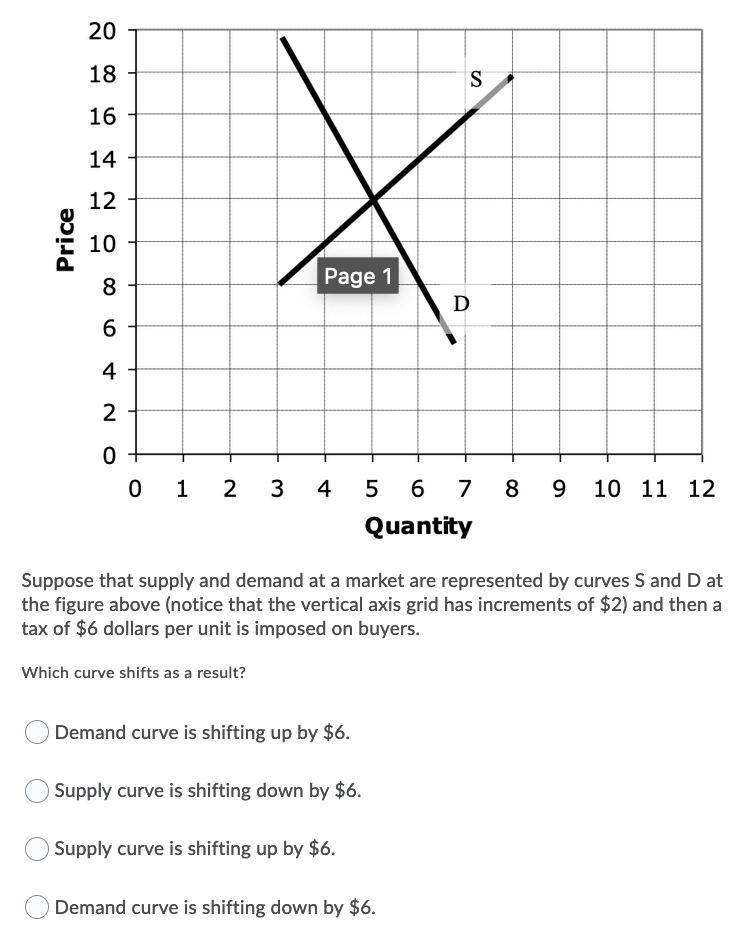

20 18 S 16 14 12 10 8 Page 1 D 6 4 2 0 1 2 3 4 5 6 7 8 9 10 11 12 Quantity Suppose that supply and demand at a market are represented by curves S and D at the figure above (notice that the vertical axis grid has increments of $2) and then a tax of $6 dollars per unit is imposed on buyers. Which curve shifts as a result? Demand curve is shifting up by $6. Supply curve is shifting down by $6. Supply curve is shifting up by $6. Demand curve is shifting down by $6. Price

20 18 S 16 14 12 10 8 Page 1 D 6 4 2 0 1 2 3 4 5 6 7 8 9 10 11 12 Quantity Suppose that supply and demand at a market are represented by curves S and D at the figure above (notice that the vertical axis grid has increments of $2) and then a tax of $6 dollars per unit is imposed on buyers. Which curve shifts as a result? Demand curve is shifting up by $6. Supply curve is shifting down by $6. Supply curve is shifting up by $6. Demand curve is shifting down by $6. Price

Chapter4: Demand, Supply, And Market Equilibrium

Section: Chapter Questions

Problem 25P

Related questions

Question

100%

Transcribed Image Text:20

18

S

16

14

12

10

8

Page 1

D

6.

4

2

0 1

2

3

4

5 6

7 8

9.

10 11 12

Quantity

Suppose that supply and demand at a market are represented by curves S and D at

the figure above (notice that the vertical axis grid has increments of $2) and then a

tax of $6 dollars per unit is imposed on buyers.

Which curve shifts as a result?

O Demand curve is shifting up by $6.

Supply curve is shifting down by $6.

Supply curve is shifting up by $6.

Demand curve is shifting down by $6.

Price

Expert Solution

Step 1

$6 per unit tax imposed on the buyers means that the buyers will pay $6 more than what the sellers will receive. So if sellers receive Ps and buyers pay Pb,

Pb=Ps+t

Now we see that Pb and Ps denote the inverse demand and inverse supply curves respectively. So, to find the new equilibrium, we have to move the supply curve up by $6.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning