2. Prepare the adjusted trial balance for the company. 3. Prepare the 2019 company's financial statements for presentation to the bank and to help address the first issue concerning Allan. 4. Has the owner's equity grown from its original $40,000 balance? Can Mr. Thorpe expect to get the loan? Give your reasons.

2. Prepare the adjusted trial balance for the company. 3. Prepare the 2019 company's financial statements for presentation to the bank and to help address the first issue concerning Allan. 4. Has the owner's equity grown from its original $40,000 balance? Can Mr. Thorpe expect to get the loan? Give your reasons.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 18EB: Krespy Corp. has a cash balance of $7,500 before the following transactions occur: A. received...

Related questions

Question

2. Prepare the adjusted

3. Prepare the 2019 company's financial statements for presentation to the bank and to help address the first issue concerning Allan.

4. Has the owner's equity grown from its original $40,000 balance? Can Mr. Thorpe expect to get the loan? Give your reasons.

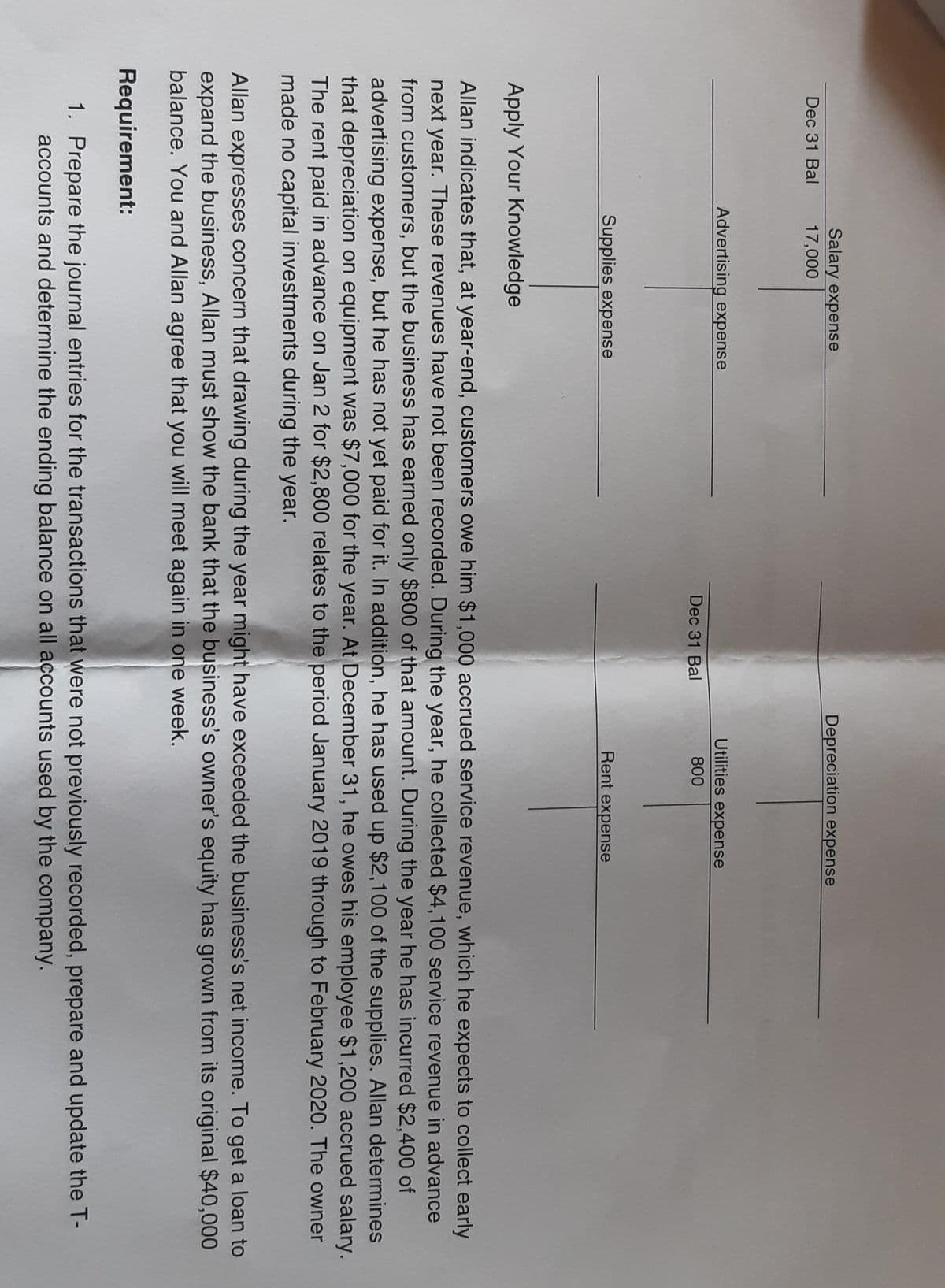

Transcribed Image Text:Salary expense

Depreciation expense

Dec 31 Bal

17,000

Advertising expense

Utilities expense

Dec 31 Bal

800

Supplies expense

Rent expense

Apply Your Knowledge

Allan indicates that, at year-end, customers owe him $1,000 accrued service revenue, which he expects to collect early

next year. These revenues have not been recorded. During the year, he collected $4,100 service revenue in advance

from customers, but the business has earned only $800 of that amount. During the year he has incurred $2,400 of

advertising expense, but he has not yet paid for it. In addition, he has used up $2,100 of the supplies. Allan determines

that depreciation on equipment was $7,000 for the year. At December 31, he owes his employee $1,200 accrued salary.

The rent paid in advance on Jan 2 for $2,800 relates to the period January 2019 through to February 2020. The owner

made no capital investments during the year.

Allan expresses concern that drawing during the year might have exceeded the business's net income. To get a loan to

expand the business, Allan must show the bank that the business's owner's equity has grown from its original $40,000

balance. You and Allan agree that you will meet again in one week.

Requirement:

1. Prepare the journal entries for the transactions that were not previously recorded, prepare and update the T-

accounts and determine the ending balance on all accounts used by the company.

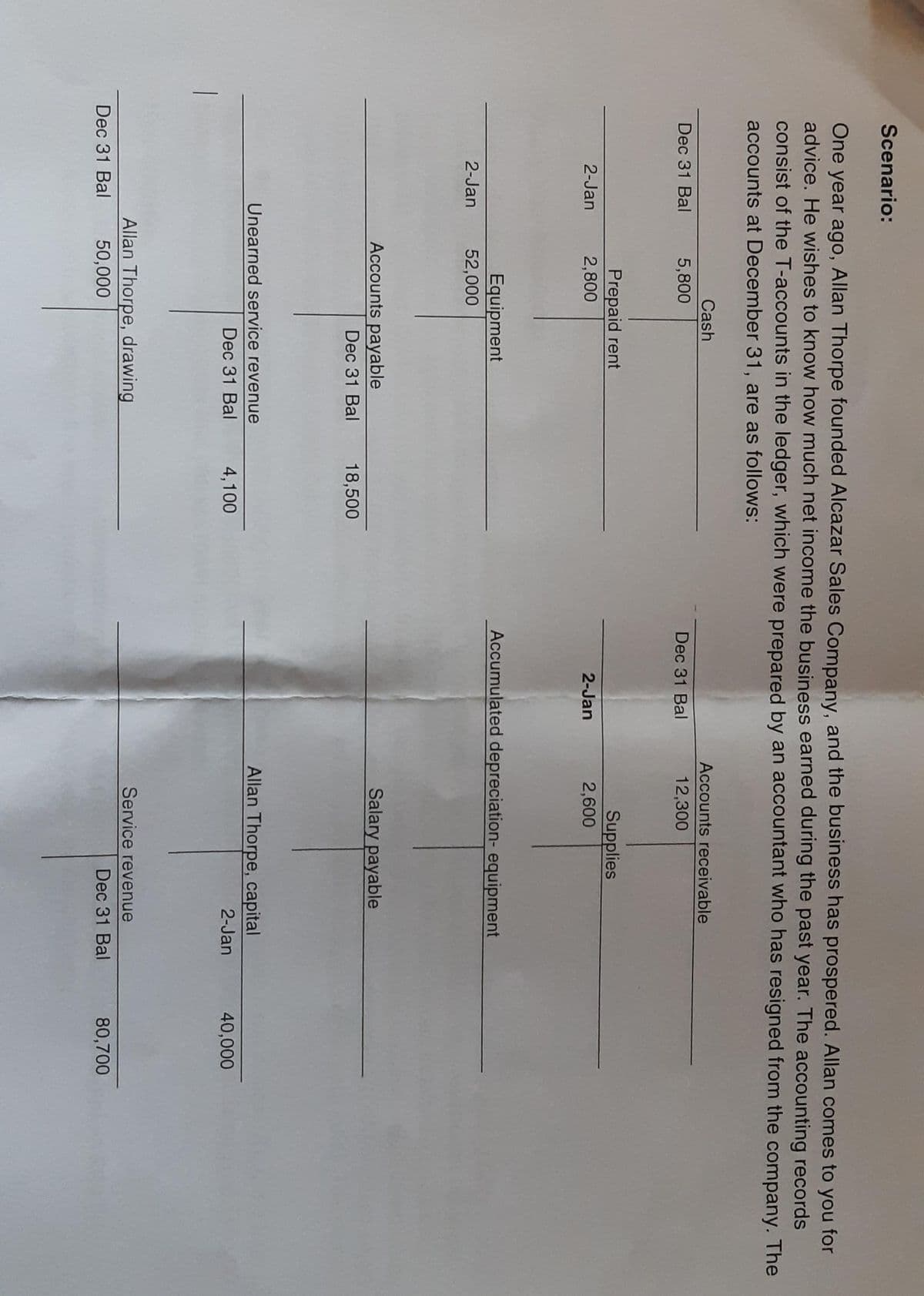

Transcribed Image Text:Scenario:

One year ago, Allan Thorpe founded Alcazar Sales Company, and the business has prospered. Allan comes to you for

advice. He wishes to know how much net income the business earned during the past year. The accounting records

consist of the T-accounts in the ledger, which were prepared by an accountant who has resigned from the company. The

accounts at December 31, are as follows:

Cash

Accounts receivable

Dec 31 Bal

5,800

Dec 31 Bal

12,300

Prepaid rent

Supplies

2,600

2-Jan

2,800

2-Jan

Accumulated depreciation- equipment

Equipment

52,000

2-Jan

Accounts payable

Salary payable

Dec 31 Bal

18,500

Unearned service revenue

Allan Thorpe, capital

Dec 31 Bal

4,100

2-Jan

40,000

Allan Thorpe, drawing

Service revenue

Dec 31 Bal

50,000

Dec 31 Bal

80,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub