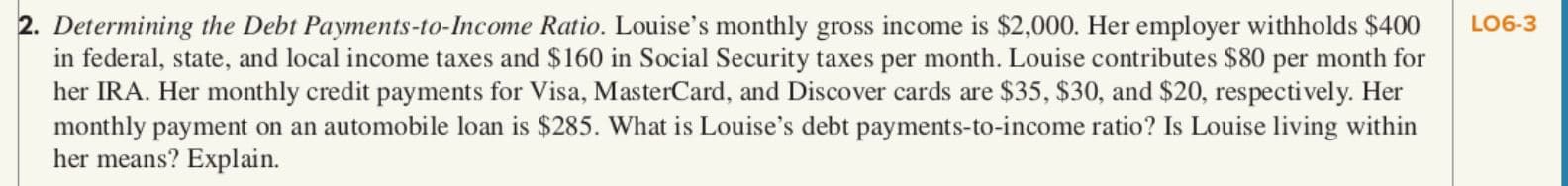

2. Determining the Debt Payments-to-Income Ratio. Louise's monthly gross income is $2,000. Her employer withholds $400 in federal, state, and local income taxes and $160 in Social Security taxes per month. Louise contributes $80 per month for her IRA. Her monthly credit payments for Visa, MasterCard, and Discover cards are $35, $30, and $20, respectively. Her monthly payment on an automobile loan is $285. What is Louise's debt payments-to-income ratio? Is Louise living within her means? Explain. LO6-3

2. Determining the Debt Payments-to-Income Ratio. Louise's monthly gross income is $2,000. Her employer withholds $400 in federal, state, and local income taxes and $160 in Social Security taxes per month. Louise contributes $80 per month for her IRA. Her monthly credit payments for Visa, MasterCard, and Discover cards are $35, $30, and $20, respectively. Her monthly payment on an automobile loan is $285. What is Louise's debt payments-to-income ratio? Is Louise living within her means? Explain. LO6-3

Chapter6: Building And Maintaining Good Credit

Section: Chapter Questions

Problem 1DTM

Related questions

Question

Chapter 6

Practice Problem #2

Transcribed Image Text:2. Determining the Debt Payments-to-Income Ratio. Louise's monthly gross income is $2,000. Her employer withholds $400

in federal, state, and local income taxes and $160 in Social Security taxes per month. Louise contributes $80 per month for

her IRA. Her monthly credit payments for Visa, MasterCard, and Discover cards are $35, $30, and $20, respectively. Her

monthly payment on an automobile loan is $285. What is Louise's debt payments-to-income ratio? Is Louise living within

her means? Explain.

LO6-3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you