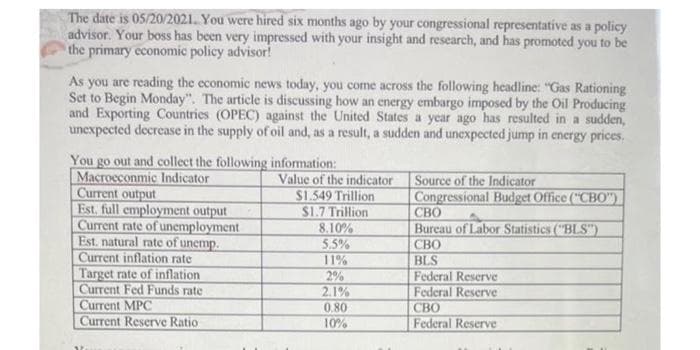

The date is 05/20/2021. You were hired six months ago by your congressional representative as a policy advisor. Your boss has been very impressed with your insight and research, and has promoted you to be the primary economic policy advisor! As you are reading the economic news today, you come across the following headline: "Gas Rationing Set to Begin Monday". The article is discussing how an energy embargo imposed by the Oil Producing and Exporting Countries (OPEC) against the United States a year ago has resulted in a sudden, unexpected decrease in the supply of oil and, as a result, a sudden and unexpected jump in energy prices,

The date is 05/20/2021. You were hired six months ago by your congressional representative as a policy advisor. Your boss has been very impressed with your insight and research, and has promoted you to be the primary economic policy advisor! As you are reading the economic news today, you come across the following headline: "Gas Rationing Set to Begin Monday". The article is discussing how an energy embargo imposed by the Oil Producing and Exporting Countries (OPEC) against the United States a year ago has resulted in a sudden, unexpected decrease in the supply of oil and, as a result, a sudden and unexpected jump in energy prices,

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter5: Business And Economic Forecasting

Section: Chapter Questions

Problem 8E: Bell Greenhouses has estimated its monthly demand for potting soil to be the following: N=400+4X...

Related questions

Question

find objective of policy & Monetary policy

Transcribed Image Text:The date is 05/20/2021. You were hired six months ago by your congressional representative as a policy

advisor. Your boss has been very impressed with your insight and research, and has promoted you to be

the primary economic policy advisor!

As you are reading the economic news today, you come across the following headline: "Gas Rationing

Set to Begin Monday". The article is discussing how an energy embargo imposed by the Oil Producing

and Exporting Countries (OPEC) against the United States a year ago has resulted in a sudden,

unexpected decrease in the supply of oil and, as a result, a sudden and unexpected jump in energy prices.

You go out and collect the following information:

Macroeconmic Indicator

Current output

Est. full employment output

Current rate of unemployment

Est. natural rate of unemp.

Current inflation rate

Target rate of inflation

Current Fed Funds rate

Current MPC

Current Reserve Ratio

Value of the indicator

$1.549 Trillion

$1.7 Trillion

8.10%

5.5%

11%

2%

2.1%

0.80

10%

Source of the Indicator

Congressional Budget Office ("CBO")

CBO

Bureau of Labor Statistics ("BLS")

CBO

BLS

Federal Reserve

Federal Reserve

СВО

Federal Reserve

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning