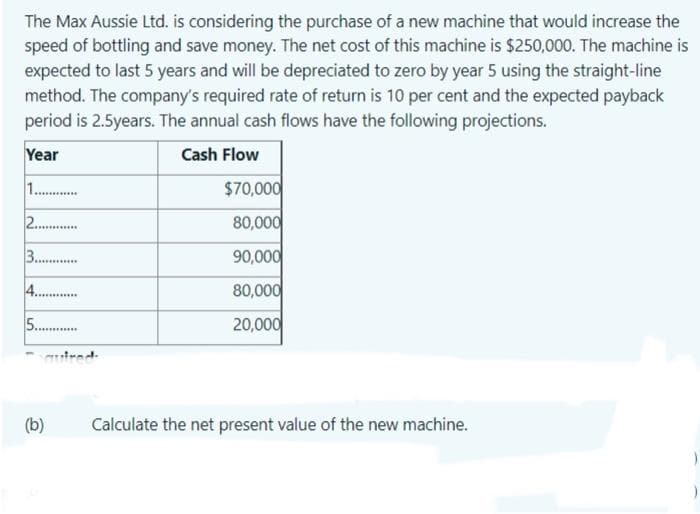

2............ 3............. 4............. 5............ (b) autred 80,000 90,000 80,000 20,000 Calculate the net present value of the new machine.

Q: Compute the missing amounts on the company’s financial statements. (Hint: What’s the difference…

A: Inventory turnover ratio is one of the efficiency ratio which shows how many times inventory is sold…

Q: Pepper Corporation owns 90% of the outstanding voting stock of Salt Company and Nike Corporation…

A: Financial statements are those which an entity prepares to indicate its financial health. The income…

Q: Question 2: Pedagogy Inc. is an e-book reader manufacturer. The company's ABC system has the…

A: Total cost of production = Direct materials + direct labor + manufacturing cost Unit product cost =…

Q: James Inc. purchased the following assets in February 2022 for a total price of $2,900,000. Below…

A: Section 179 means a section that is implemented for the allowing deduction of the cost of equipment.…

Q: c. The internal rate of return is between what two whole discount rates (e.g.. between 10% and 11%,…

A: The project can be evaluated based on discounted cash flow methods. The IRR method is used to…

Q: REQUIRED: Prepare the Statement of Comprehensive Income and the Statement of Financial Position as…

A: As per the format and sequence, ratio analysis is done when financial statements are prepared. The…

Q: Calculate net cash provided by operating activities for CQ Photography using the indirect method.…

A: Operating Activities are the Main activities of the Business, by which major revenue is earned by…

Q: Which of the following statements are true? (select all that apply) O the cost of direct laborers…

A: Job costing is the cost of a specific job or contract when work is carried out in accordance with…

Q: Jaclyn Biggs, who files as a head of household, never paid AMT before 2021. In 2021, her regular tax…

A: Compute the Jacklyn's total income tax for 2021:- Jacklyn's total income tax is $ 111,110…

Q: Department W had 2,580 units, one-third completed at the beginning of the period; 12,000 units were…

A: Total number of units is the total of all the units on which cost has been incurred during the…

Q: Solstice Company, which uses the direct write-off method, determines on October 1 that it cannot…

A: Under the direct method, the bad debt expense is recorded as and when it is incurred. The bad debt…

Q: Sudoku Company issues 19,000 shares of $6 par value common stock in exchange for land and a…

A: If value of land and building value is greater than the par value of common stock then the excess…

Q: The expected average rate of return for a proposed investment of $6,250,000 in a fixed asset, using…

A: Rate of return on investment is the percentage return earned on the investment in fixed assets by an…

Q: At September 30, the end of Beijing Company's third quarter, the following stockholders' equity…

A: The shareholders' equity account represents the equity and retained earnings that belong to the…

Q: What is the EPS and dividend growth in years 2-7? What is the current stock price? Why does the…

A: The plowback ratio is important because it determines how much earnings are reinvested back into the…

Q: Cutter Enterprises purchased equipment for $54,000 on January 1, 2021 The equipment is expected to…

A: Lets understand the basics. In double declining depreciation method, depreciation is calculated at…

Q: The following information relates to ABC Pty Ltd, a business that manufactures electric products…

A: There are two ways of making a cash flow statement direct and indirect. The difference between them…

Q: Positivism Corporation paid $150,000 for an 30% interest in Science Tech Corporation on January 1,…

A: When a buyer buys some business and pays more money compared to the net asset value received. The…

Q: With respect to the content of government-wide statements, which of the following is correct? A)…

A: Available for Sale- Securities- The fair value of the available-for-sale securities is recorded. The…

Q: 1. Kinkaid Company was incorporated at the beginning of this year and had a number of transactions.…

