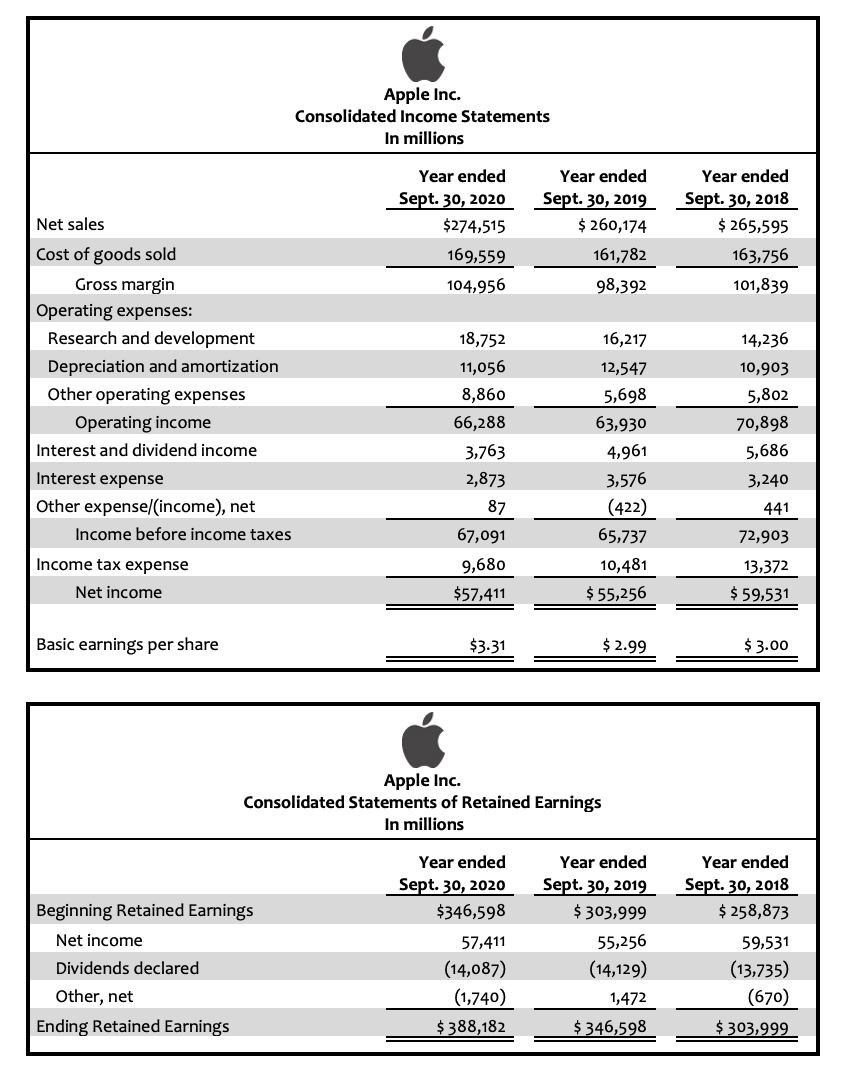

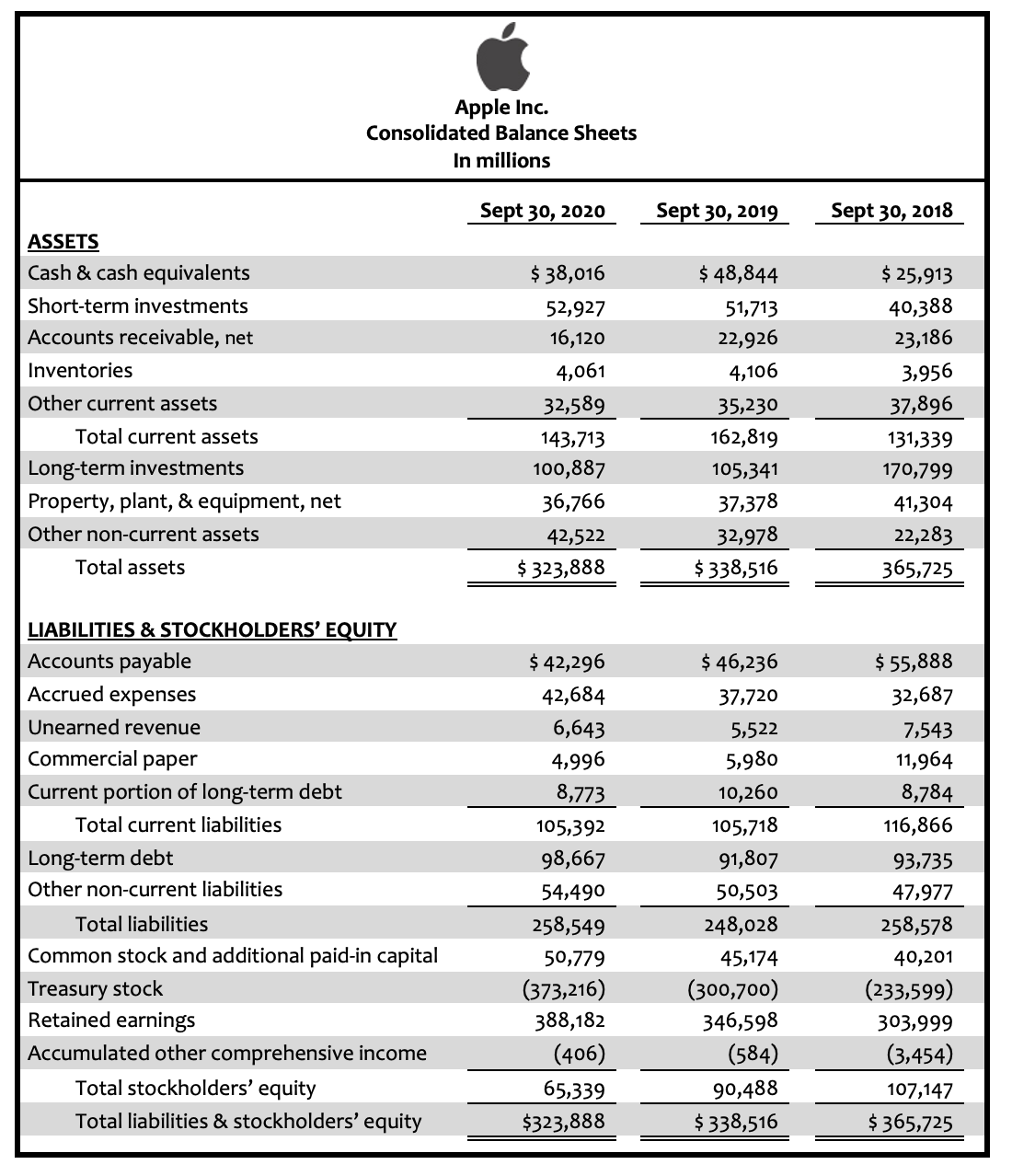

Use Apple’s financial statements to calculate the following ratios and summary measures for fiscal 2020 and 2019 (round to the nearest tenth). Indicate whether the ratio was more favorable in 2020 or 2019. Apple’s stock price was $115 per share on Sept. 30, 2020 and $55 on Sept. 30, 2019. Fiscal 2020 Fiscal 2019 Is the Ratio more favorable in 2020 or 2019? DAYS RECEIVABLE DAYS INVENTORY RETURN ON ASSETS PROFIT MARGIN % GROSS MARGIN % RETURN ON EQUITY CURRENT RATIO QUICK RATIO EBITDA DEBT-TO-EQUITY RATIO n/a DIVIDEND PAYOUT RATIO n/a PE RATIO

Use Apple’s financial statements to calculate the following ratios and summary measures for fiscal 2020 and 2019 (round to the nearest tenth). Indicate whether the ratio was more favorable in 2020 or 2019. Apple’s stock price was $115 per share on Sept. 30, 2020 and $55 on Sept. 30, 2019.

|

|

|

Fiscal 2020 |

|

Fiscal 2019 |

|

Is the Ratio more favorable in 2020 or 2019? |

|

|

|

|

|

|

|

|

|

|

|

DAYS RECEIVABLE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DAYS INVENTORY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RETURN ON ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROFIT MARGIN % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GROSS MARGIN % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RETURN ON EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

QUICK RATIO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEBT-TO-EQUITY RATIO |

|

|

|

|

|

n/a |

|

|

|

|

|

|

|

|

|

|

|

DIVIDEND PAYOUT RATIO |

|

|

|

|

|

n/a |

|

|

|

|

|

|

|

|

|

|

|

PE RATIO |

|

|

|

|

|

n/a |

|

“Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for you. To get the remaining sub-part solved please repost the complete question and mention the sub-parts to be solved.”.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images