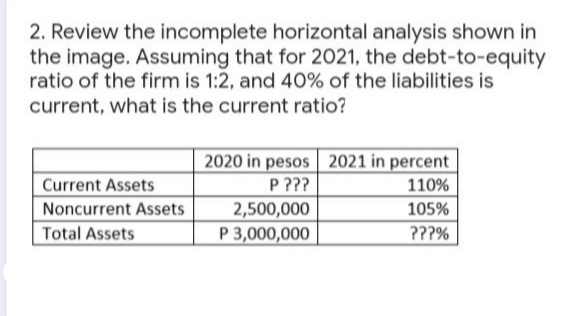

2. Review the incomplete horizontal analysis shown in the image. Assuming that for 2021, the debt-to-equity ratio of the firm is 1:2, and 40% of the liabilities is current, what is the current ratio? 2020 in pesos 2021 in percent P ??? Current Assets 110% Noncurrent Assets 2,500,000 105% Total Assets P 3,000,000 ???%

2. Review the incomplete horizontal analysis shown in the image. Assuming that for 2021, the debt-to-equity ratio of the firm is 1:2, and 40% of the liabilities is current, what is the current ratio? 2020 in pesos 2021 in percent P ??? Current Assets 110% Noncurrent Assets 2,500,000 105% Total Assets P 3,000,000 ???%

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Long-term Liabilities: Bonds And Notes

Section: Chapter Questions

Problem 1PEB: Brower Co. is considering the following alternative financing plans: Income tax is estimated at 40%...

Related questions

Question

Practice Pack

Transcribed Image Text:2. Review the incomplete horizontal analysis shown in

the image. Assuming that for 2021, the debt-to-equity

ratio of the firm is 1:2, and 40% of the liabilities is

current, what is the current ratio?

2020 in pesos 2021 in percent

P ???

2,500,000

P 3,000,000

Current Assets

110%

Noncurrent Assets

105%

Total Assets

???%

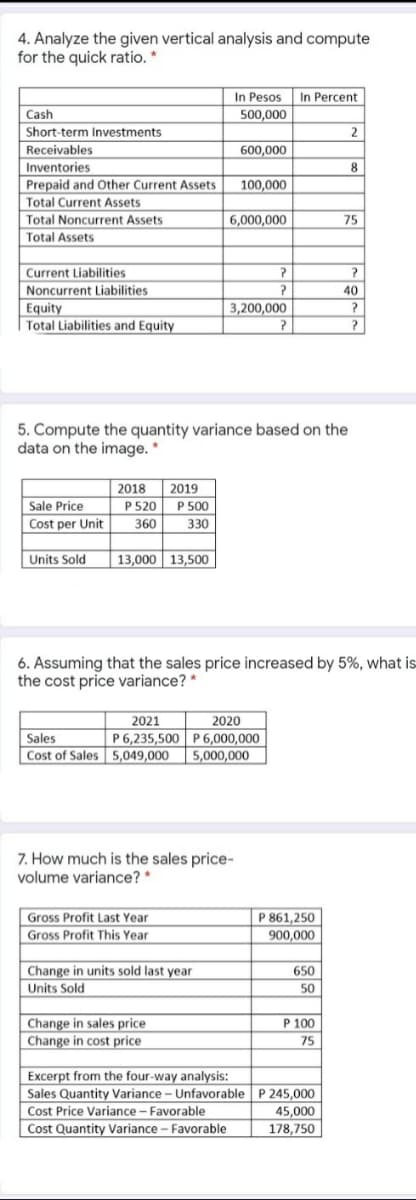

Transcribed Image Text:4. Analyze the given vertical analysis and compute

for the quick ratio. *

In Pesos In Percent

500,000

Cash

Short-term Investments

2

Receivables

600,000

Inventories

8

Prepaid and Other Current Assets

100,000

Total Current Assets

Total Noncurrent Assets

6,000,000

75

Total Assets

Current Liabilities

?

Noncurrent Liabilities

Equity

Total Liabilities and Equity

40

3,200,000

5. Compute the quantity variance based on the

data on the image.

2018

Sale Price

Cost per Unit

2019

P 520 P 500

330

360

Units Sold

13,000 13,500

6. Assuming that the sales price increased by 5%, what is

the cost price variance? *

2021

P 6,235,500| P 6,000,000

Cost of Sales 5,049,000 5,000,000

2020

Sales

7. How much is the sales price-

volume variance? *

P 861,250

900,000

Gross Profit Last Year

Gross Profit This Year

Change in units sold last year

Units Sold

650

50

P 100

Change in sales price

Change in cost price

75

Excerpt from the four-way analysis:

Sales Quantity Variance - Unfavorable P 245,000

Cost Price Variance - Favorable

45,000

Cost Quantity Variance - Favorable

178,750

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT