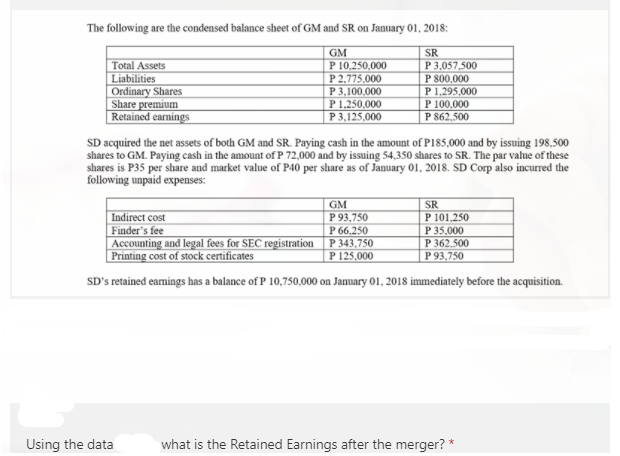

The following are the condensed balance sheet of GM and SR on January 01, 2018: Total Assets Liabilities Ordinary Shares Share premium Retained earnings GM P 10,250,000 P 2,775,000 P 3,100.000 P1.250.000 P3,125,000 SR P 3,057,500 P 800,000 P1,295,000 P 100.000 P 862,500 SD acquired the net assets of both GM and SR. Paying cash in the amount of P185,000 and by issuing 198,500 shares to GM. Paying cash in the amount of P 72,000 and by issuing 54,350 shares to SR. The par value of these shares is P35 per share and market value of P40 per share as of January 01, 2018. SD Corp also incurred the following unpaid expenses: GM P 93,750 P 66,250 Accounting and legal fees for SEC registration | P 343,750 P 125,000 SR P 101,250 P 35,000 P 362.500 P 93,750 |Indirect cost Finder's fee Printing cost of stock certificates SD's retained earnings has a balance of P 10,750,000 on Jamuary 01, 2018 immediately before the acquisition.

The following are the condensed balance sheet of GM and SR on January 01, 2018: Total Assets Liabilities Ordinary Shares Share premium Retained earnings GM P 10,250,000 P 2,775,000 P 3,100.000 P1.250.000 P3,125,000 SR P 3,057,500 P 800,000 P1,295,000 P 100.000 P 862,500 SD acquired the net assets of both GM and SR. Paying cash in the amount of P185,000 and by issuing 198,500 shares to GM. Paying cash in the amount of P 72,000 and by issuing 54,350 shares to SR. The par value of these shares is P35 per share and market value of P40 per share as of January 01, 2018. SD Corp also incurred the following unpaid expenses: GM P 93,750 P 66,250 Accounting and legal fees for SEC registration | P 343,750 P 125,000 SR P 101,250 P 35,000 P 362.500 P 93,750 |Indirect cost Finder's fee Printing cost of stock certificates SD's retained earnings has a balance of P 10,750,000 on Jamuary 01, 2018 immediately before the acquisition.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 3P: Income Statement, Lower Portion Cunningham Company reports a retained earnings balance of 365,200 at...

Related questions

Question

19

Transcribed Image Text:The following are the condensed balance sheet of GM and SR on January 01, 2018:

GM

P 10,250,000

P 2,775.000

P 3,100,000

P1,250.000

P 3,125,000

SR

Total Assets

|Liabilities

Ordinary Shares

Share premium

Retained earnings

P 3,057,500

P 800,000

P 1,295,000

P 100.000

P 862,500

SD acquired the net assets of both GM and SR. Paying cash in the amount of P185,000 and by issuing 198,500

shares to GM. Paying cash in the amount of P 72,000 and by issuing 54,350 shares to SR. The par value of these

shares is P35 per share and market value of P40 per share as of January 01, 2018. SD Corp also incurred the

following unpaid expenses:

SR

P 101,250

P 35,000

P 362,500

P 93,750

GM

Indirect cost

Finder's fee

Accounting and legal fees for SEC registration P 343,750

| Printing cost of stock certificates

P 93,750

P 66,250

P 125,000

SD's retained eamings has a balance of P 10,750.000 on Jamuary 01, 2018 immediately before the acquisition.

Using the data

what is the Retained Earnings after the merger? *

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning