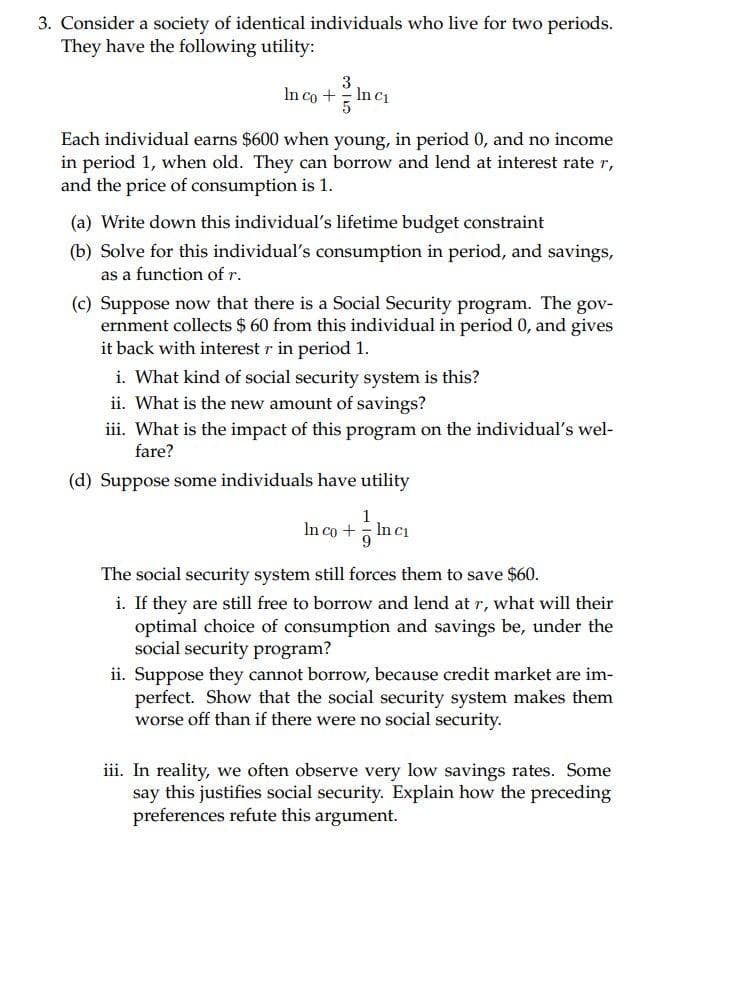

3. Consider a society of identical individuals who live for two periods. They have the following utility: 3 In co +In c₁ Each individual earns $600 when young, in period 0, and no income in period 1, when old. They can borrow and lend at interest rate r, and the price of consumption is 1. (a) Write down this individual's lifetime budget constraint (b) Solve for this individual's consumption in period, and savings, as a function of r. (c) Suppose now that there is a Social Security program. The gov- ernment collects $ 60 from this individual in period 0, and gives it back with interest r in period 1. i. What kind of social security system is this? ii. What is the new amount of savings? iii. What is the impact of this program on the individual's wel- fare?

3. Consider a society of identical individuals who live for two periods. They have the following utility: 3 In co +In c₁ Each individual earns $600 when young, in period 0, and no income in period 1, when old. They can borrow and lend at interest rate r, and the price of consumption is 1. (a) Write down this individual's lifetime budget constraint (b) Solve for this individual's consumption in period, and savings, as a function of r. (c) Suppose now that there is a Social Security program. The gov- ernment collects $ 60 from this individual in period 0, and gives it back with interest r in period 1. i. What kind of social security system is this? ii. What is the new amount of savings? iii. What is the impact of this program on the individual's wel- fare?

Chapter17: Capital And Time

Section: Chapter Questions

Problem 17.8P

Related questions

Question

Transcribed Image Text:3. Consider a society of identical individuals who live for two periods.

They have the following utility:

In co +

3

5

In ci

Each individual earns $600 when young, in period 0, and no income

in period 1, when old. They can borrow and lend at interest rate r,

and the price of consumption is 1.

(a) Write down this individual's lifetime budget constraint

(b) Solve for this individual's consumption in period, and savings,

as a function of r.

(c) Suppose now that there is a Social Security program. The gov-

ernment collects $ 60 from this individual in period 0, and gives

it back with interest r in period 1.

i. What kind of social security system is this?

ii. What is the new amount of savings?

iii. What is the impact of this program on the individual's wel-

fare?

(d) Suppose some individuals have utility

1

In co +In c₁

9

The social security system still forces them to save $60.

i. If they are still free to borrow and lend at r, what will their

optimal choice of consumption and savings be, under the

social security program?

ii. Suppose they cannot borrow, because credit market are im-

perfect. Show that the social security system makes them

worse off than if there were no social security.

iii. In reality, we often observe very low savings rates. Some

say this justifies social security. Explain how the preceding

preferences refute this argument.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax