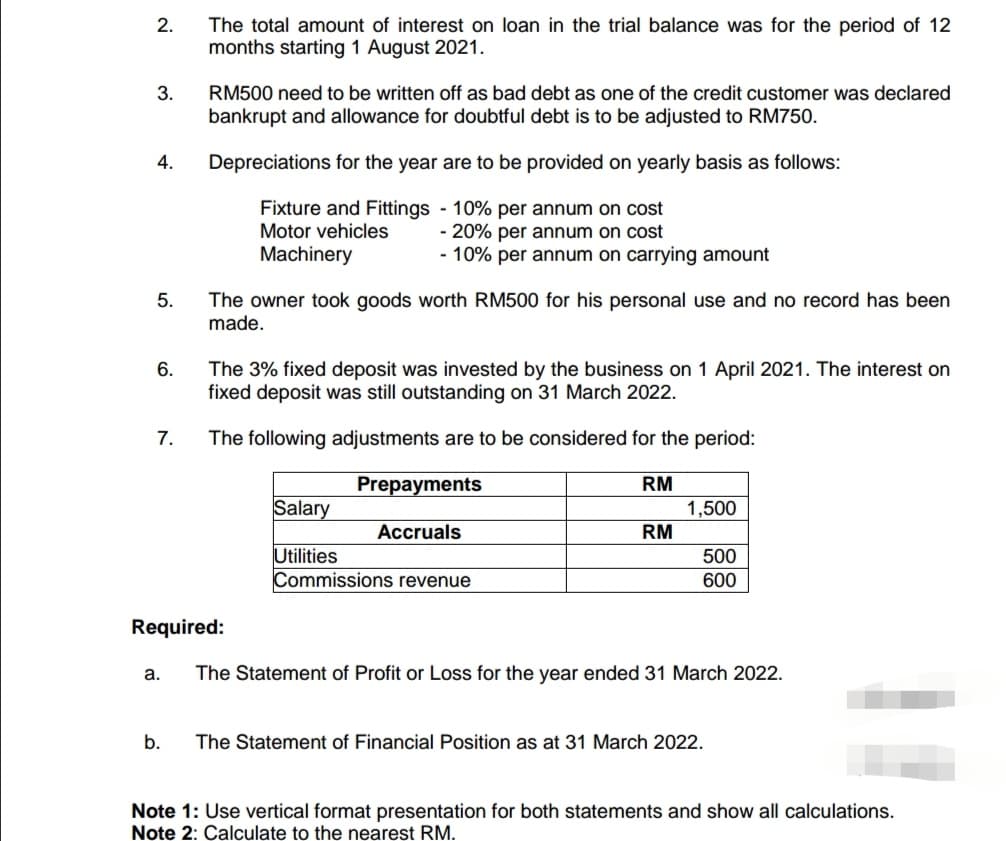

2. 3. 4. 5. 6. 7. The total amount of interest on loan in the trial balance was for the period of 12 months starting 1 August 2021. a. RM500 need to be written off as bad debt as one of the credit customer was declared bankrupt and allowance for doubtful debt is to be adjusted to RM750. Depreciations for the year are to be provided on yearly basis as follows: Fixture and Fittings Motor vehicles Machinery - 10% per annum on cost -20% per annum on cost -10% per annum on carrying amount The owner took goods worth RM500 for his personal use and no record has been made. The 3% fixed deposit was invested by the business on 1 April 2021. The interest on fixed deposit was still outstanding on 31 March 2022. The following adjustments are to be considered for the period: RM Required: Prepayments Salary Utilities Commissions revenue Accruals RM 1,500 500 600 The Statement of Profit or Loss for the year ended 31 March 2022. b. The Statement of Financial Position as at 31 March 2022. Note 1: Use vertical format presentation for both statements and show all calculations. Note 2: Calculate to the nearest RM

2. 3. 4. 5. 6. 7. The total amount of interest on loan in the trial balance was for the period of 12 months starting 1 August 2021. a. RM500 need to be written off as bad debt as one of the credit customer was declared bankrupt and allowance for doubtful debt is to be adjusted to RM750. Depreciations for the year are to be provided on yearly basis as follows: Fixture and Fittings Motor vehicles Machinery - 10% per annum on cost -20% per annum on cost -10% per annum on carrying amount The owner took goods worth RM500 for his personal use and no record has been made. The 3% fixed deposit was invested by the business on 1 April 2021. The interest on fixed deposit was still outstanding on 31 March 2022. The following adjustments are to be considered for the period: RM Required: Prepayments Salary Utilities Commissions revenue Accruals RM 1,500 500 600 The Statement of Profit or Loss for the year ended 31 March 2022. b. The Statement of Financial Position as at 31 March 2022. Note 1: Use vertical format presentation for both statements and show all calculations. Note 2: Calculate to the nearest RM

Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter14: Activities Required In Completing A Quality Audit

Section: Chapter Questions

Problem 65RSCQ

Related questions

Question

Transcribed Image Text:2.

3.

4.

5.

6.

7.

The total amount of interest on loan in the trial balance was for the period of 12

months starting 1 August 2021.

a.

RM500 need to be written off as bad debt as one of the credit customer was declared

bankrupt and allowance for doubtful debt is to be adjusted to RM750.

Depreciations for the year are to be provided on yearly basis as follows:

Fixture and Fittings - 10% per annum on cost

Motor vehicles

-20% per annum on cost

Machinery

The owner took goods worth RM500 for his personal use and no record has been

made.

Required:

- 10% per annum on carrying amount

The 3% fixed deposit was invested by the business on 1 April 2021. The interest on

fixed deposit was still outstanding on 31 March 2022.

