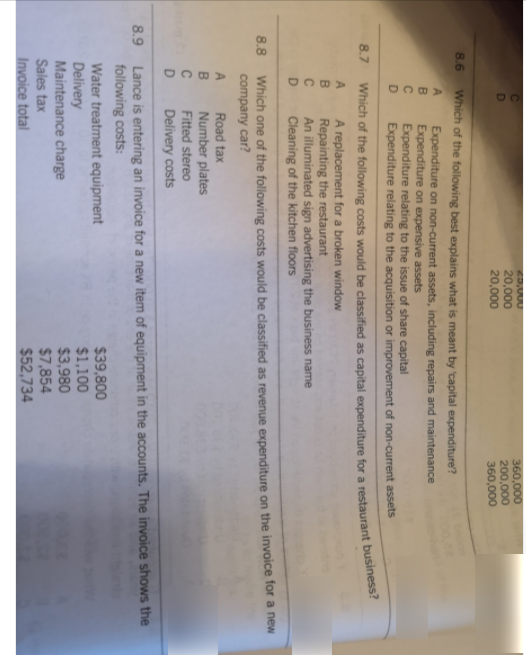

20,000 20,000 20,000 360,000 200,000 360,000 8.6 Which of the following best explains what is meant by 'capital expenditure? A B. Expenditure on non-current assets, including repairs and maintenance Expenditure on expensive assets Expenditure relating to the isue of share capital Expenditure relating to the acquisition or improvement of non-current assets 8.7 A replacement for a broken window Repainting the restaurant An illuminated sign advertising the business name Cleaning of the kitchen floors Which one of the following costs would be classified as revenue expenditure on the invoice for a hew company car? 8.8 A. Road tax Number plates Fitted stereo C Delivery costs 8.9 Lance is entering an invoice for a new item of equipment in the accounts. The invoice shows the following costs: Water treatment equipment Delivery Maintenance charge Sales tax $39,800 $1,100 $3,980 $7,854 $52,734 Invoice total Which of the costs would be as for a business?

20,000 20,000 20,000 360,000 200,000 360,000 8.6 Which of the following best explains what is meant by 'capital expenditure? A B. Expenditure on non-current assets, including repairs and maintenance Expenditure on expensive assets Expenditure relating to the isue of share capital Expenditure relating to the acquisition or improvement of non-current assets 8.7 A replacement for a broken window Repainting the restaurant An illuminated sign advertising the business name Cleaning of the kitchen floors Which one of the following costs would be classified as revenue expenditure on the invoice for a hew company car? 8.8 A. Road tax Number plates Fitted stereo C Delivery costs 8.9 Lance is entering an invoice for a new item of equipment in the accounts. The invoice shows the following costs: Water treatment equipment Delivery Maintenance charge Sales tax $39,800 $1,100 $3,980 $7,854 $52,734 Invoice total Which of the costs would be as for a business?

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter5: Adjusting Entries And The Work Sheet

Section: Chapter Questions

Problem 1MC: LO1 The purpose of depreciation is to (a) spread the cost of an asset over its useful life. (b) show...

Related questions

Question

Transcribed Image Text:20,000

20,000

20,000

360,000

200,000

360,000

8.6

Which of the following best explains what is meant by 'capital expenditure?

A

B.

Expenditure on non-current assets, including repairs and maintenance

Expenditure on expensive assets

Expenditure relating to the isue of share capital

Expenditure relating to the acquisition or improvement of non-current assets

8.7

A replacement for a broken window

Repainting the restaurant

An illuminated sign advertising the business name

Cleaning of the kitchen floors

Which one of the following costs would be classified as revenue expenditure on the invoice for a hew

company car?

8.8

A.

Road tax

Number plates

Fitted stereo

C

Delivery costs

8.9 Lance is entering an invoice for a new item of equipment in the accounts. The invoice shows the

following costs:

Water treatment equipment

Delivery

Maintenance charge

Sales tax

$39,800

$1,100

$3,980

$7,854

$52,734

Invoice total

Which of the costs would be as for a business?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,