A: Introduction: Common stock is a type of investment that represents ownership in an organization.…

Q: Estimating Allowance for Doubtful Accounts Evers Industries has a past history of uncollectible…

A: The allowance for doubtful accounts is the contra asset for the business and it has credit balance.…

Q: ormation pertains to Carlton Company. Assume that all balance sheet amounts represent both average…

A: Introduction: A liquidity ratio that attempts to measure a company's ability to pay short-term or…

Q: 4. Recalculate the NPV assuming BBS's cost of capital is 15 percent. 5. Based on your calculation of…

A: Here we will use the capital budgeting tools of NPV and IRR. The capital budgeting tools are used to…

Q: or accounting what journals do you do if you have 2 revaluation increments in a row?

A: Revaluation seems to be a procedure in which the business recognizes a gain or loss based on the…

Q: Riley Company promises to pay Janet Anderson or her estate $150,000 per year for the next 10 years,…

A: Deffered Compensation Liabilities :— it is an arrangement on which a portion of individual income…

Q: On February 11, Year 1, an individual 100 shares of stock at $10 per share. On June 11, Year 2, the…

A: Capital Assets :— Capital assets are significant pieces of property such as homes, cars, investment…

Q: QUESTION 3 Hercules Health Club provides the following information regarding their expected…

A: Supplies Budget :— The office supply budget is a breakdown of costs that can serve as a spending…

Q: Effective after-tax cost of 401(k) contribution Jared Nguyen is an operations manager for a large…

A: 401 (k) contribution plan :— It is retirement saving plan for the employers of USA. Under this plan,…

Q: Sales Revenue Variable Costs Fixed costs Profit Number of rooms occupied Sales Room Rate Variable…

A: whenever there is case of evaluation to be done it is important to analyse the actual data and…

Q: Analyzing transactions and trial balance 00 (40 min) Check Figure Total Trial Balance Debits $43,500…

A: Journal Entries - Journal Entries are the recording of the transactions in the form of debit and…

Q: (2) Compute the company’s cash flow on total assets ratio for its fiscal year 2021.

A: Cash flow on Total Assets Ratio = Net Cash flow from Operating Activities/Average Total Assets…

Q: 2. Fill in the blank your numeric answer for each of the following question. 1. A machine with a…

A: "Since you have asked multiple questions, we will solve first question for you. If you want any…

Q: Prepare an Income Statement for the year ended 31 March 2020 and a Statement of Financial Position…

A: Income statement :— Income statement Is the part of the Financial Statement of the Company. Income…

Q: simplify this

A: Traditional costing and activity based cost in our one of the most widely use technique in order to…

Q: PRESENT YOUR ANSWER AS: (10) IF FAVORABLE OR 10 IFUNFAVORABLE. The Standard manufacturing…

A: Variable overheads are those indirect costs incurred in the production and manufacturing, which…

Q: A souvenir shop has the following information about T-shirt sales. What is the quantity variance of…

A: Revenue Variance: Revenue Variance is calculated to measure the difference between the expected…

Q: Why is this not $5,000?

A: According to the given question, we are required to compute the total amount owed by the customers.…

Q: Requirement 7. Calculate the following ratios as of January 31, 2025 for Milton Delivery Service:…

A: Return on Assets: Return on assets (ROA), which is often referred to as return on total assets, is a…

Q: What is the difference between margin and markup?

A: Margin and Markup are two terms used for calculation of selling price of the product. Margin is also…

Q: Comparative data on three companies in the same service industry are given below: Required: 2.…

A: Ratio analysis helps to analyze the financial statements of the company. The management can make…

Q: When the indirect method is used to determine net cash provided by (used in) operating activities,…

A: Under the indirect method, the net cash flow from operating activities is calculated by adjusting…

Q: Compute the company’s return on investment (ROI) for the period using the ROI formula stated in…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: On the first day of the fiscal year, a company issues a $3,200,000, 6%, 5-year bond that pays…

A: Bond :— Bond is a type of security which is issued to the party for the purpose of Enhance of…

Q: Hampton Company reports the following information for its recent calendar year. Income Statement…

A: Introduction: Operating activities are the actions that a business takes that are directly related…

Q: Bramble Company estimates that 384,000 direct labor hours will be worked during the coming year,…

A: Budgeting is a process of planning future expenses and income for a particular period. Budgeting…

Q: On March 1, 2021, E Corp. issued $1,000,000 of 10% nonconvertible bonds at 104, due on February 28,…

A: Increase in shareholders equity=Number of bonds issued×Stock warrants per bond×Market price of each…

Q: Riverview Hospital bases its budgets on patient-visits. The hospital's static budget for September…

A: A budget is a forecast of revenue and expenses for a certain future period of time that is generally…

Q: Lee, a candidate for a graduate degree, worked at the local golf course as a clubhouse employee and…

A:

Q: Lansing Company’s current-year income statement and selected balance sheet data at December 31 of…

A: Cash flow from operating activities is a part of the cash flow statement and it includes transection…

Q: 4. In 2011, Canadian federal tax rates were 0% on the first $10,000 of gross income earned, 15% on…

A: Answer : Total Tax paid = $12000 Calculate gross annual income for 2011

Step by step

Solved in 2 steps with 2 images

- Gina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?Gardner Denver Company is considering the purchase of a new piece of factory equipment that will cost $420,000 and will generate $95,000 per year for 5 years. Calculate the IRR for this piece of equipment. For further Instructions on internal rate of return in Excel, see Appendix C.Dauten is offered a replacement machine which has a cost of 8,000, an estimated useful life of 6 years, and an estimated salvage value of 800. The replacement machine is eligible for 100% bonus depreciation at the time of purchase- The replacement machine would permit an output expansion, so sales would rise by 1,000 per year; even so, the new machines much greater efficiency would cause operating expenses to decline by 1,500 per year The new machine would require that inventories be increased by 2,000, but accounts payable would simultaneously increase by 500. Dautens marginal federal-plus-state tax rate is 25%, and its WACC is 11%. Should it replace the old machine?

- The Rodriguez Company is considering an average-risk investment in a mineral water spring project that has an initial after-tax cost of 170,000. The project will produce 1,000 cases of mineral water per year indefinitely, starting at Year 1. The Year-1 sales price will be 138 per case, and the Year-1 cost per case will be 105. The firm is taxed at a rate of 25%. Both prices and costs are expected to rise after Year 1 at a rate of 6% per year due to inflation. The firm uses only equity, and it has a cost of capital of 15%. Assume that cash flows consist only of after-tax profits because the spring has an indefinite life and will not be depreciated. a. What is the present value of future cash flows? (Hint: The project is a growing perpetuity, so you must use the constant growth formula to find its NPV.) What is the NPV? b. Suppose that the company had forgotten to include future inflation. What would they have incorrectly calculated as the projects NPV?Friedman Company is considering installing a new IT system. The cost of the new system is estimated to be 2,250,000, but it would produce after-tax savings of 450,000 per year in labor costs. The estimated life of the new system is 10 years, with no salvage value expected. Intrigued by the possibility of saving 450,000 per year and having a more reliable information system, the president of Friedman has asked for an analysis of the projects economic viability. All capital projects are required to earn at least the firms cost of capital, which is 12 percent. Required: 1. Calculate the projects internal rate of return. Should the company acquire the new IT system? 2. Suppose that savings are less than claimed. Calculate the minimum annual cash savings that must be realized for the project to earn a rate equal to the firms cost of capital. Comment on the safety margin that exists, if any. 3. Suppose that the life of the IT system is overestimated by two years. Repeat Requirements 1 and 2 under this assumption. Comment on the usefulness of this information.Although the Chen Company’s milling machine is old, it is still in relatively good working order and would last for another 10 years. It is inefficient compared to modern standards, though, and so the company is considering replacing it. The new milling machine, at a cost of $110,000 delivered and installed, would also last for 10 years and would produce after-tax cash flows (labor savings and depreciation tax savings) of $19,000 per year. It would have zero salvage value at the end of its life. The project cost of capital is 10%, and its marginal tax rate is 25%. Should Chen buy the new machine?

- Bouvier Restaurant is considering an investment in a grill that costs $140,000, and will produce annual net cash flows of $21,950 for 8 years. The required rate of return is 6%. Compute the net present value of this investment to determine whether Bouvier should invest in the grill.Talbot Industries is considering launching a new product. The new manufacturing equipment will cost $17 million, and production and sales will require an initial $5 million investment in net operating working capital. The company’s tax rate is 25%. What is the initial investment outlay? The company spent and expensed $150,000 on research related to the new product last year. What is the initial investment outlay? Rather than build a new manufacturing facility, the company plans to install the equipment in a building it owns but is not now using. The building could be sold for $1.5 million after taxes and real estate commissions. What is the initial investment outlay?Shao Airlines is considering the purchase of two alternative planes. Plane A has an expected life of 5 years, will cost $100 million, and will produce net cash flows of $30 million per year. Plane B has a life of 10 years, will cost $132 million, and will produce net cash flows of $25 million per year. Shao plans to serve the route for only 10 years. Inflation in operating costs, airplane costs, and fares are expected to be zero, and the company’s cost of capital is 12%. By how much would the value of the company increase if it accepted the better project (plane)? What is the equivalent annual annuity for each plane?