The following adjustments are to be considered for the period:

RM

Salary

Prepayments

Accruals

Utilities

Commissions revenue

RM

1,500

500

600

The Statement of Profit or Loss for the year ended 31 March 2022.

b. The Statement of Financial Position as at 31 March 2022.

Note 1: Use vertical format presentation for both statements and show all calculations.

Note 2: Calculate to the nearest RM.

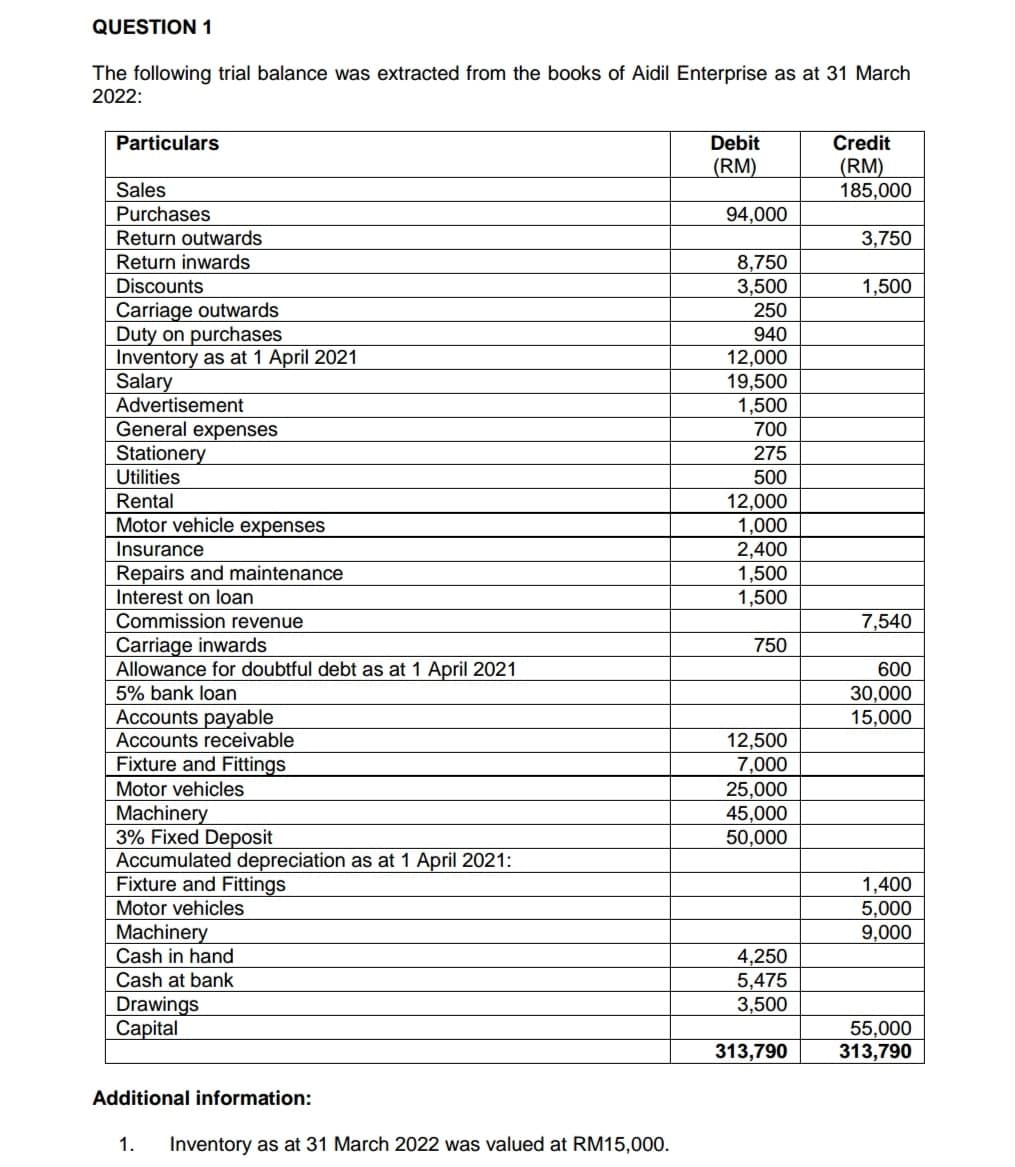

Transcribed Image Text:QUESTION 1

The following trial balance was extracted from the books of Aidil Enterprise as at 31 March

2022:

Particulars

Sales

Purchases

Return outwards

Return inwards

Discounts

Carriage outwards

Duty on purchases

Inventory as at 1 April 2021

Salary

Advertisement

General expenses

Stationery

Utilities

Rental

Motor vehicle expenses

Insurance

Repairs and maintenance

Interest on loan

Commission revenue

Carriage inwards

Allowance for doubtful debt as at 1 April 2021

5% bank loan

Accounts payable

Accounts receivable

Fixture and Fittings

Motor vehicles

Machinery

3% Fixed Deposit

Accumulated depreciation as at 1 April 2021:

Fixture and Fittings

Motor vehicles

Machinery

Cash in hand

Cash at bank

Drawings

Capital

Additional information:

1. Inventory as at 31 March 2022 was valued at RM15,000.

Debit

(RM)

94,000

8,750

3,500

250

940

12,000

19,500

1,500

700

275

500

12,000

1,000

2,400

1,500

1,500

750

12,500

7,000

25,000

45,000

50,000

4,250

5,475

3,500

313,790

Credit

(RM)

185,000

3,750

1,500

7,540

600

30,000

15,000

1,400

5,000

9,000

55,000

313,790

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,