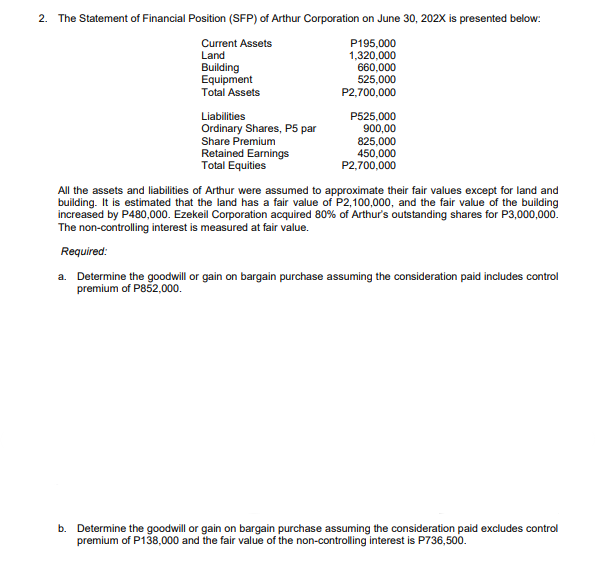

2. The Statement of Financial Position (SFP) of Arthur Corporation on June 30, 202X is presented below: Current Assets Land P195,000 1,320,000 660,000 525,000 P2,700,000 Building Equipment Total Assets Liabilities Ordinary Shares, P5 par Share Premium Retained Earnings Total Equities P525,000 900,00 825,000 450,000 P2,700,000 All the assets and liabilities of Arthur were assumed to approximate their fair values except for land and building. It is estimated that the land has a fair value of P2,100,000, and the fair value of the building increased by P480,000. Ezekeil Corporation acquired 80% of Arthur's outstanding shares for P3,000,000. The non-controlling interest is measured at fair value. Required: a. Determine the goodwill or gain on bargain purchase assuming the consideration paid includes control premium of P852,000. b. Determine the goodwill or gain on bargain purchase assuming the consideration paid excludes control premium of P138,000 and the fair value of the non-controlling interest is P736,500.

2. The Statement of Financial Position (SFP) of Arthur Corporation on June 30, 202X is presented below: Current Assets Land P195,000 1,320,000 660,000 525,000 P2,700,000 Building Equipment Total Assets Liabilities Ordinary Shares, P5 par Share Premium Retained Earnings Total Equities P525,000 900,00 825,000 450,000 P2,700,000 All the assets and liabilities of Arthur were assumed to approximate their fair values except for land and building. It is estimated that the land has a fair value of P2,100,000, and the fair value of the building increased by P480,000. Ezekeil Corporation acquired 80% of Arthur's outstanding shares for P3,000,000. The non-controlling interest is measured at fair value. Required: a. Determine the goodwill or gain on bargain purchase assuming the consideration paid includes control premium of P852,000. b. Determine the goodwill or gain on bargain purchase assuming the consideration paid excludes control premium of P138,000 and the fair value of the non-controlling interest is P736,500.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 13P: Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and...

Related questions

Question

Transcribed Image Text:2. The Statement of Financial Position (SFP) of Arthur Corporation on June 30, 202X is presented below:

Current Assets

Land

P195,000

1,320,000

660,000

525,000

Building

Equipment

Total Assets

P2,700,000

Liabilities

Ordinary Shares, P5 par

Share Premium

Retained Earnings

Total Equities

P525,000

900,00

825,000

450,000

P2,700,000

All the assets and liabilities of Arthur were assumed to approximate their fair values except for land and

building. It is estimated that the land has a fair value of P2,100,000, and the fair value of the building

increased by P480,000. Ezekeil Corporation acquired 80% of Arthur's outstanding shares for P3,000,000.

The non-controlling interest is measured at fair value.

Required:

a. Determine the goodwill or gain on bargain purchase assuming the consideration paid includes control

premium of P852,000.

b. Determine the goodwill or gain on bargain purchase assuming the consideration paid excludes control

premium of P138,000 and the fair value of the non-controlling interest is P736,500.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning