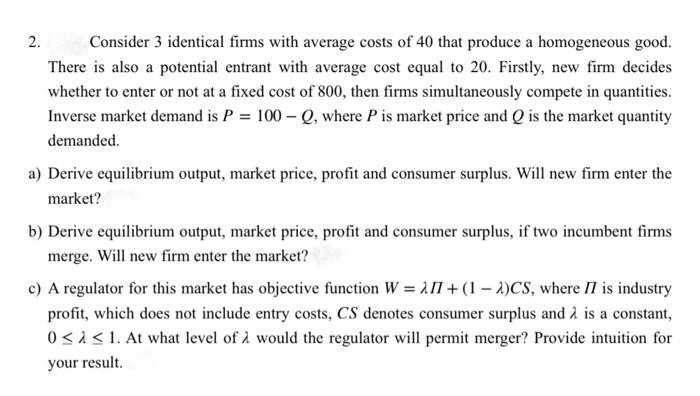

2. Consider 3 identical firms with average costs of 40 that produce a homogeneous good. There is also a potential entrant with average cost equal to 20. Firstly, new firm decides whether to enter or not at a fixed cost of 800, then firms simultaneously compete in quantities. Inverse market demand is P = 100-Q, where P is market price and Q is the market quantity demanded. a) Derive equilibrium output, market price, profit and consumer surplus. Will new firm enter the market? b) Derive equilibrium output, market price, profit and consumer surplus, if two incumbent firms merge. Will new firm enter the market? c) A regulator for this market has objective function W = AII+(1-2)CS, where II is industry profit, which does not include entry costs, CS denotes consumer surplus and 2 is a constant, 0 ≤ ≤ 1. At what level of would the regulator will permit merger? Provide intuition for your result.

2. Consider 3 identical firms with average costs of 40 that produce a homogeneous good. There is also a potential entrant with average cost equal to 20. Firstly, new firm decides whether to enter or not at a fixed cost of 800, then firms simultaneously compete in quantities. Inverse market demand is P = 100-Q, where P is market price and Q is the market quantity demanded. a) Derive equilibrium output, market price, profit and consumer surplus. Will new firm enter the market? b) Derive equilibrium output, market price, profit and consumer surplus, if two incumbent firms merge. Will new firm enter the market? c) A regulator for this market has objective function W = AII+(1-2)CS, where II is industry profit, which does not include entry costs, CS denotes consumer surplus and 2 is a constant, 0 ≤ ≤ 1. At what level of would the regulator will permit merger? Provide intuition for your result.

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter24: Price-searcher Markets With High Entry Barriers

Section: Chapter Questions

Problem 7CQ

Related questions

Question

Please no written by hand solution

Transcribed Image Text:2.

Consider 3 identical firms with average costs of 40 that produce a homogeneous good.

There is also a potential entrant with average cost equal to 20. Firstly, new firm decides

whether to enter or not at a fixed cost of 800, then firms simultaneously compete in quantities.

Inverse market demand is P = 100-Q, where P is market price and Q is the market quantity

demanded.

a) Derive equilibrium output, market price, profit and consumer surplus. Will new firm enter the

market?

b) Derive equilibrium output, market price, profit and consumer surplus, if two incumbent firms

merge. Will new firm enter the market?

c) A regulator for this market has objective function W = I1+(1-2)CS, where II is industry

profit, which does not include entry costs, CS denotes consumer surplus and is a constant,

0< < 1. At what level of would the regulator will permit merger? Provide intuition for

your result.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning